Refining Superfi's debt calculator experience

Refining Superfi's debt calculator experience

OVERVIEW

OVERVIEW

This is a redesign of Superfi’s debt calculator experience. The goal was to improve usability and use interactions to craft an engaging and informative experience.

This is a redesign of Superfi’s debt calculator experience. The goal was to improve usability and use interactions to craft an engaging and informative experience.

ABOUT SUPERFI

ABOUT SUPERFI

Superfi is a UK fintech startup focused on helping people to easily manage their debts and finances. Users link their bank accounts through OpenBanking to add their account balances, debts and bills in one place.

The repayment calculator is Superfi’s core feature that creates a personalised repayment plan for users using debt strategies that will guide them out of debt faster.

Superfi is a UK fintech startup focused on helping people to easily manage their debts and finances. Users link their bank accounts through OpenBanking to add their account balances, debts and bills in one place.

The repayment calculator is Superfi’s core feature that creates a personalised repayment plan for users using debt strategies that will guide them out of debt faster.

ROLE

ROLE

Lead end-to-end design project, from synthesising UX research to ideation, to testing and build.

Lead end-to-end design project, from synthesising UX research to ideation, to testing and build.

TEAM

TEAM

CPO/PM + development agency (front and back end developers) + me

CPO/PM + development agency (front and back end developers) + me

AUDIT & ANALYSIS

AUDIT & ANALYSIS

Identifying pain points & opportunities in existing flow

Identifying pain points & opportunities in existing flow

Identifying pain points & opportunities in existing flow

USER RESEARCH

USER RESEARCH

User interviews revealed areas of friction around usability and content

User interviews revealed areas of friction around usability and content

User interviews revealed areas of friction around usability and content

I conducted remote usability tests with existing design to identify areas of friction. Participants all had multiple debts and considered themselves struggling with their finances. Here are our key findings:

I conducted remote usability tests with existing design to identify areas of friction. Participants all had multiple debts and considered themselves struggling with their finances. Here are our key findings:

“I’m still not sure what avalanche and snowball [strategies] is...The term’s aren’t clear. I’d like to know a bit more.”

of participants were confused and unclear about the different strategies (avalanche and snowball) and language used.

of participants were confused and unclear about the different strategies (avalanche and snowball) and language used.

“I don’t understand what to do. I want more functionality. I want to know how everything is connected and what it all means“

of participants are unsure what the effect of increasing repayments meant to overall debt. Users were not clear on which components they could interact with on screen.

of participants are unsure what the effect of increasing repayments meant to overall debt. Users were not clear on which components they could interact with on screen.

THE HUMAN PROBLEM

THE HUMAN PROBLEM

Navigating and managing multiple debts can be extremely stressful. Superfi’s current debt repayment calculator experience is currently unclear and not impactful, creating even more confusion and low engagement.

Navigating and managing multiple debts can be extremely stressful. Superfi’s current debt repayment calculator experience is currently unclear and not impactful, creating even more confusion and low engagement.

Navigating and managing multiple debts can be extremely stressful. Superfi’s current debt repayment calculator experience is currently unclear and not impactful, creating even more confusion and low engagement.

DESIGN PRINCIPLES

DESIGN PRINCIPLES

Help users easily understand the 2 different repayment strategies (avalanche & snowball).

Educate the user on impact of increasing their repayments to reducing their debts.

Increase engagement by making the design encouraging & easy to use.

