Crafting a seamless onboarding experience for mobile bank users

Crafting a seamless onboarding experience for mobile bank users

Crafting a seamless onboarding experience for mobile bank users

INTRODUCTION

Ethos, a brand spanking new startup, aims to be a industry leading ethically Sharia-complaint, mobile-first banking solution for UK Muslims.

As the first designers brought on, we were tasked with creating the first touchpoint of the banking experience - the onboarding journey.

Ethos, a brand spanking new startup, aims to be a industry leading ethically Sharia-complaint, mobile-first banking solution for UK Muslims.

As the first designers brought on, we were tasked with creating the first touchpoint of the banking experience - the onboarding journey.

Ethos, a brand spanking new startup, aims to be a industry leading ethically Sharia-complaint, mobile-first banking solution for UK Muslims.

As the first designers brought on, we were tasked with creating the first touchpoint of the banking experience - the onboarding journey.

ROLE

Develop branding and design principles to start creating the user flow and wireframes.

Develop branding and design principles to start creating the user flow and wireframes.

TOOLS

Branding, UX research, user flow and wireframes

Branding, UX research, user flow and wireframes

TEAM

CPO + Senior Designer + Me

CPO + Senior Designer + Me

TIMELINE

Kick off November 2023

Kick off November 2023

UNDERSTANDING THE USERS

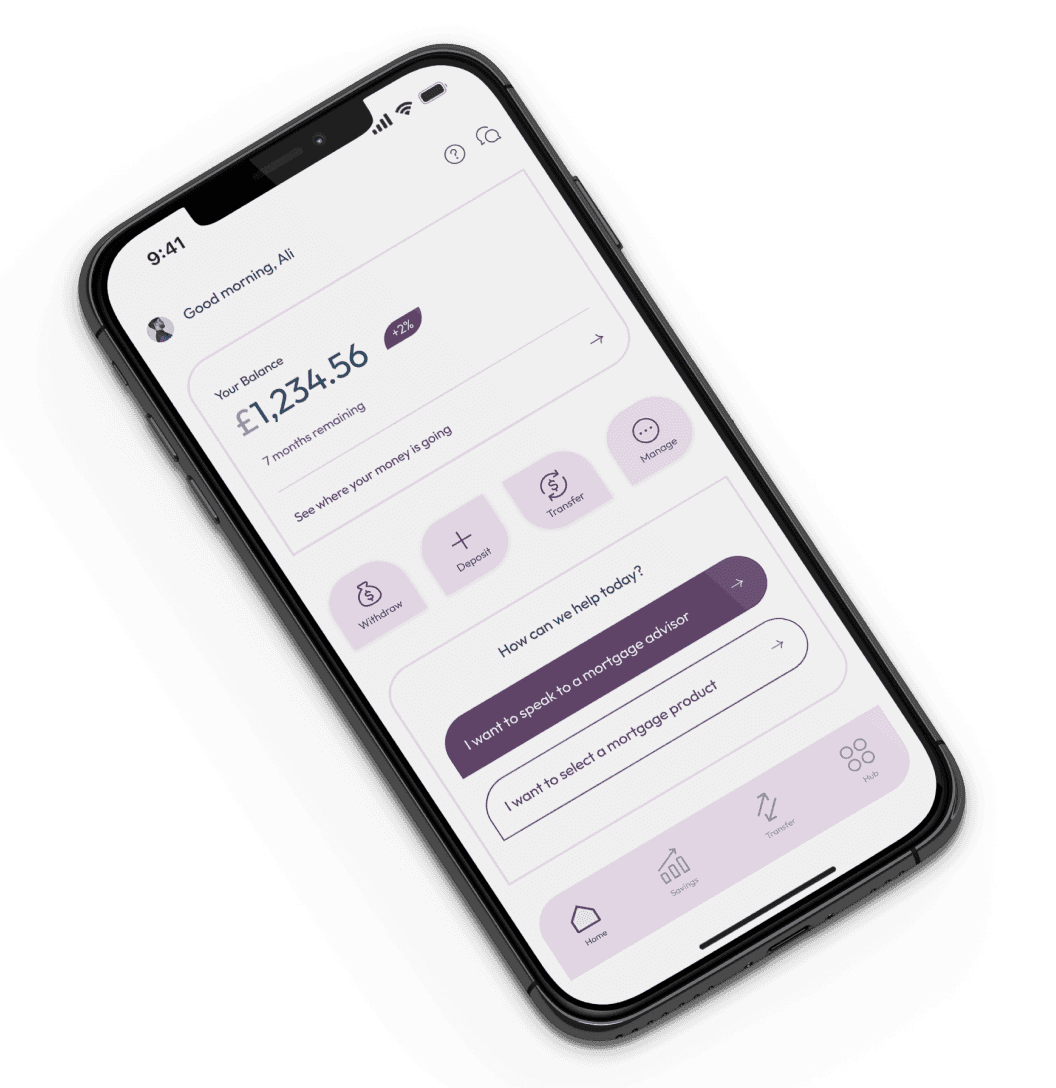

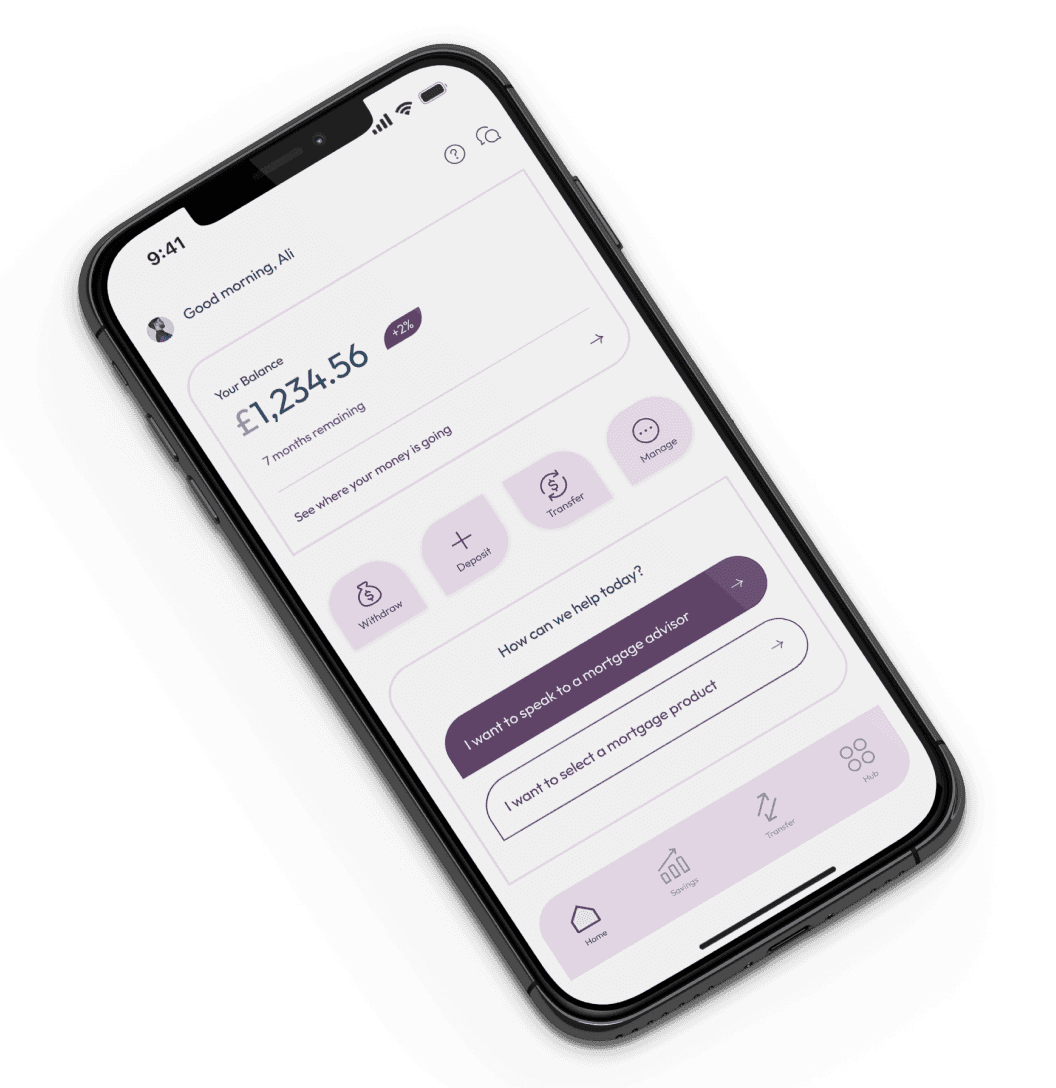

Through user interviews, we identified 4 distinct customer profiles with different end uses and needs, different life stages, behaviours and values.

1. Younger savers looking to save for a goal.

2. Older savers find themselves with more disposable income and want to support their family members.

3. First home buyers needs support in getting a competitive home loan for their first home purchase.

4. Re-mortagers want to make sure re-align their home loans with their faith and values.

Through user interviews, we identified 4 distinct customer profiles with different end uses and needs, different life stages, behaviours and values.

1. Younger savers looking to save for a goal.

2. Older savers find themselves with more disposable income and want to support their family members.

3. First home buyers needs support in getting a competitive home loan for their first home purchase.

4. Re-mortagers want to make sure re-align their home loans with their faith and values.

Through user interviews, we identified 4 distinct customer profiles with different end uses and needs, different life stages, behaviours and values.