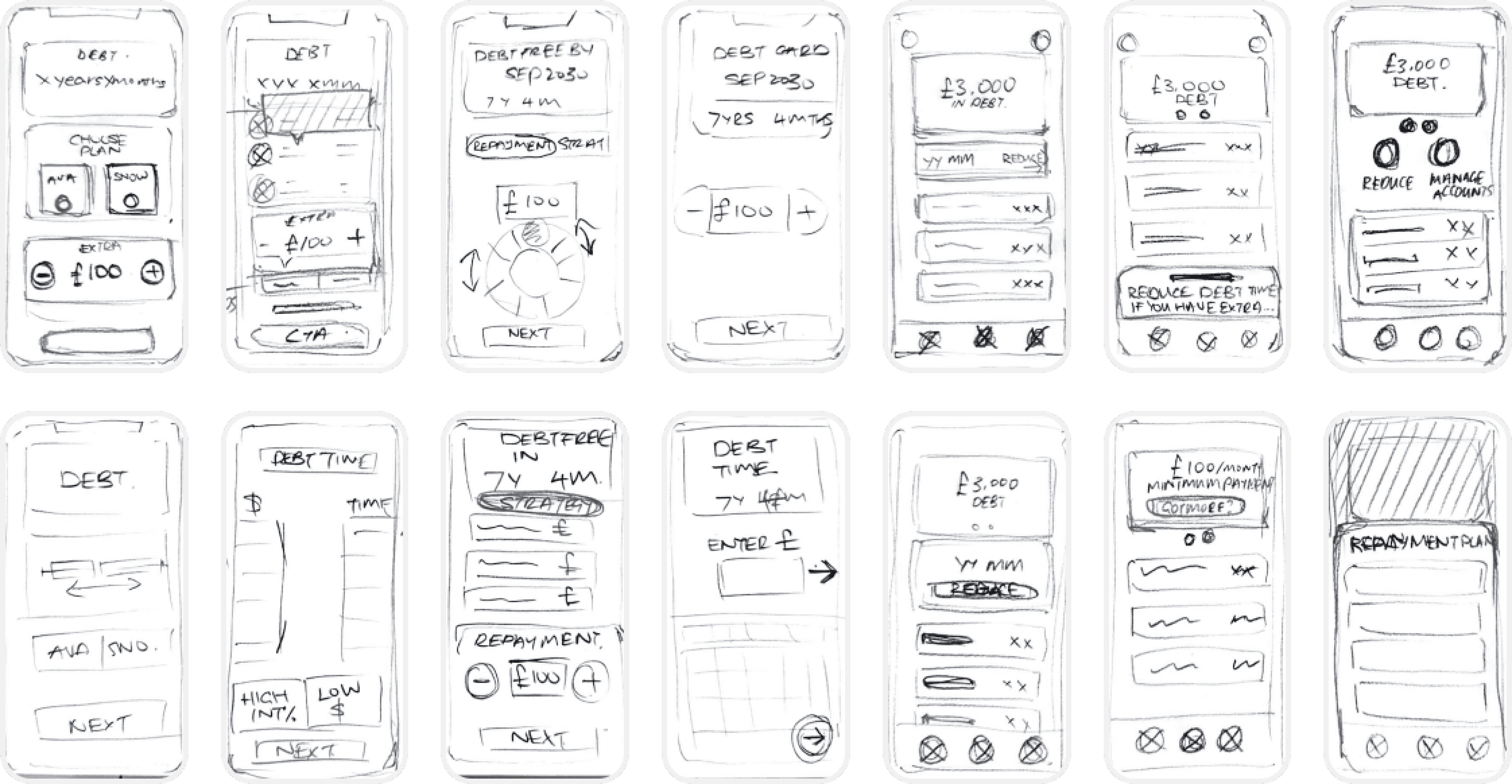

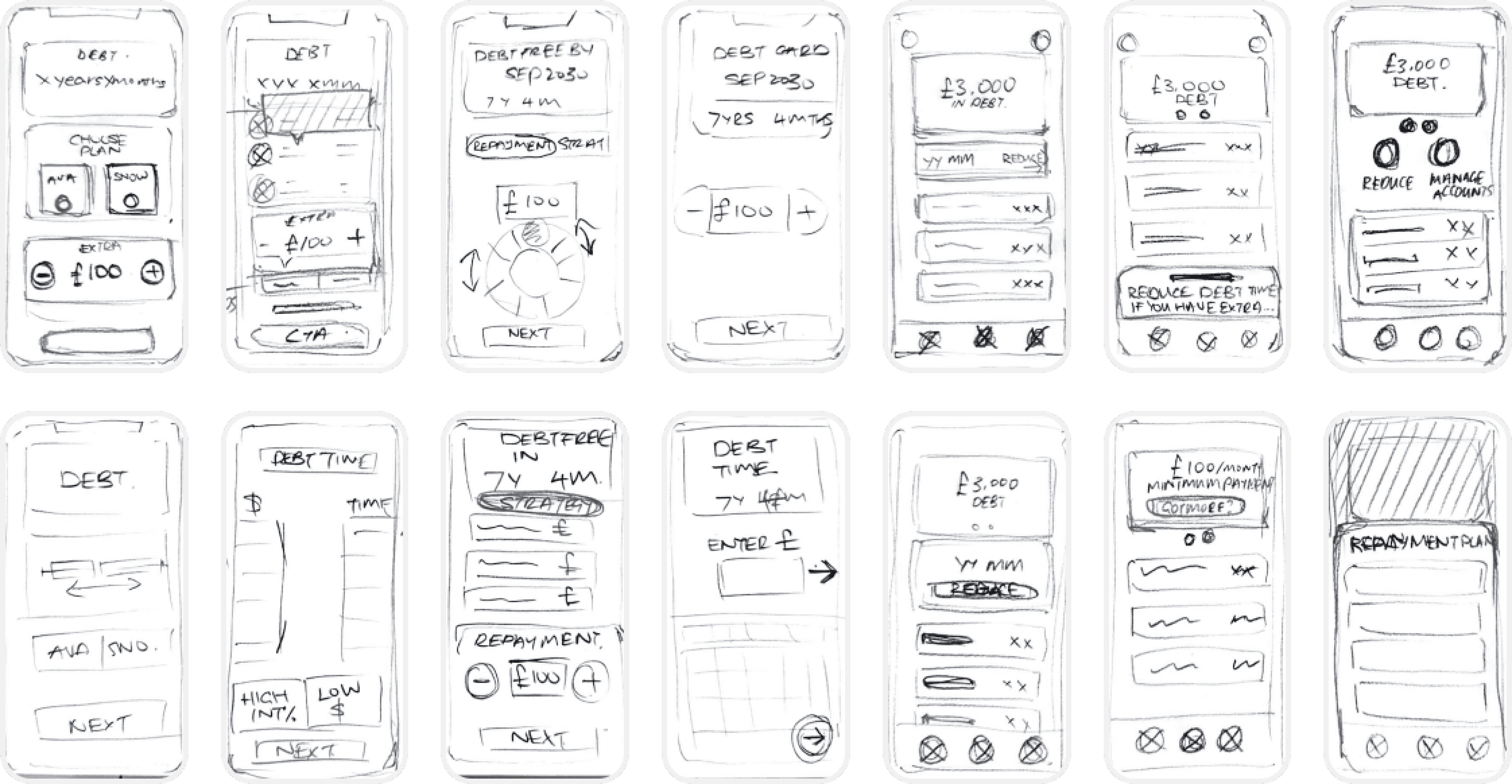

IDEATION

IDEATION

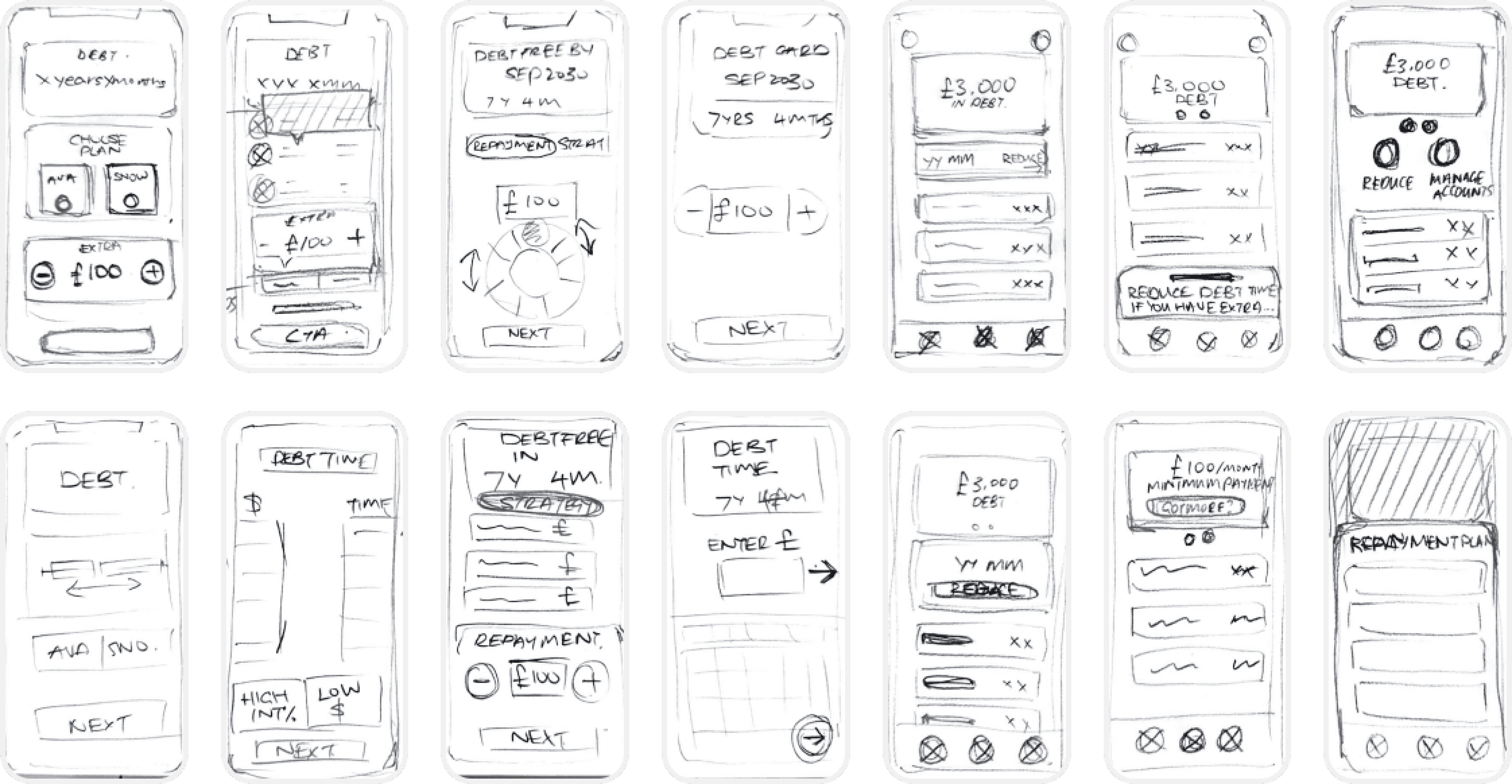

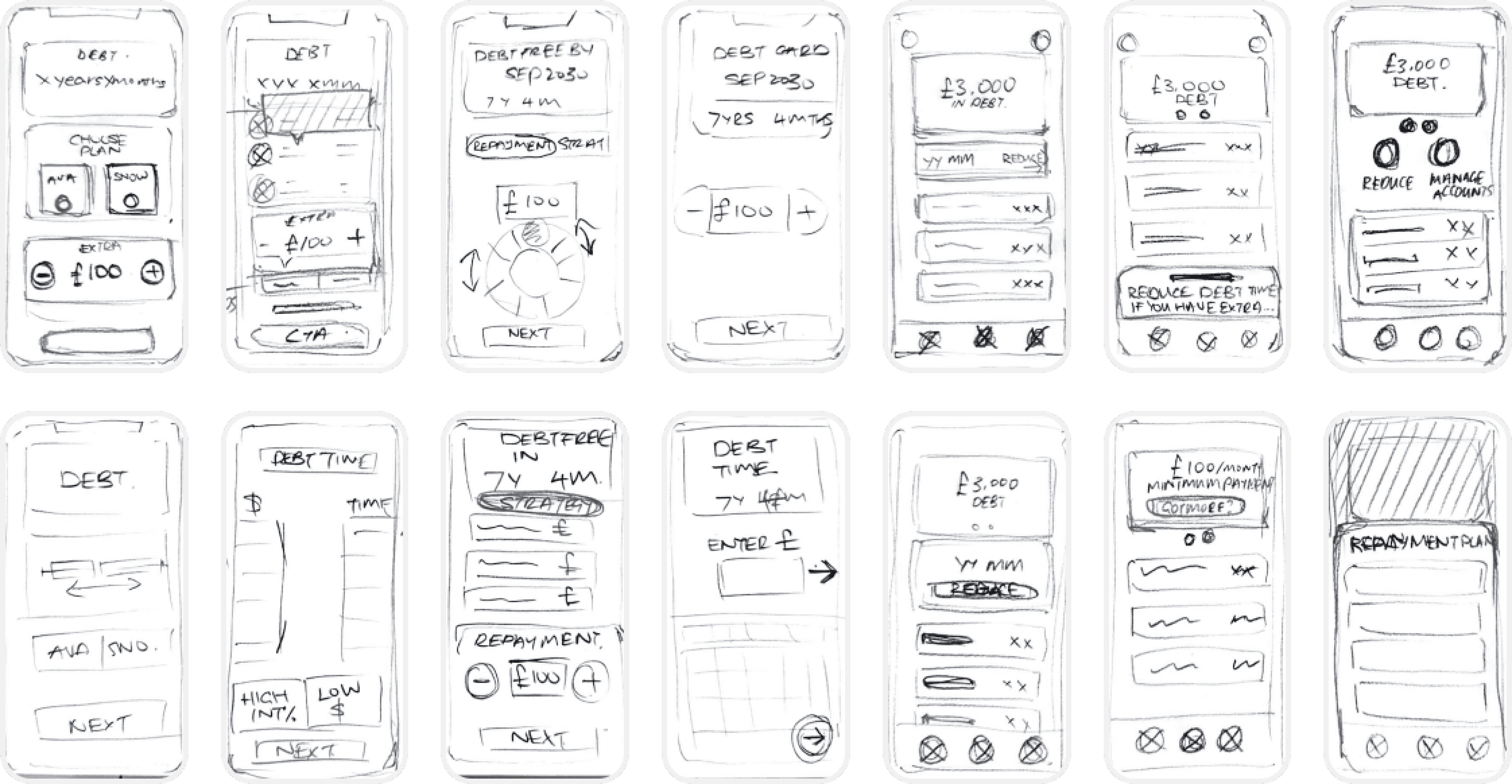

Exploring interactive elements to encourage users to increase repayments

Exploring interactive elements to encourage users to increase repayments

Exploring interactive elements to encourage users to increase repayments

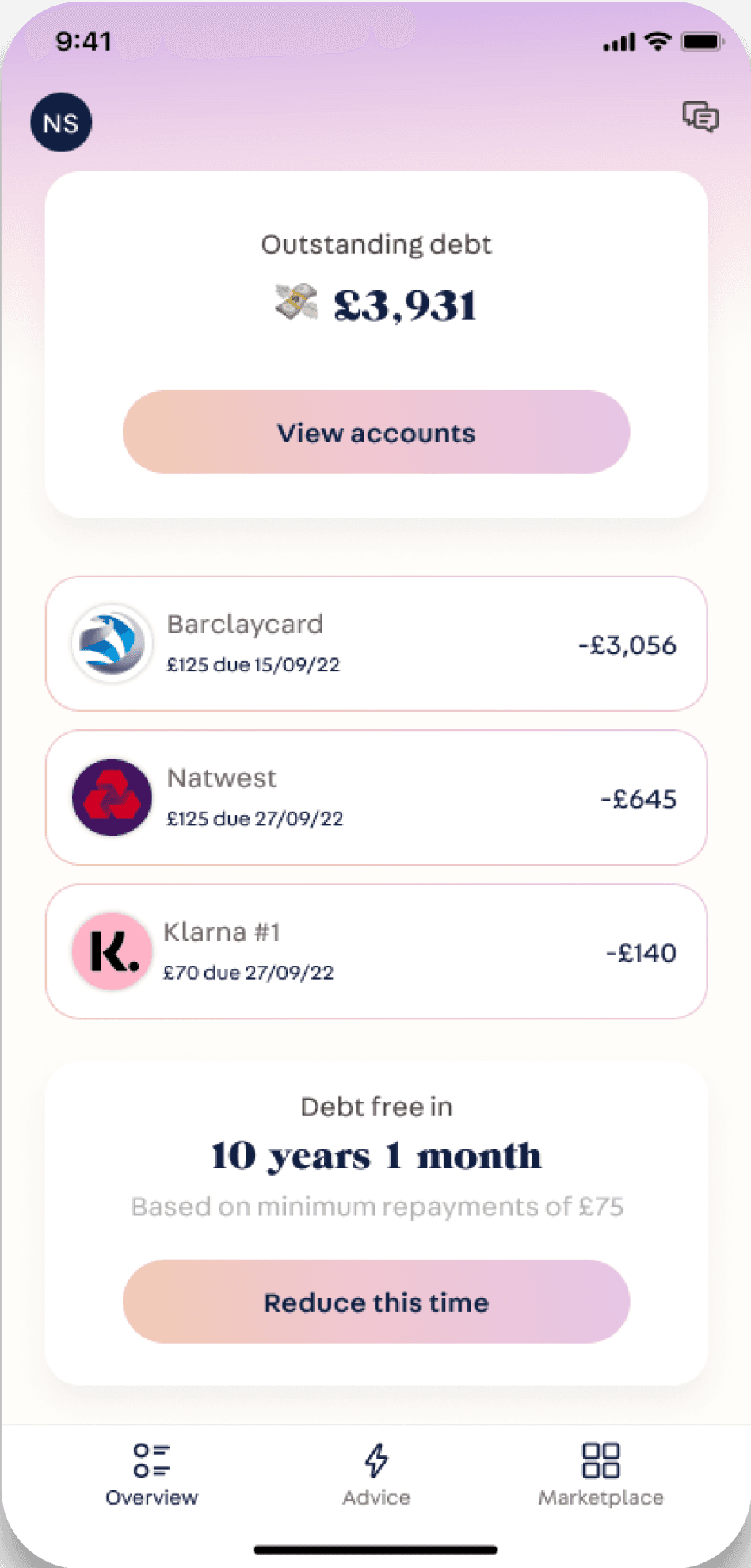

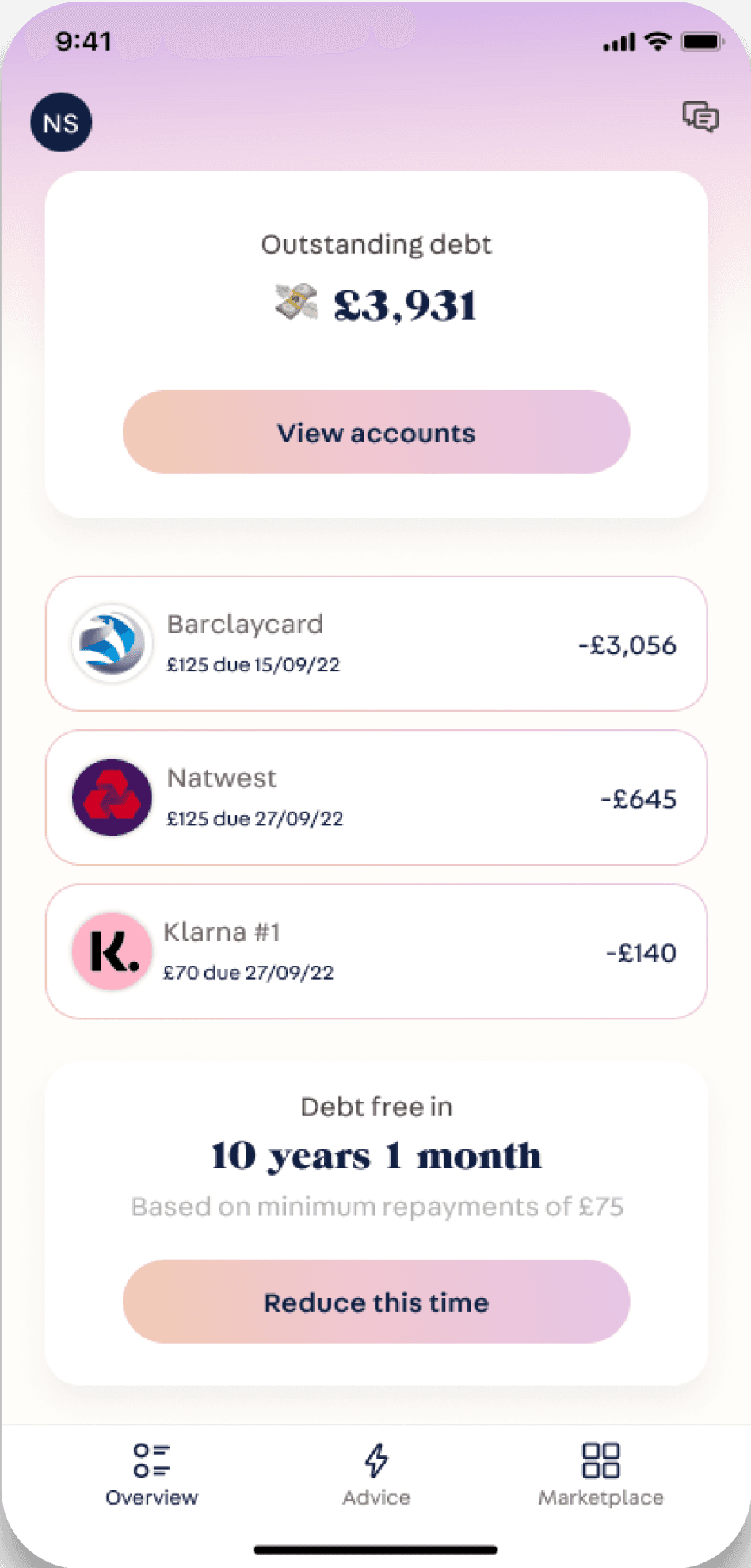

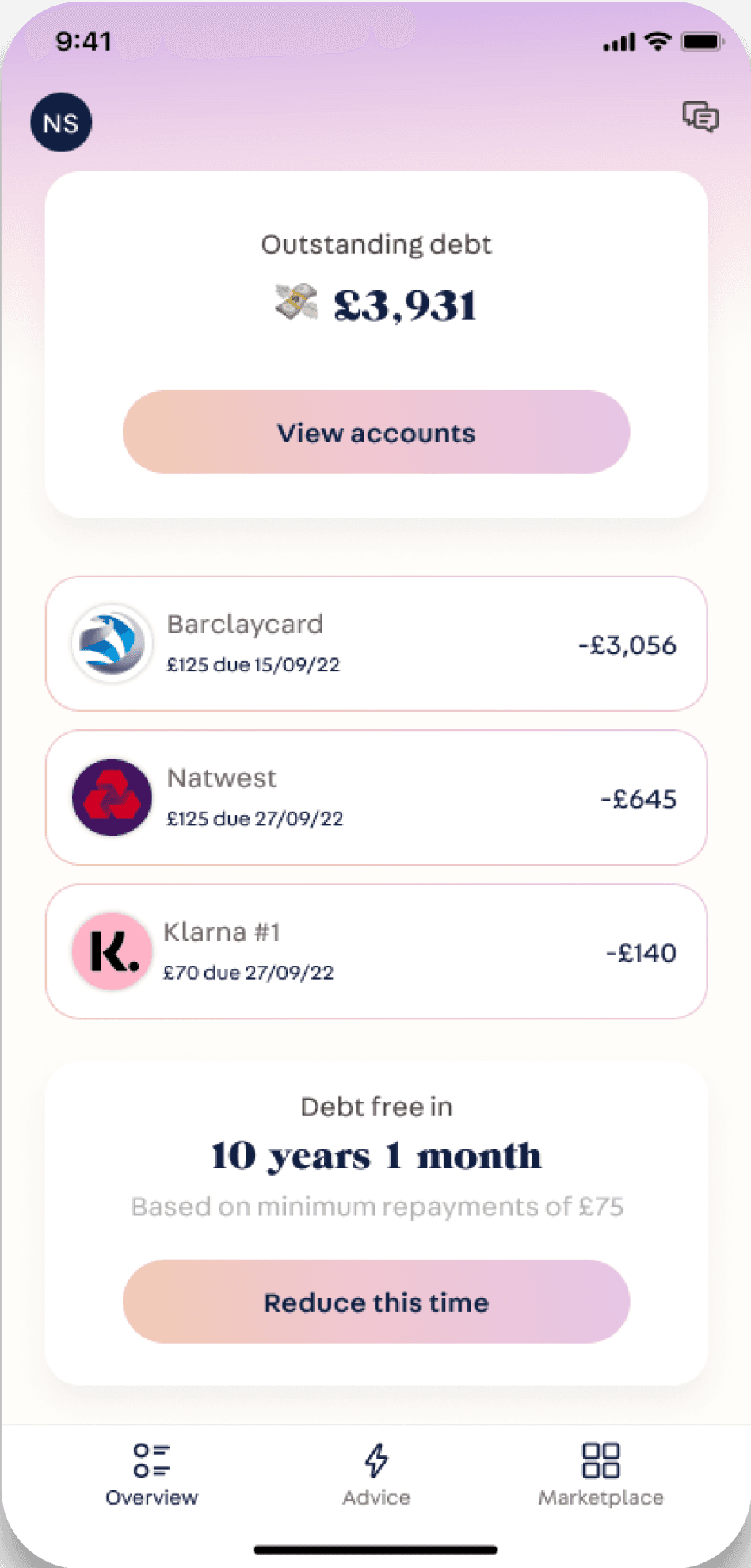

Before

Before

Difficult to see the full picture. How can I know how my repayments affect my total debt time? What does the strategy even do?

Exploring more visual and interactive designs to show impact and to educate

Affordance - using familiar patterns in the industry that users will understand instantly

Operating more like a calculator to ‘calculate’ debt free time

Before

Difficult to see the full picture. How can I know how my repayments affect my total debt time? What does the strategy even do?

Exploring more visual and interactive designs to show impact and to educate

Affordance - using familiar patterns in the industry that users will understand instantly

Operating more like a calculator to ‘calculate’ debt free time

USER TESTING

USER TESTING

Testing engagement & content hypotheses with 2 prototypes

Testing engagement & content hypotheses with 2 prototypes

Testing engagement & content hypotheses with 2 prototypes

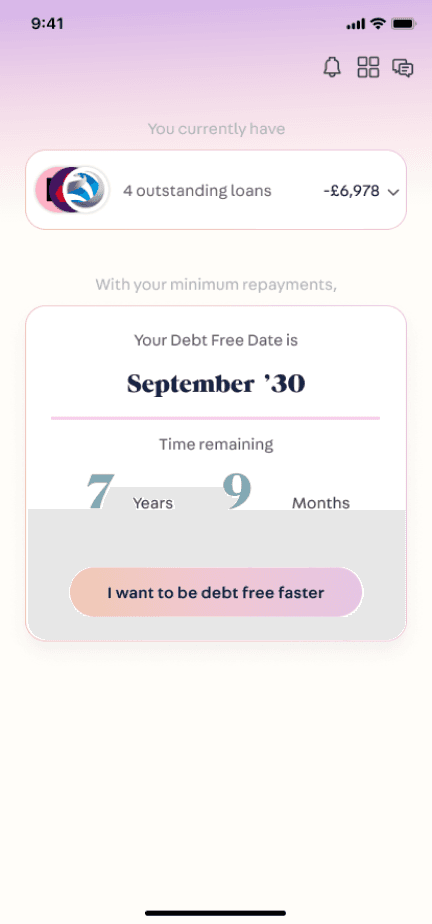

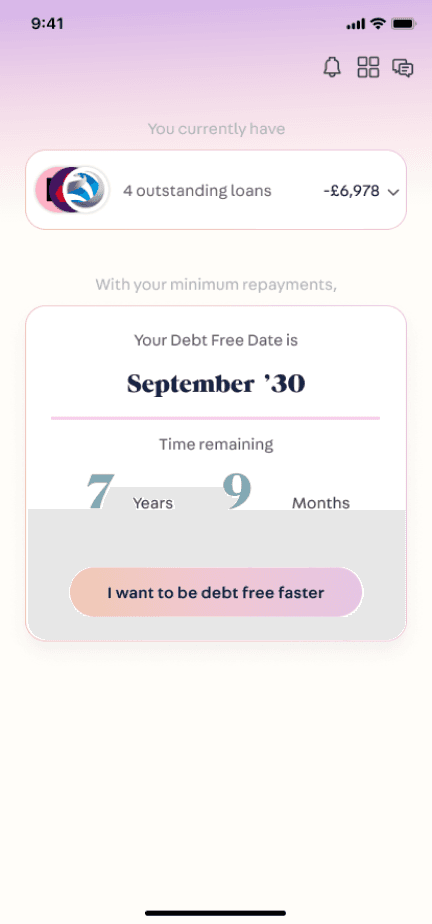

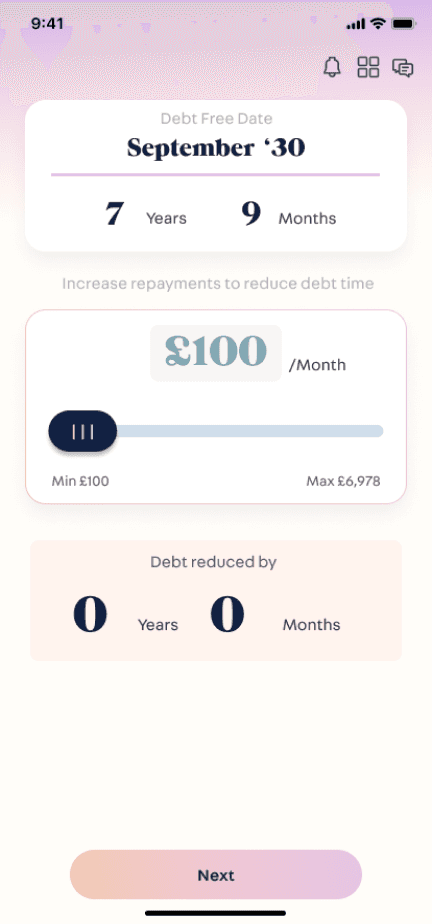

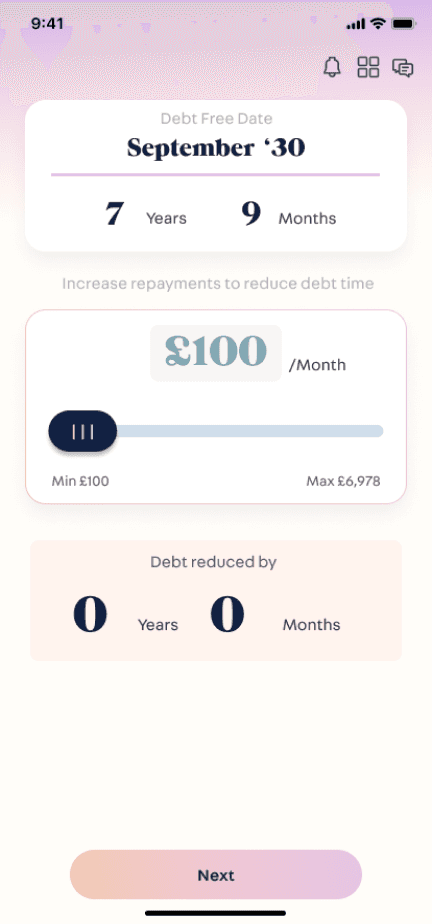

Var. 1

As simple and clear as possible, showcasing key info only

Var. 1

As simple and clear as possible, showcasing key info only

Var. 1

As simple and clear as possible, showcasing key info only

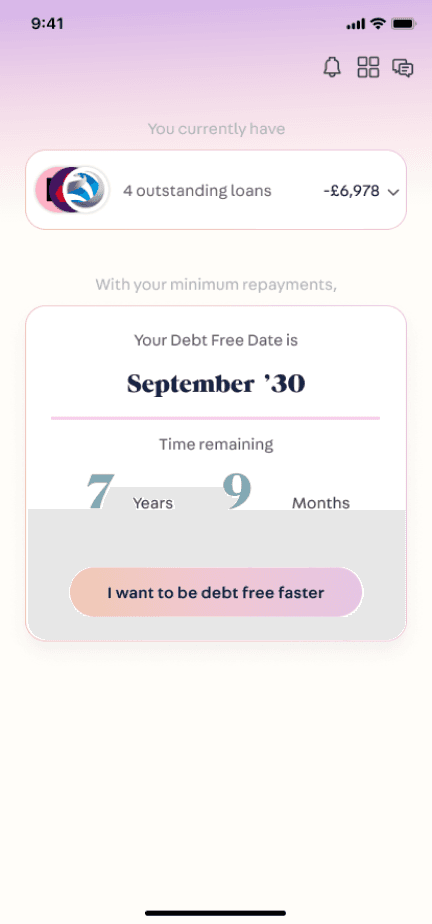

Intro page to explain current financial situation.

Intro page to explain current financial situation.

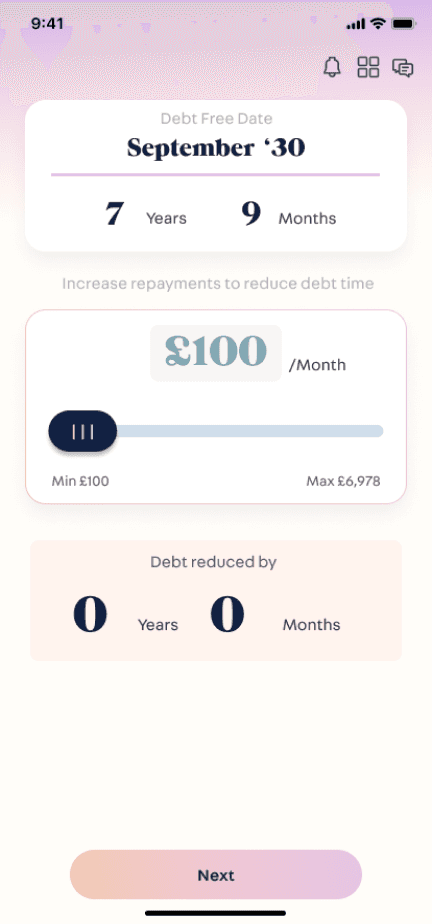

Step by step flow to select repayment amount first. Slider interaction with clear CTA

Step by step flow to select repayment amount first. Slider interaction with clear CTA

Step by step flow to select repayment amount first. Slider interaction with clear CTA