1. Younger savers looking to save for a goal.

2. Older savers find themselves with more disposable income and want to support their family members.

3. First home buyers needs support in getting a competitive home loan for their first home purchase.

4. Re-mortagers want to make sure re-align their home loans with their faith and values.

RESEARCH

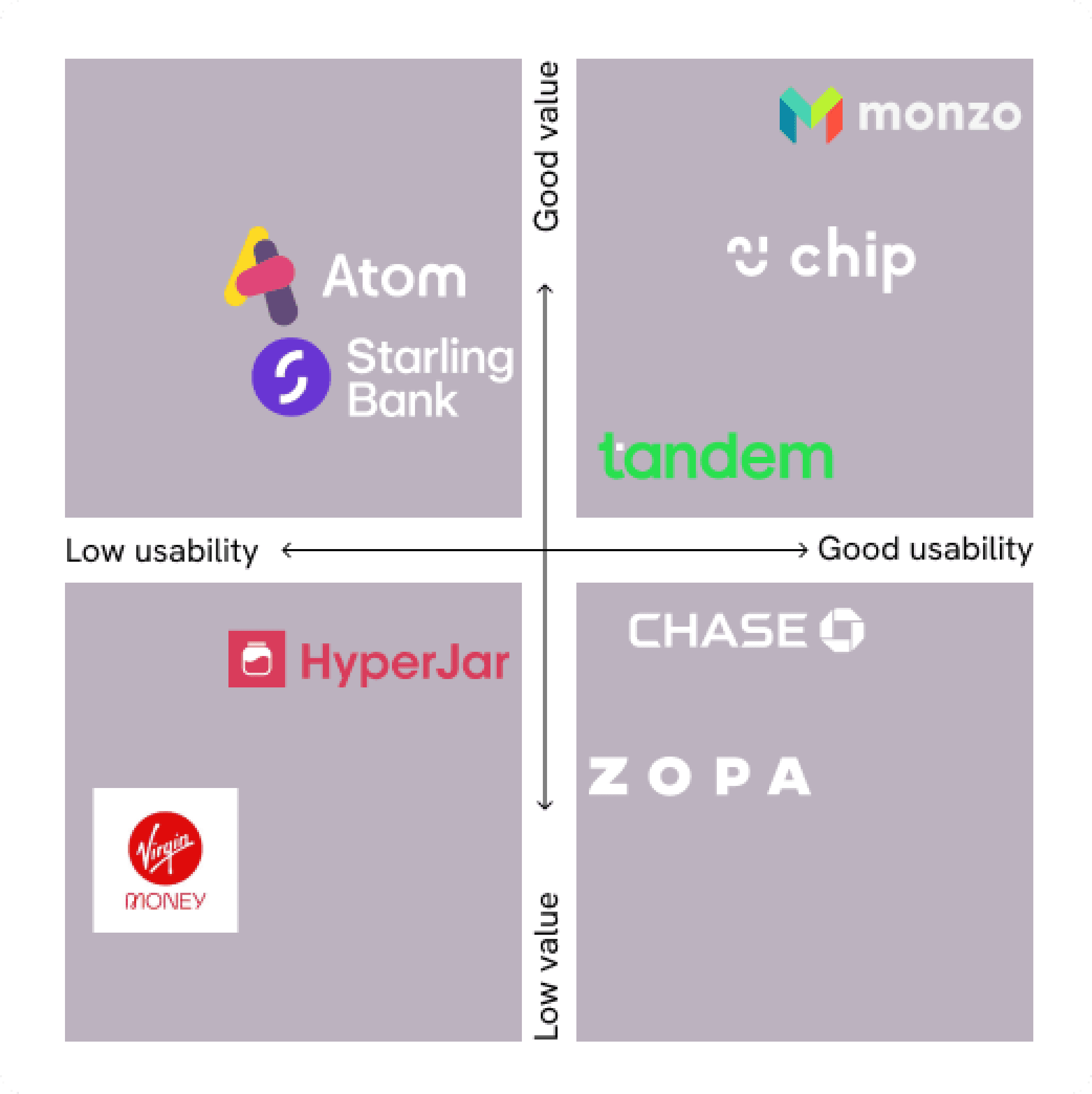

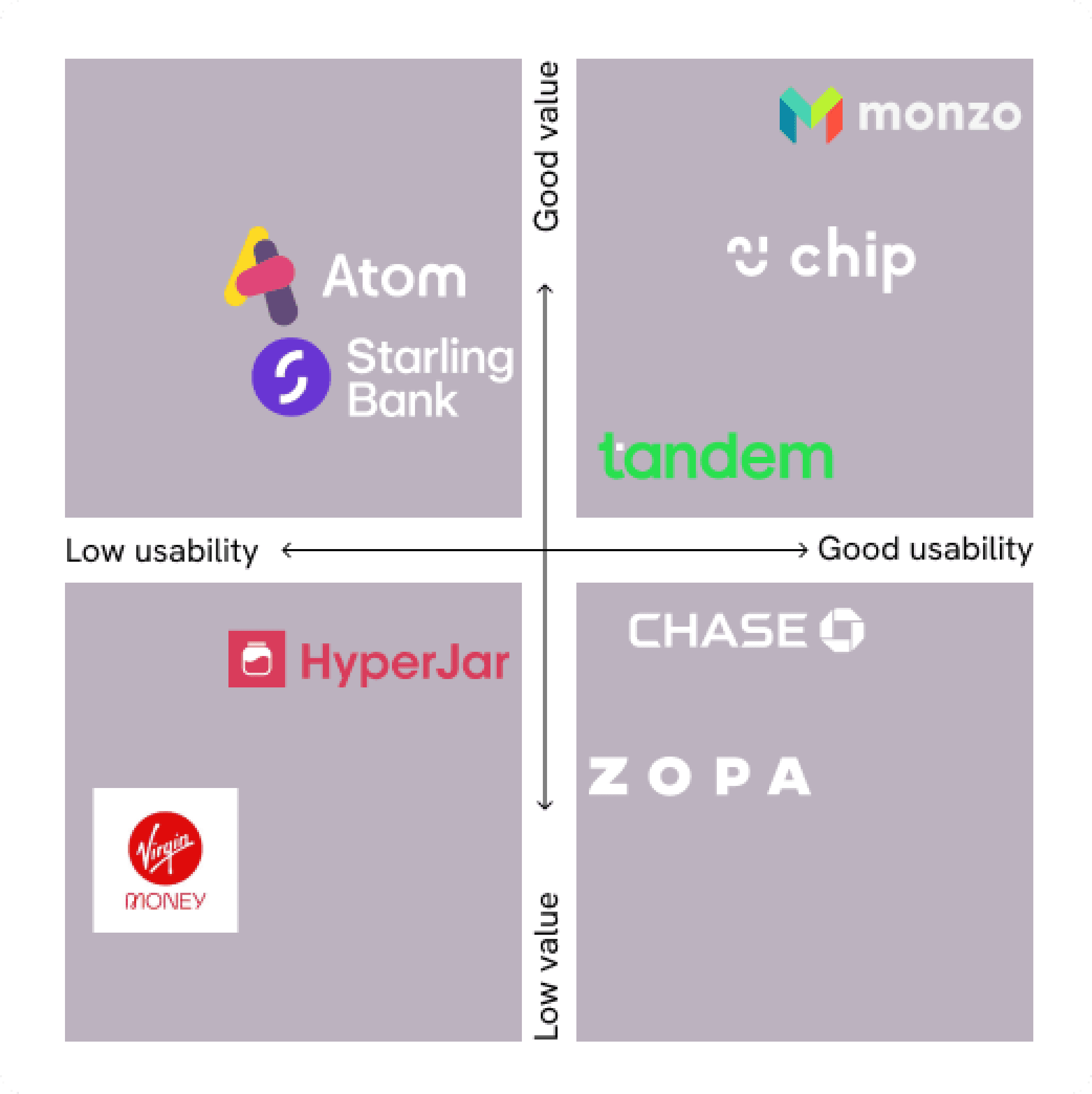

In our research, many users called out how easy the Monzo’s onboarding journey was. Inspired by this example, we analysed competitors in the industry and identified key design considerations.

In our research, many users called out how easy the Monzo’s onboarding journey was. Inspired by this example, we analysed competitors in the industry and identified key design considerations.

In our research, many users called out how easy the Monzo’s onboarding journey was. Inspired by this example, we analysed competitors in the industry and identified key design considerations.

DEFINING THE SOLUTION

Deciding the approach and measures of success

Deciding the approach and measures of success

Deciding the approach and measures of success

With a diverse range of user profiles, how do we position the onboarding experience? We aimed to create a smooth onboarding process while personalising the app for our diverse users. We came with 2 objectives to define our solution scope for ideation.

1

Simplify onboarding for quick access and introduction to the app.

Simplify onboarding for quick access and introduction to the app.

Simplify onboarding for quick access and introduction to the app.

2

Personalise the experience for the range of different life stages.

Personalise the experience for the range of different life stages.

Personalise the experience for the range of different life stages.

Key design considerations:

Key design considerations:

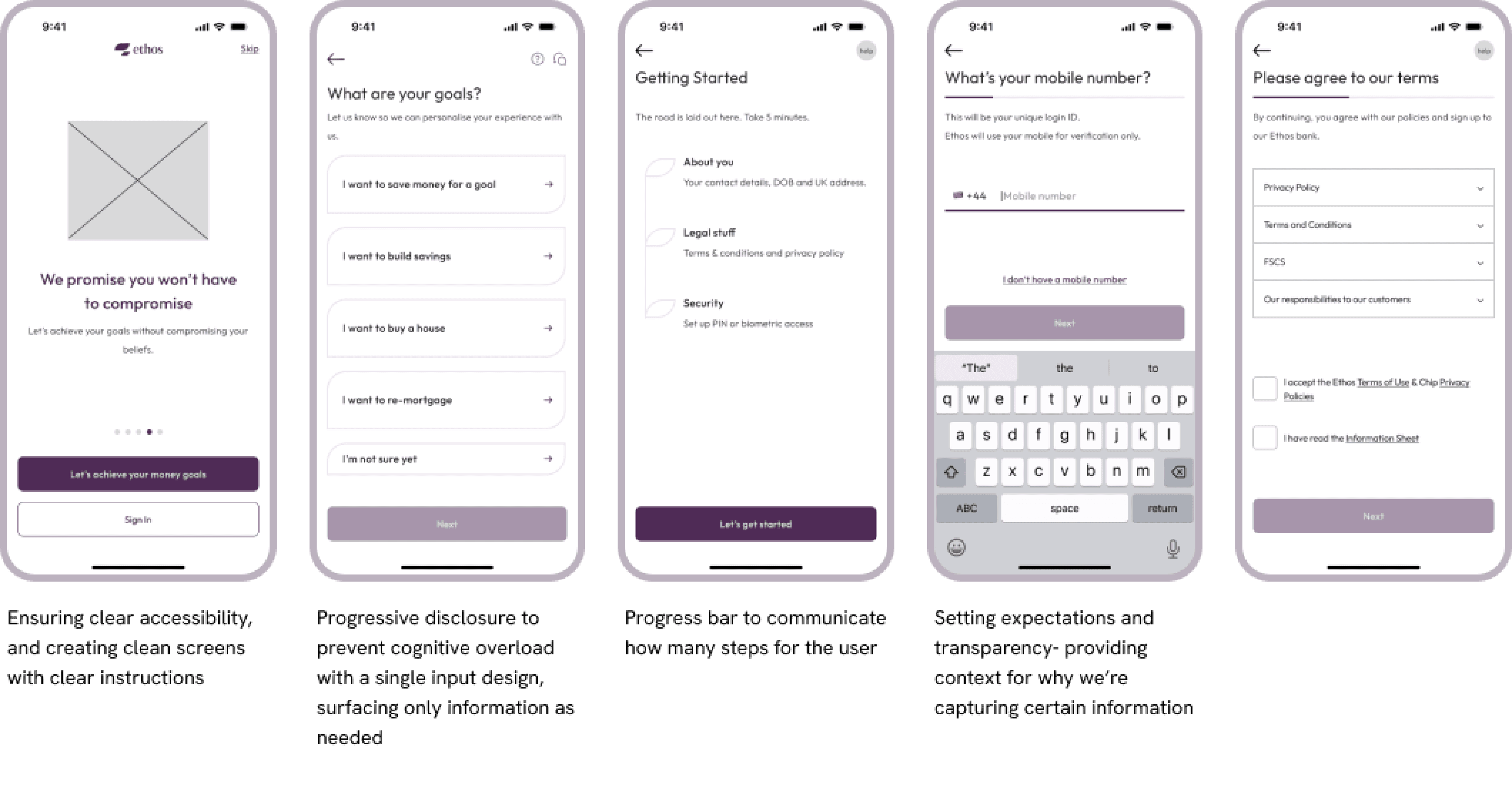

🤝 Transparency & Trust

Clear signposting and progress updates to gain user’s confidence. Earning their trust by educating on who we are and explaining where necessary as to why we require their personal data.

🤝 Transparency & Trust

Clear signposting and progress updates to gain user’s confidence. Earning their trust by educating on who we are and explaining where necessary as to why we require their personal data.

👯♂️ Engaging

We need to engage our customers with relatable language and friendly prompts so they will finish their onboarding process.

👯♂️ Engaging

We need to engage our customers with relatable language and friendly prompts so they will finish their onboarding process.

👀 Accessible

For improved retention, the onboarding needs to be simple and easy to understand, obvious next steps and bold CTA’s.

👀 Accessible

For improved retention, the onboarding needs to be simple and easy to understand, obvious next steps and bold CTA’s.

🧠 Easy to use and intuitive

Using clear instructions to reduce cognitive load to not overwhelm the user.

🧠 Easy to use and intuitive

Using clear instructions to reduce cognitive load to not overwhelm the user.