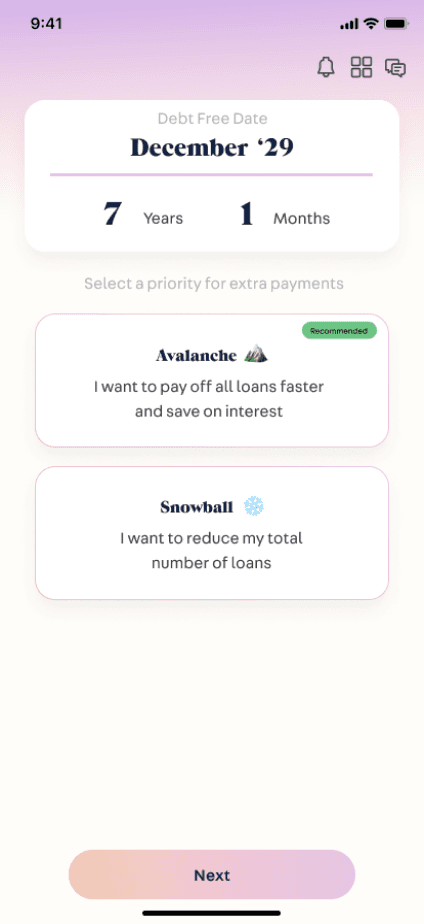

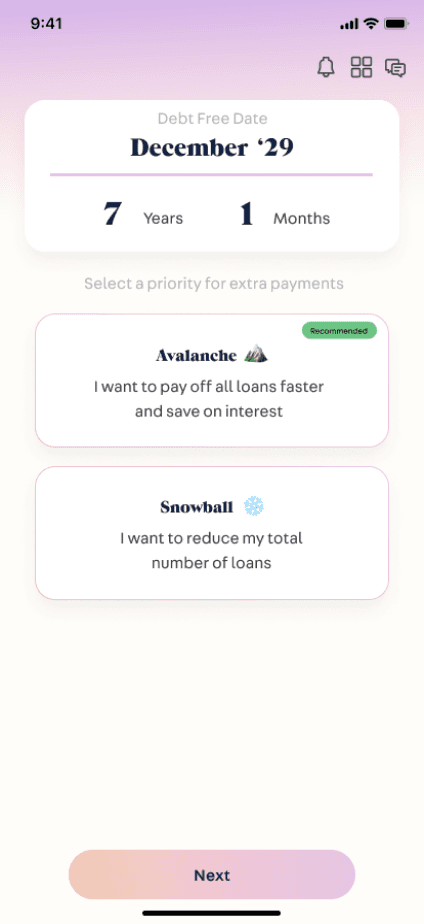

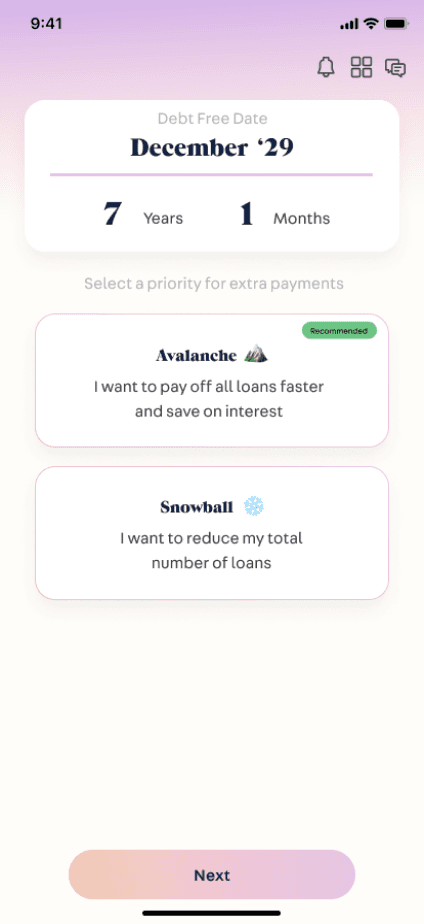

Select the strategy with simple explanation

Select the strategy with simple explanation

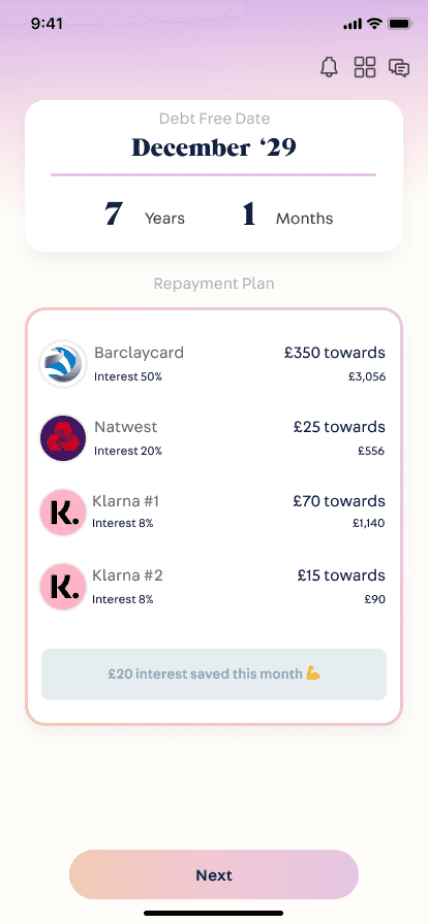

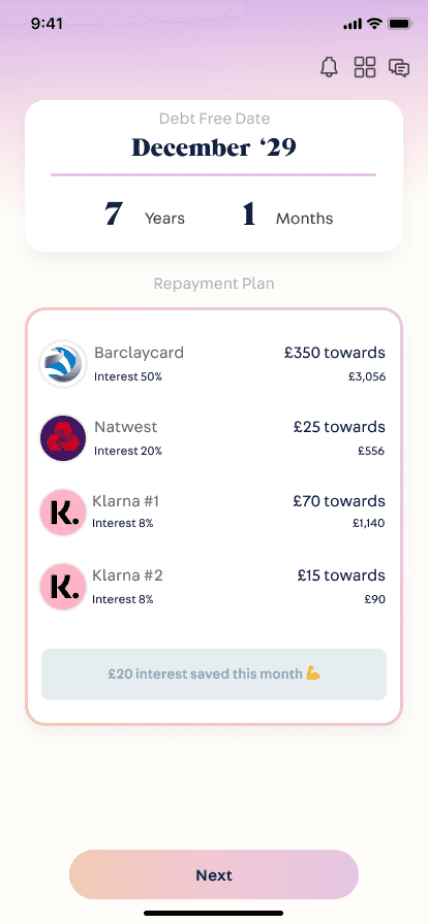

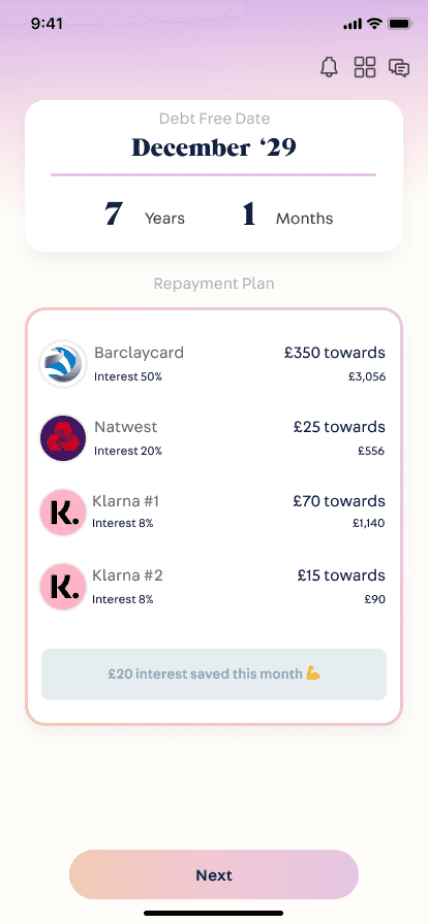

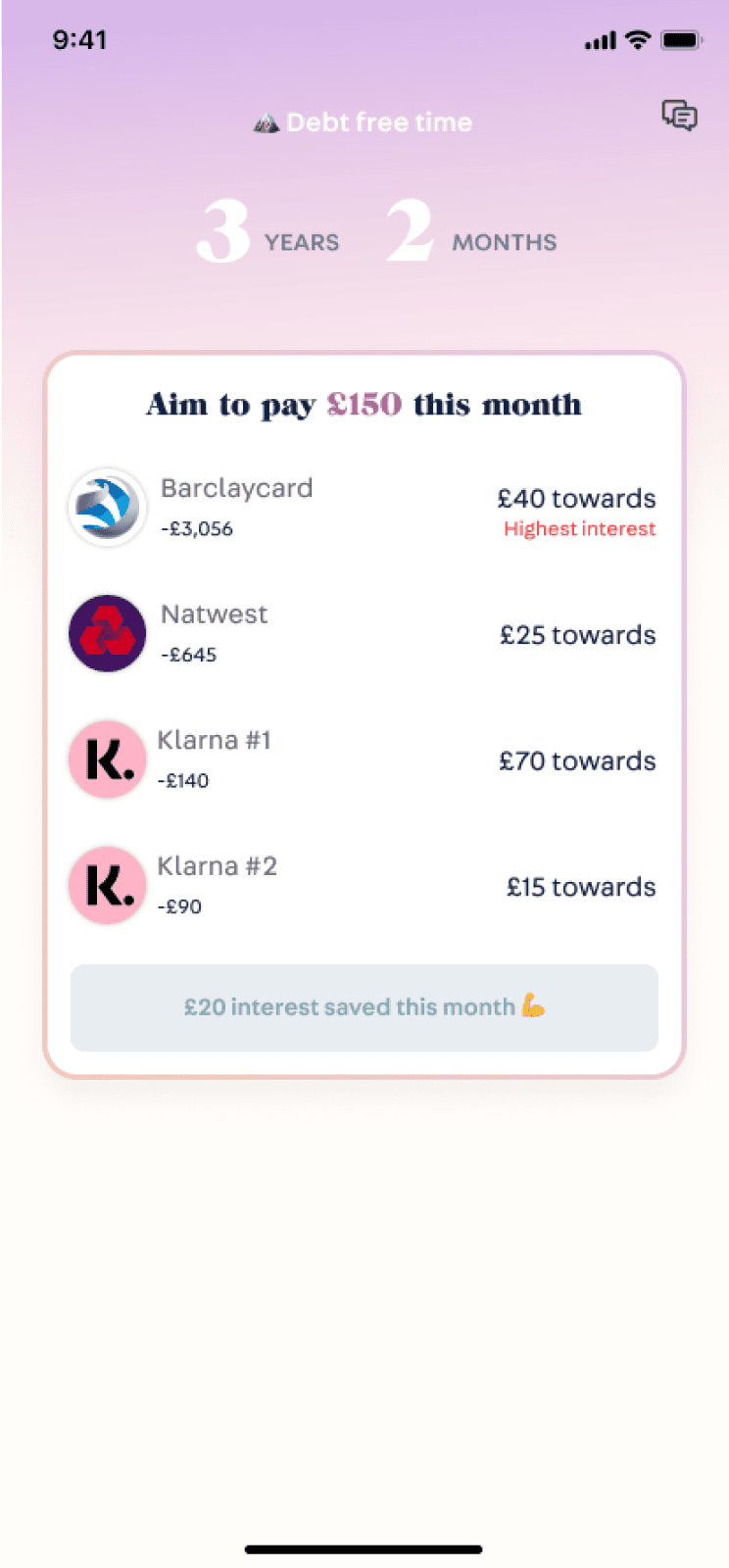

Showing breakdown of all debts owed and what priorities are. Clear instructions

Showing breakdown of all debts owed and what priorities are. Clear instructions

Breakdown of all debts owed and what priorities are. Clear instructions

Intro page to explain current financial situation.