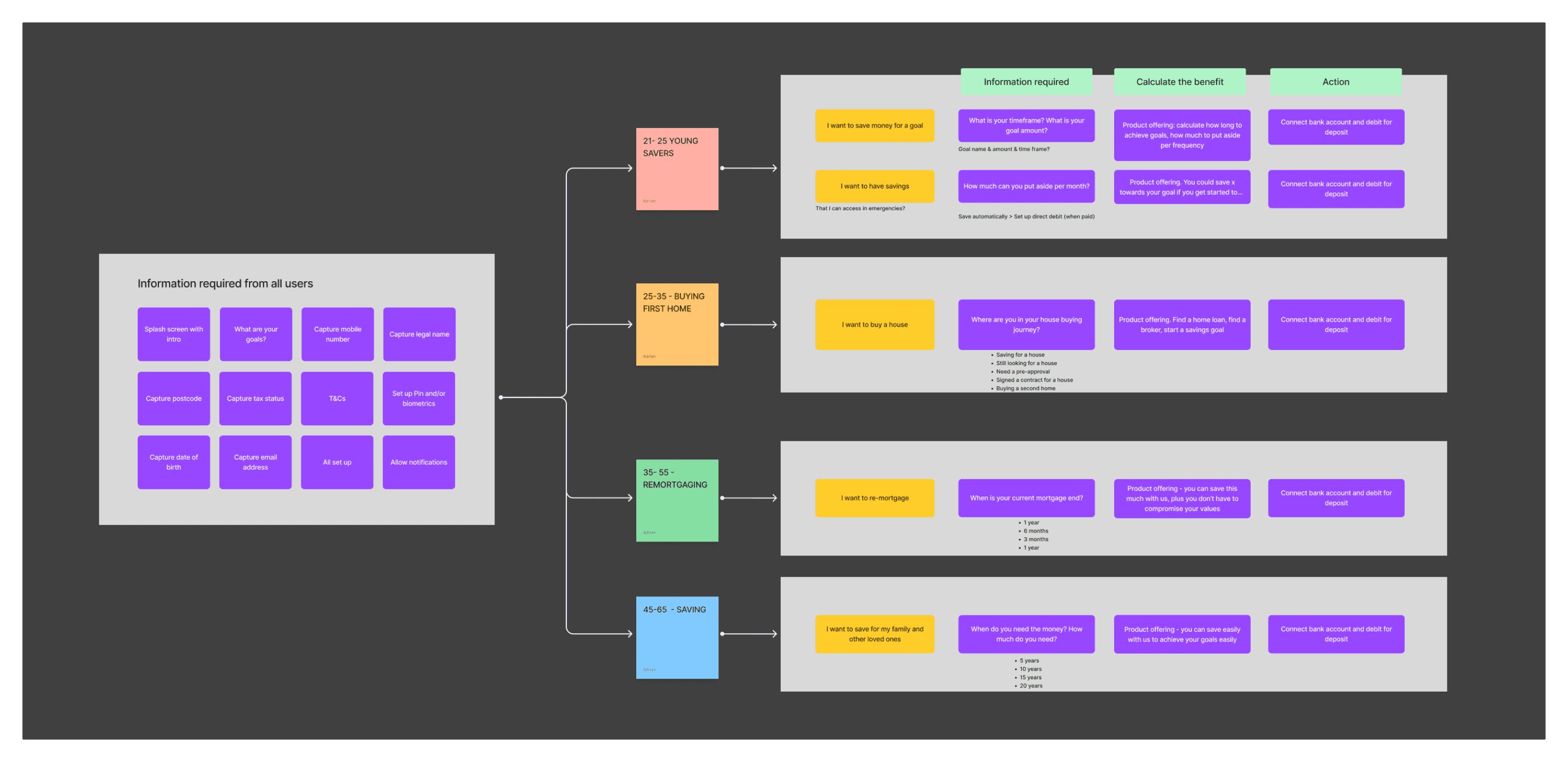

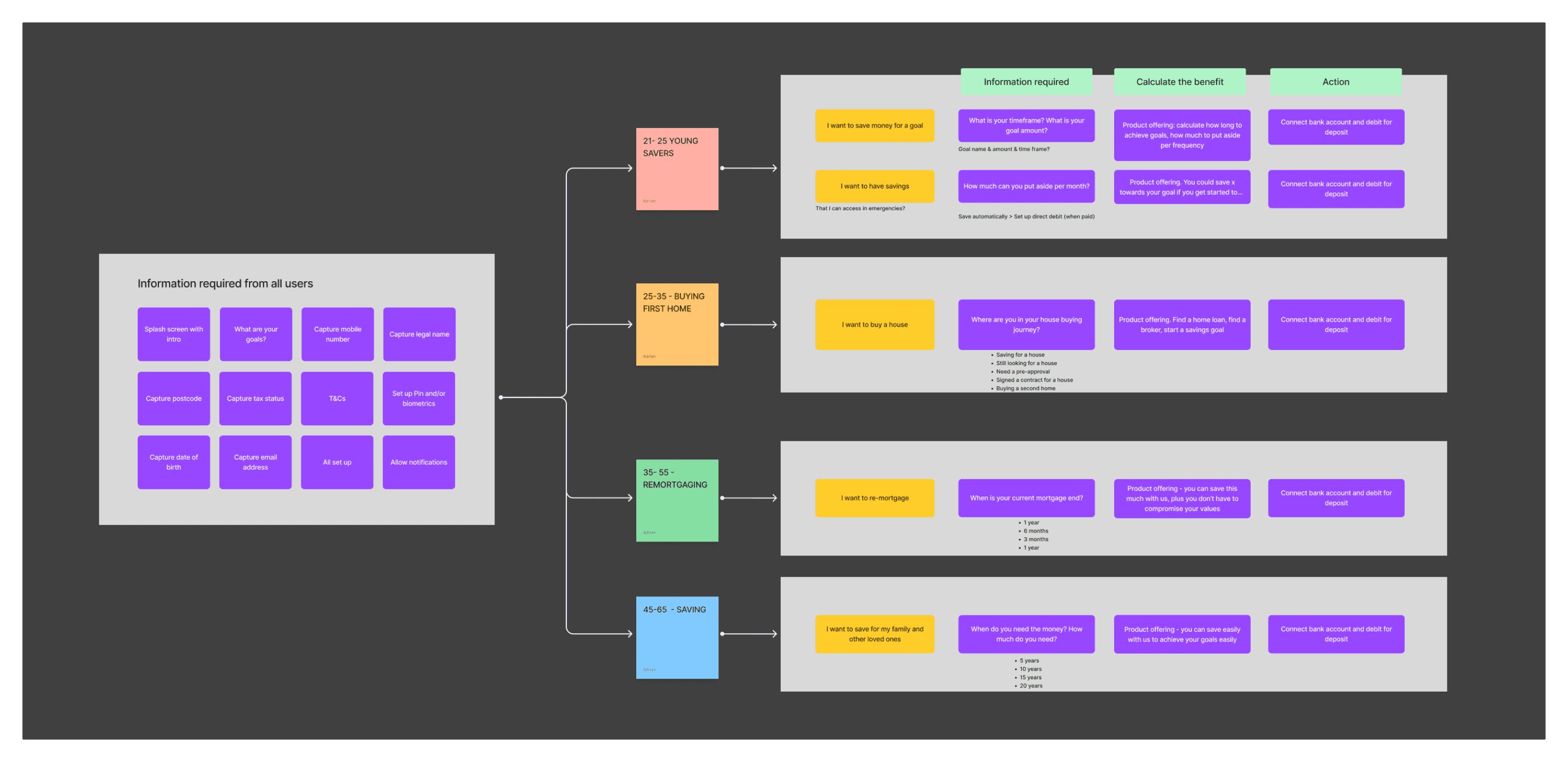

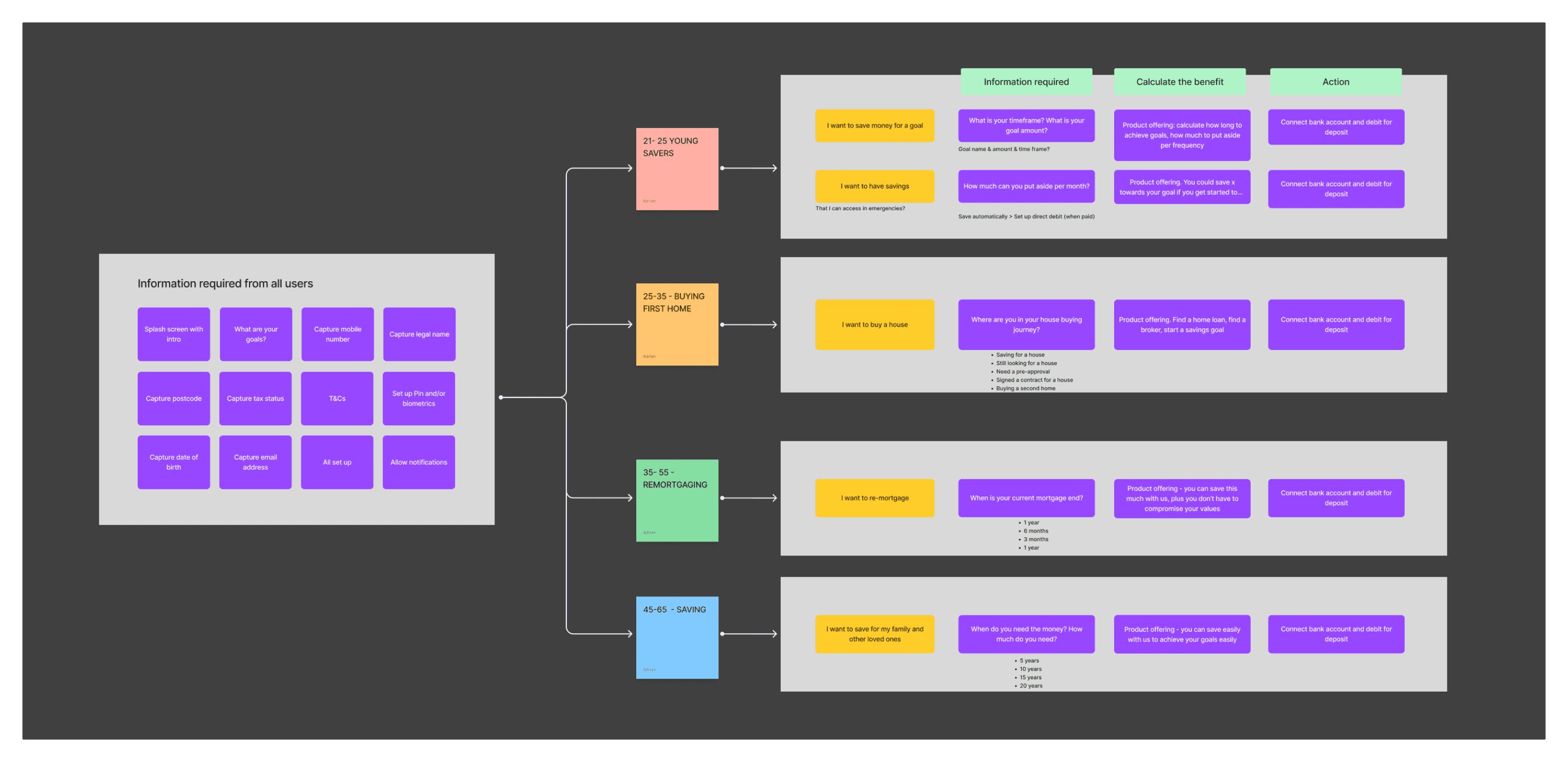

USER FLOW

Mapping the user flow based on profiles

Mapping the user flow based on profiles

Mapping the user flow based on profiles

We identified and categorised into 1) absolutely necessary information required from all users and 2) additional user information based on different functions, refining the customer journey and defining the user flow.