Step by step flow to select repayment amount first. Slider interaction with clear CTA

Select the strategy with simple explanation

Breakdown of all debts owed and what priorities are. Clear instructions

Var. 1

As simple and clear as possible, showcasing key info only

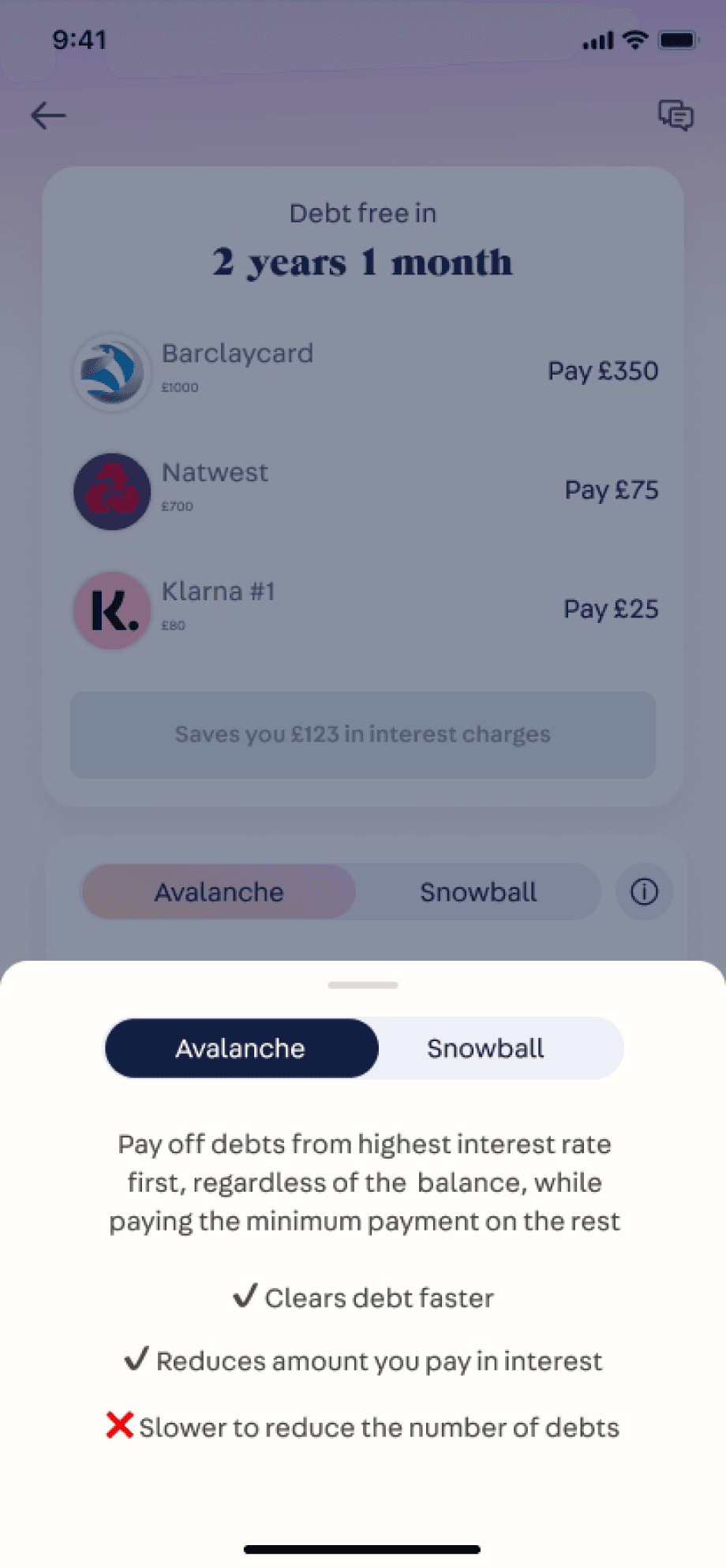

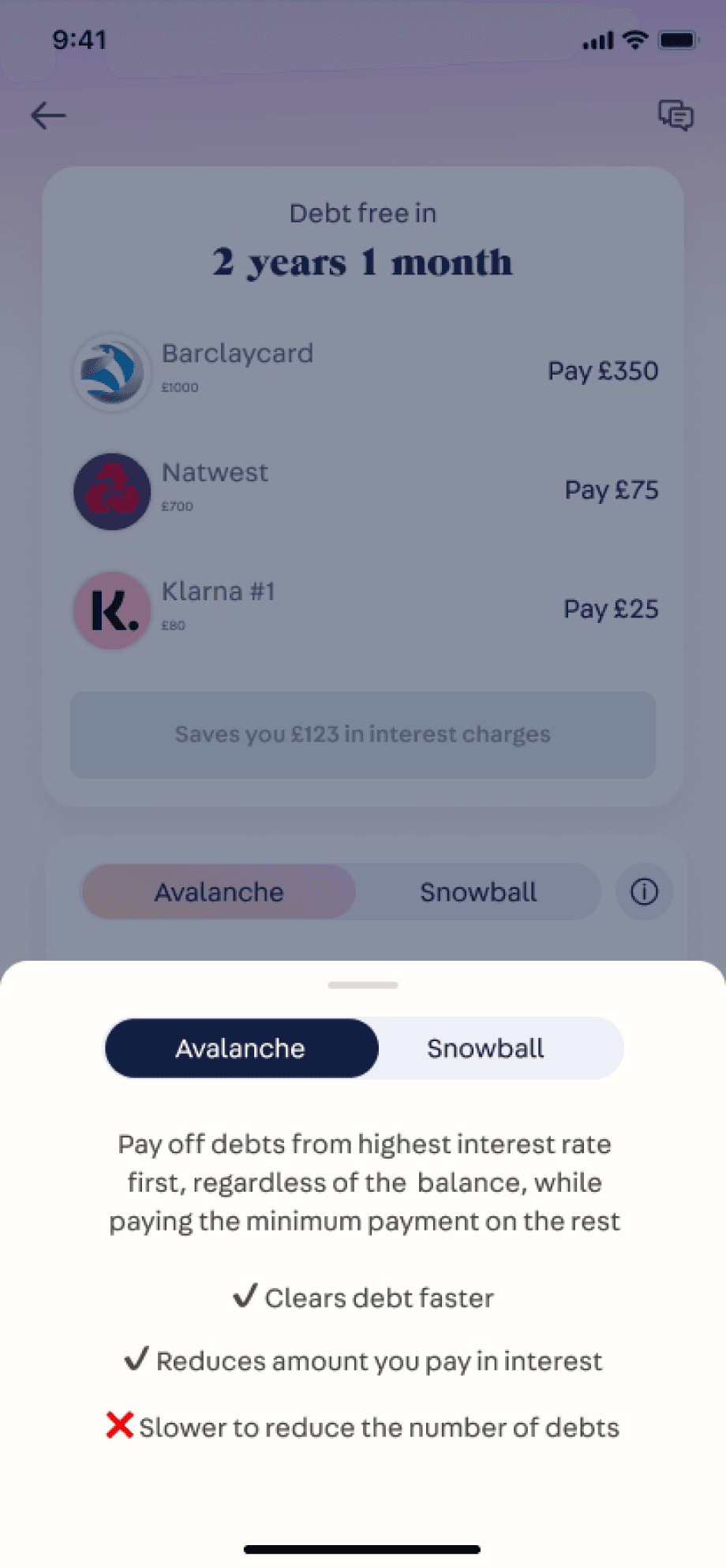

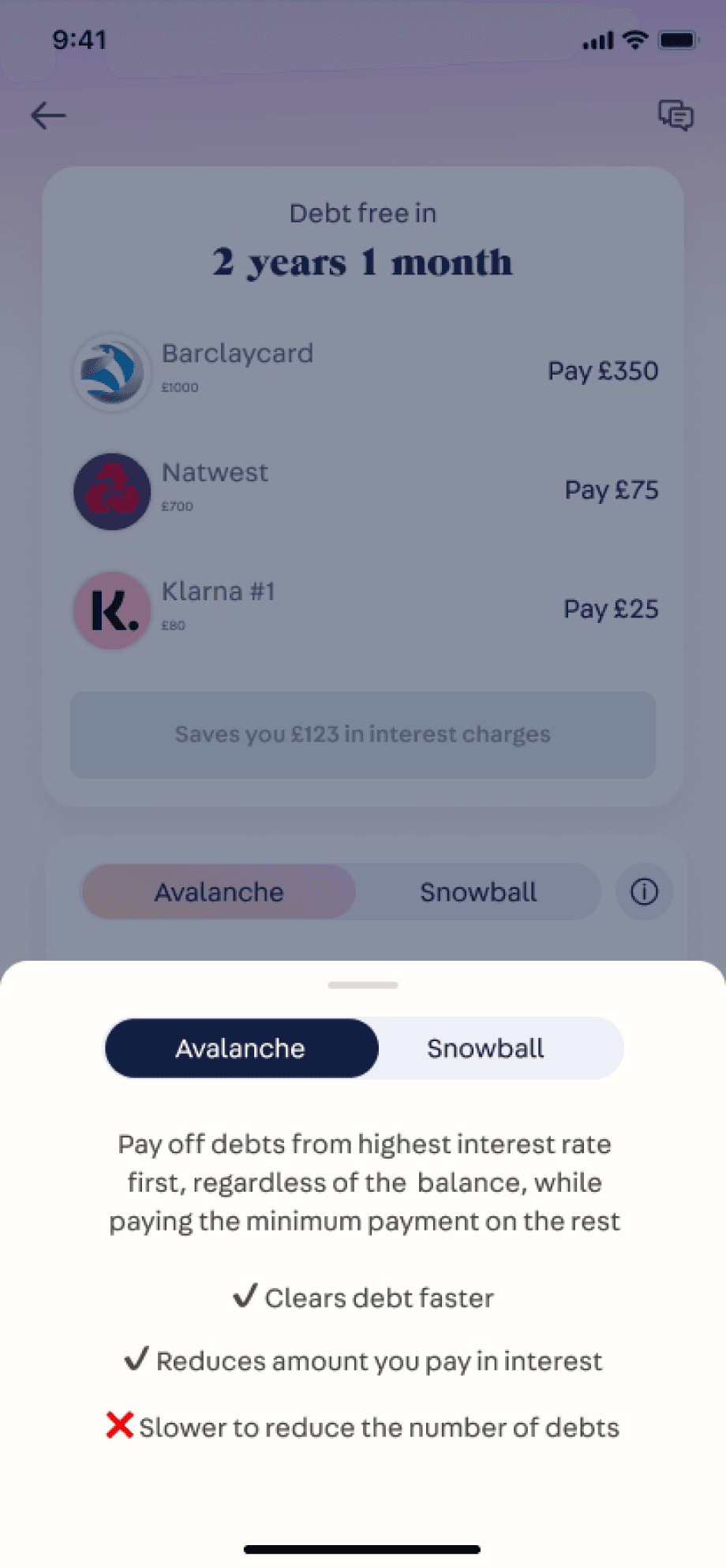

Var. 2

Optional information is always accessible, more educational

Var. 2

Optional information is always accessible, more educational

Var. 2

Optional information is always accessible, more educational

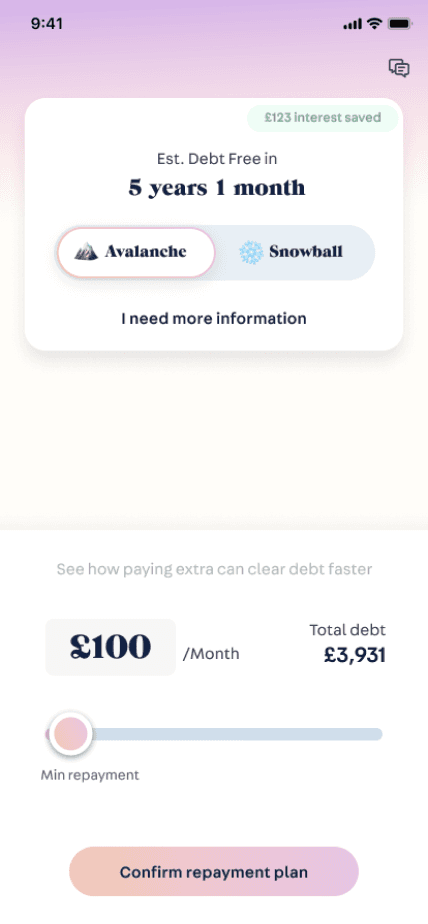

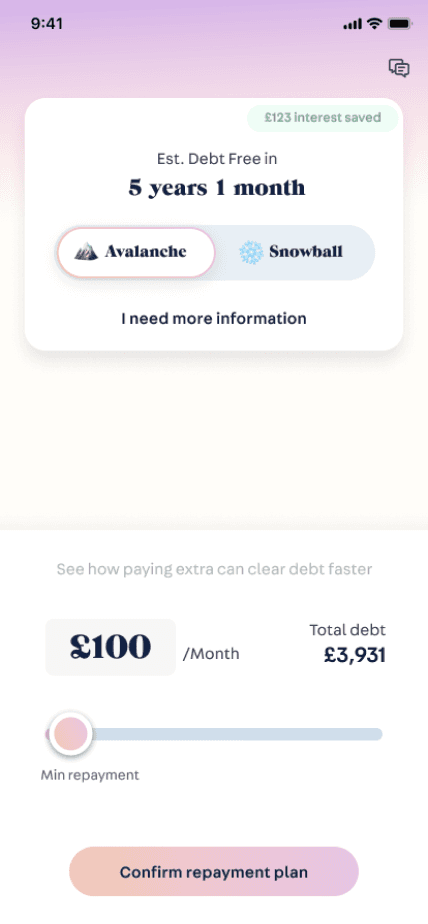

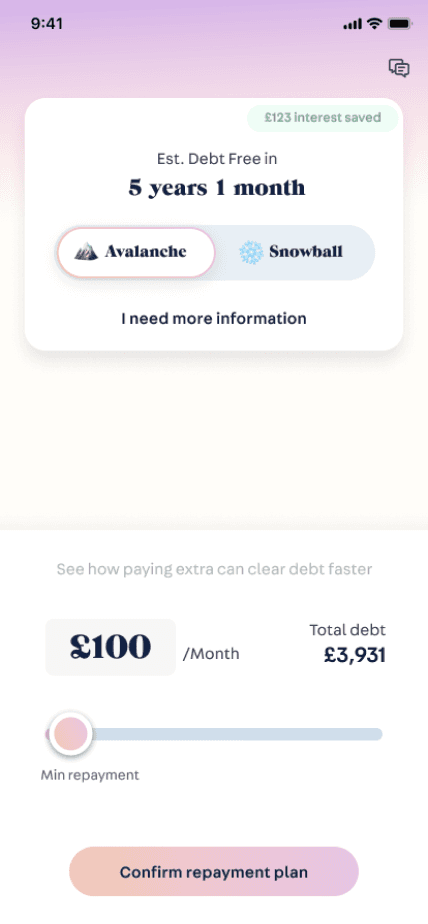

Slider component with live changes to debt free time to show impact

Slider component with live changes to debt free time to show impact

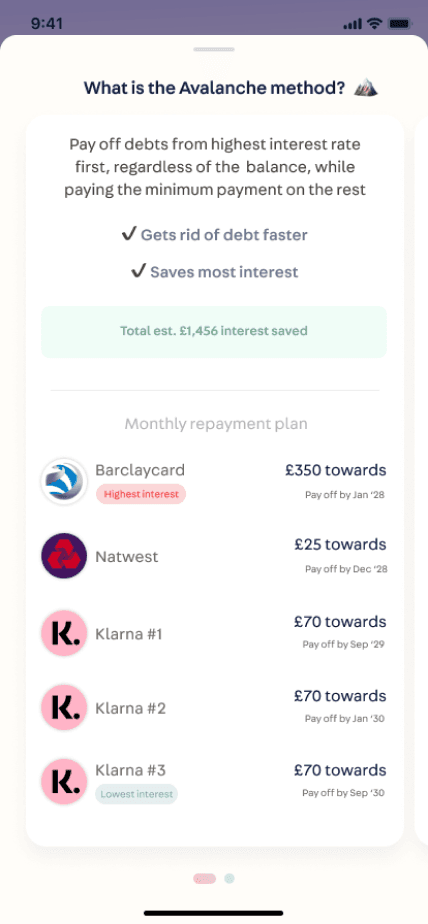

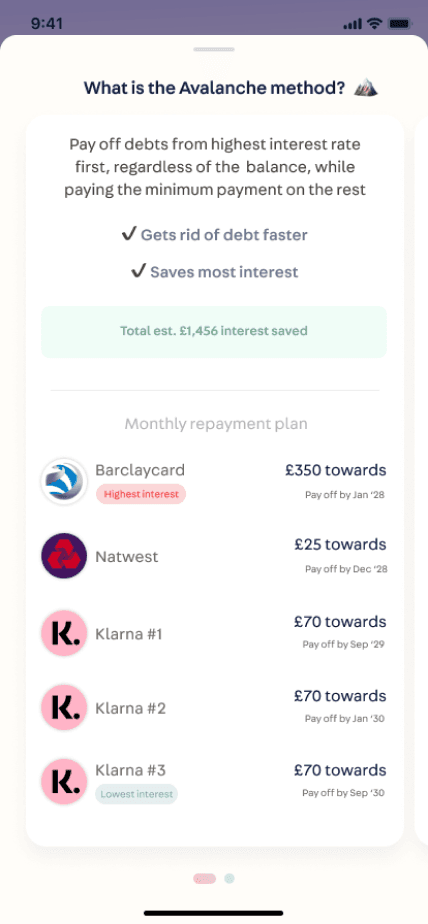

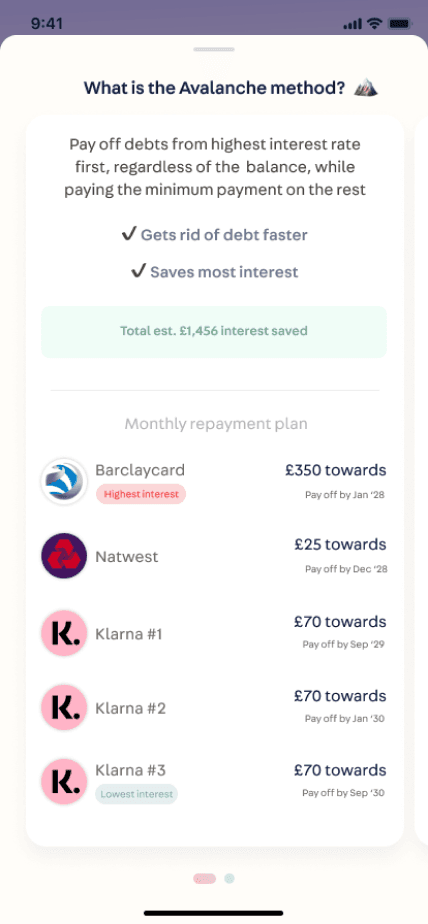

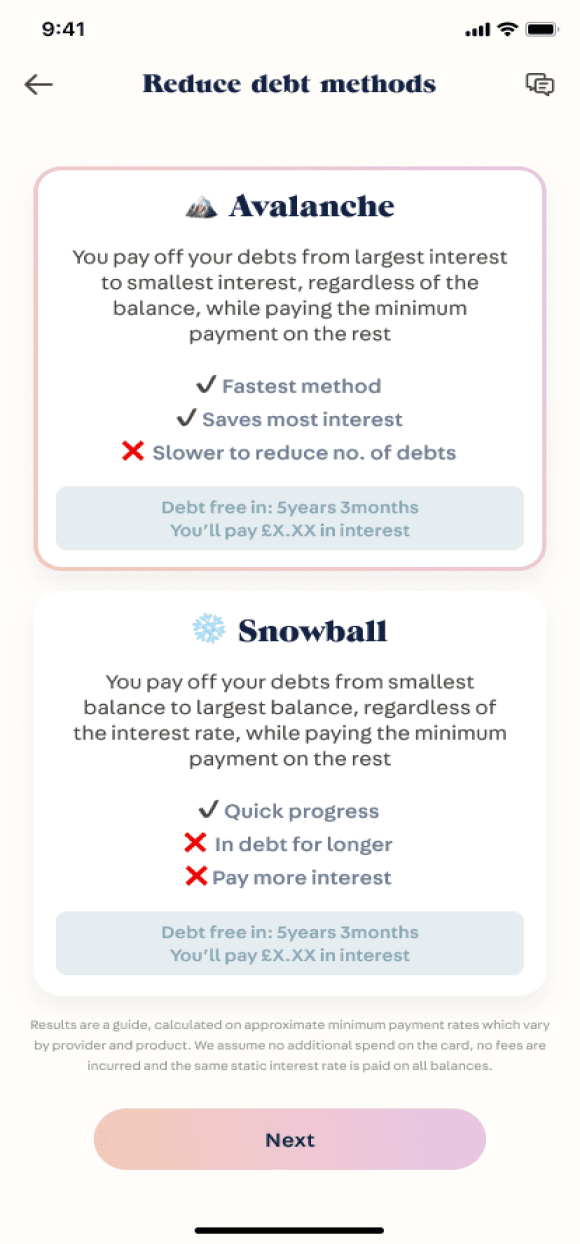

Avalanche information. Clearly showing value and benefits with breakdown

Avalanche information. Clearly showing value and benefits with breakdown