We identified and categorised into 1) absolutely necessary information required from all users and 2) additional user information based on different functions, refining the customer journey and defining the user flow.

We identified and categorised into 1) absolutely necessary information required from all users and 2) additional user information based on different functions, refining the customer journey and defining the user flow.

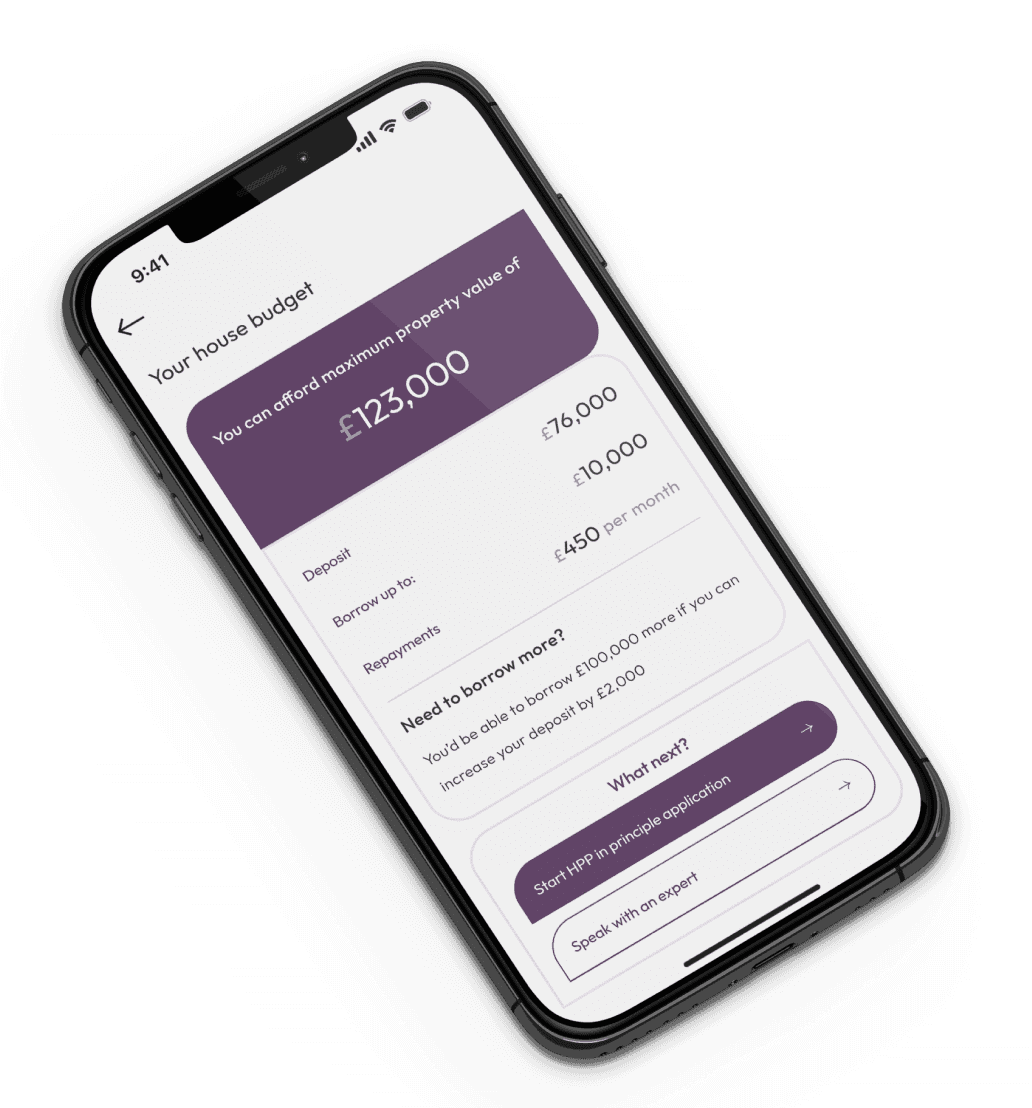

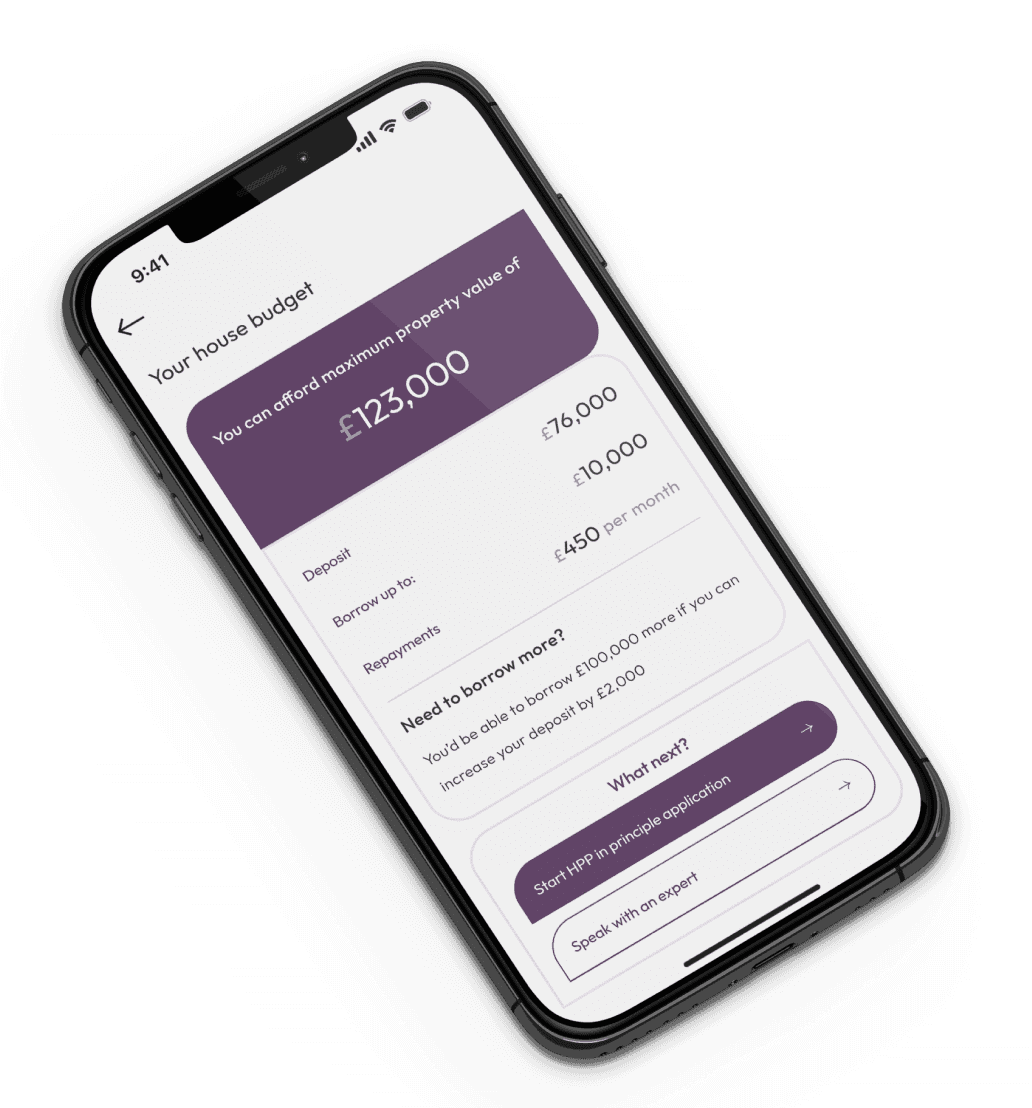

IDEATION

Exploration of the customer journey through lo-fi wireframes.

Exploration of the customer journey through lo-fi wireframes.

Exploration of the customer journey through lo-fi wireframes.

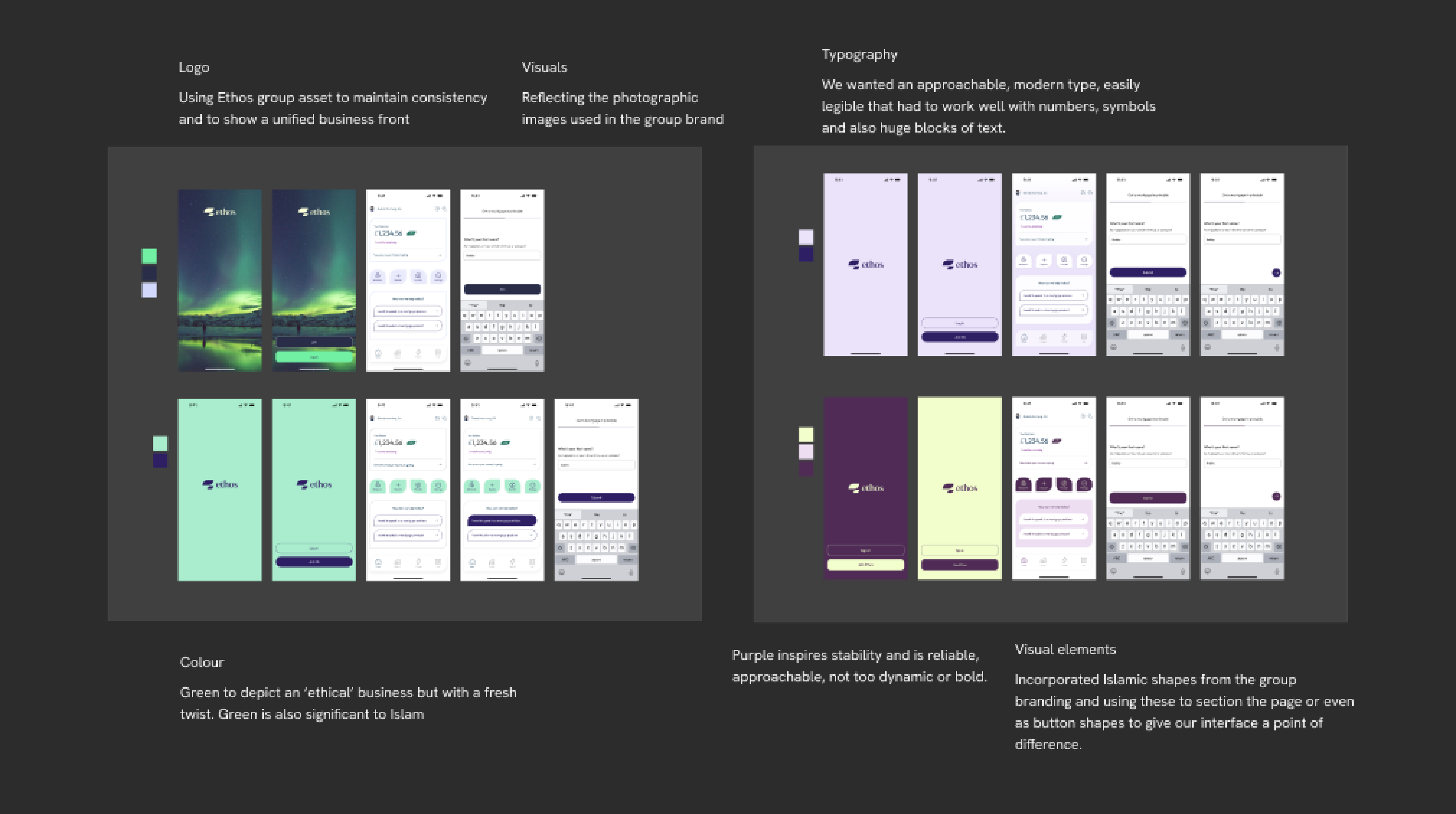

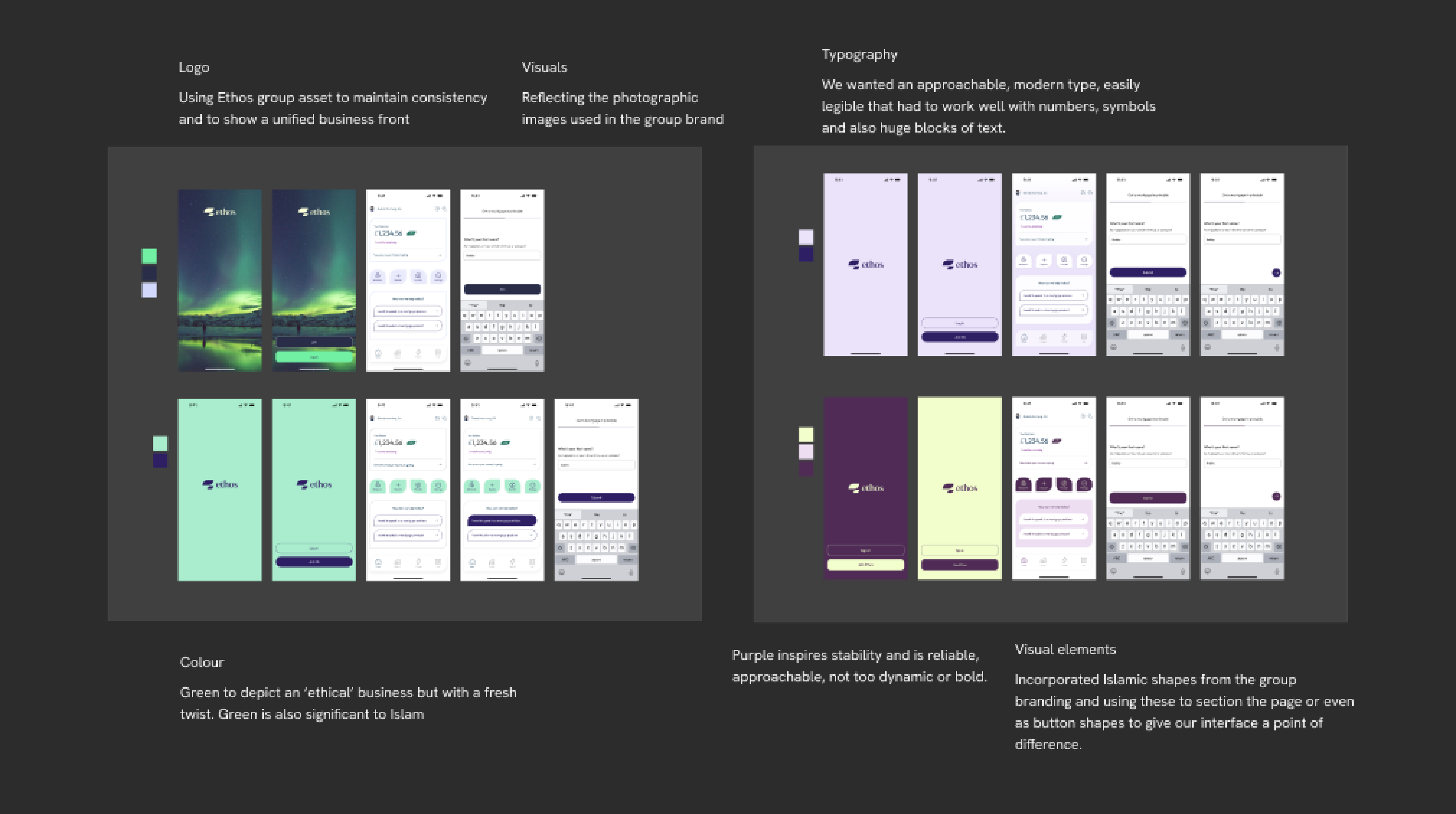

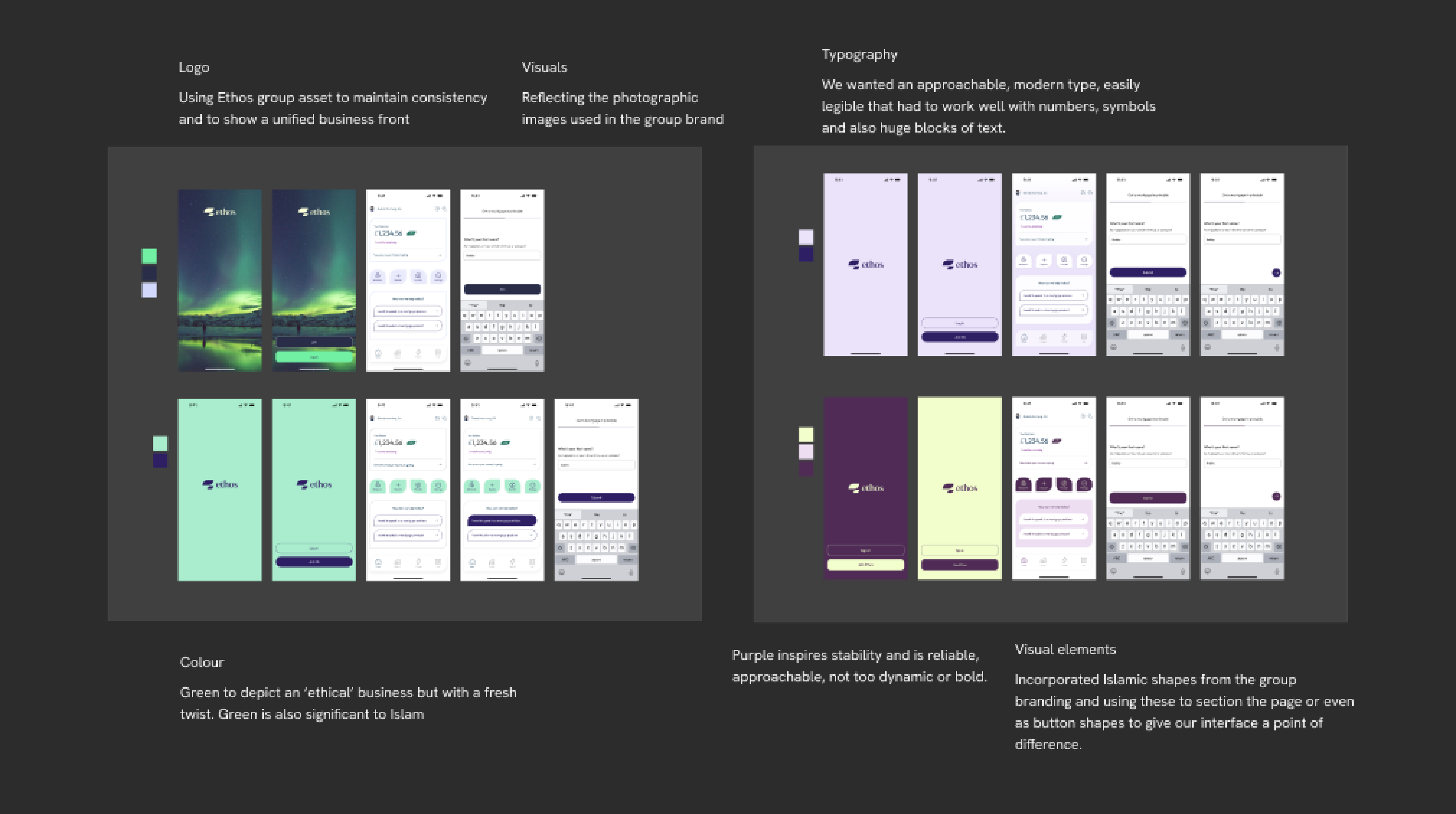

BRANDING

Generating the visual elements for user testing.

Generating the visual elements for user testing.

We conducted unrestricted explorations to visualise the brand’s look and feel, aiming to align with stakeholder input and user feedback.

We attempted to align the branding with the group to which it was determined with the inclusion of stakeholders this couldn’t be translated directly into a digital medium.

The colours and visuals will be tested with users to gauge a reaction to be able to confirm a definitive design direction.

RETROSPECTIVE

Unfortunately my contract ended before we could get the designs in front of eyes for testing. Although exciting, starting from scratch presented it’s own challenges, without existing guidelines and without any live data on the product, it was very green fields thinking.

However reflecting on this unfinished process, we continuously iterated to refine a onboarding experience that resonates with users and sets the foundation for a seamless and personalised banking journey with Ethos Bank.

Unfortunately my contract ended before we could get the designs in front of eyes for testing. Although exciting, starting from scratch presented it’s own challenges, without existing guidelines and without any live data on the product, it was very green fields thinking.

However reflecting on this unfinished process, we continuously iterated to refine a onboarding experience that resonates with users and sets the foundation for a seamless and personalised banking journey with Ethos Bank.

Get in touch. I’d love to connect

I’m in Melbourne, Australia

Get in touch. I’d love to connect

I’m in Melbourne, Australia

Get in touch. I’d love to connect

I’m in Melbourne, Australia