Avalanche information. Clearly showing value and benefits with breakdown

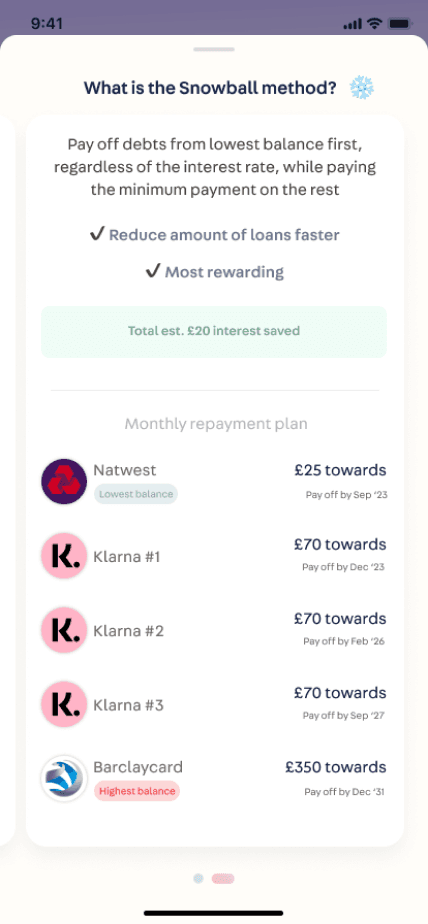

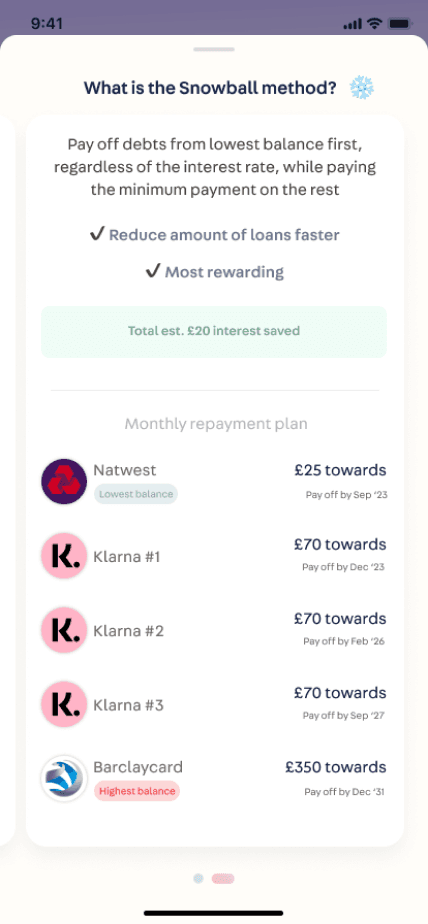

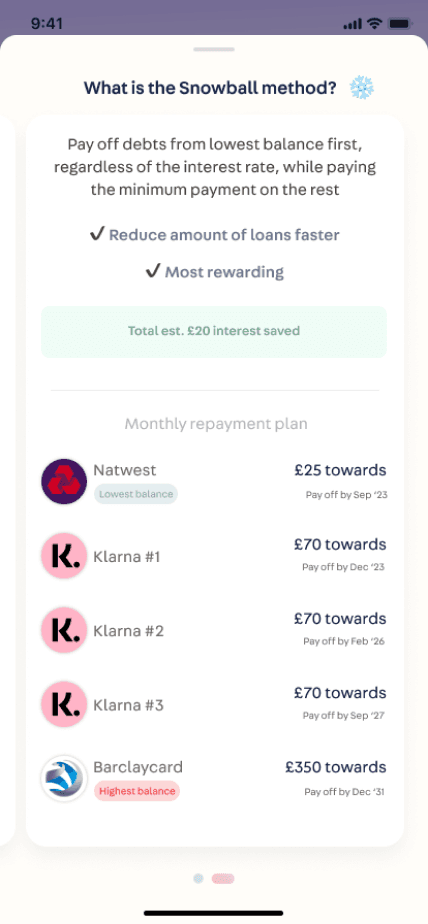

Pagination swipe for Snowball information

Pagination swipe for Snowball information

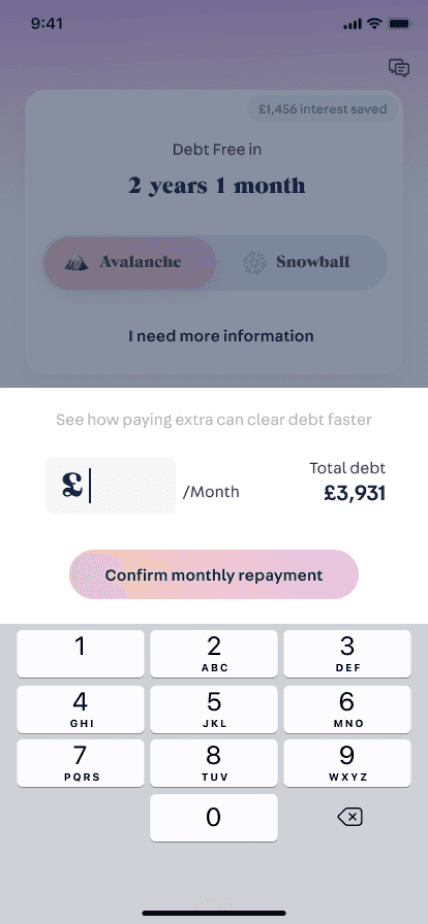

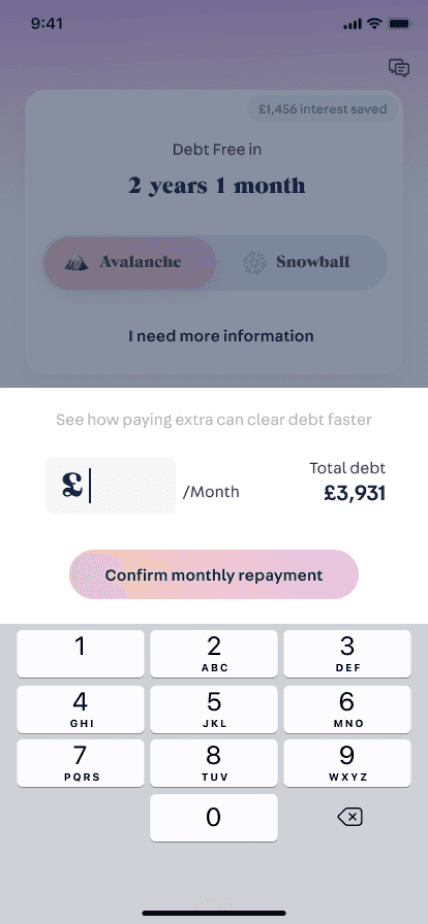

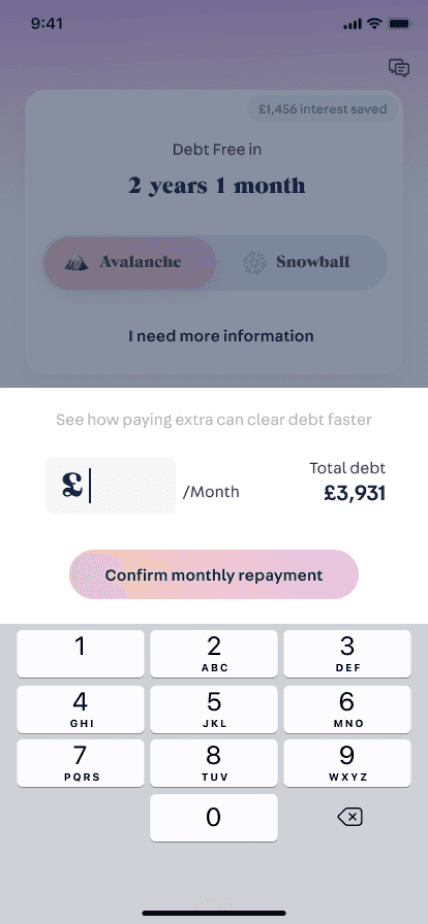

Can also manually input if slider is not precise enough

Can also manually input if slider is not precise enough

Showing breakdown of all debts owed and what priorities are. Clear instructions

Showing breakdown of all debts owed and what priorities are. Clear instructions

Breakdown of all debts owed and what priorities are. Clear instructions

Var. 2

Optional information is always accessible, more educational

Slider component with live changes to debt free time to show impact

Avalanche information. Clearly showing value and benefits with breakdown

Pagination swipe for Snowball information

Can also manually input if slider is not precise enough

Breakdown of all debts owed and what priorities are. Clear instructions

KEY FINDINGS

Var 1 feedback

“Instructions were clear, simple and easy to use.”

“I expect some more explanation of how the method works.”

“I like the straightforward, simple approach to finance which is usually difficult”

Var 2 feedback

“Much more informative and more in-depth...”

“Clear to understand. Very easy to interact.”

“Easy to understand that these are different strategies on how to pay off debt and what the benefits are of each.”

Var 1

Var 2

Task success rate

Task success rate

83%

83%

100%

100%

Participants that understood the avalanche and snowball repayment strategies and it’s impact

Participants that understood the avalanche and snowball repayment strategies and it’s impact

66%

66%

83%

83%

Participants that thought designs were simple and easy to understand

Participants that thought designs were simple and easy to understand

100%

100%

100%

100%

Var 1 feedback

“Instructions were clear, simple and easy to use.”

“I expect some more explanation of how the method works.”

“I like the straightforward, simple approach to finance which is usually difficult”

Var 2 feedback

“Much more informative and more in-depth...”

“Clear to understand. Very easy to interact.”

“Easy to understand that these are different strategies on how to pay off debt and what the benefits are of each.”

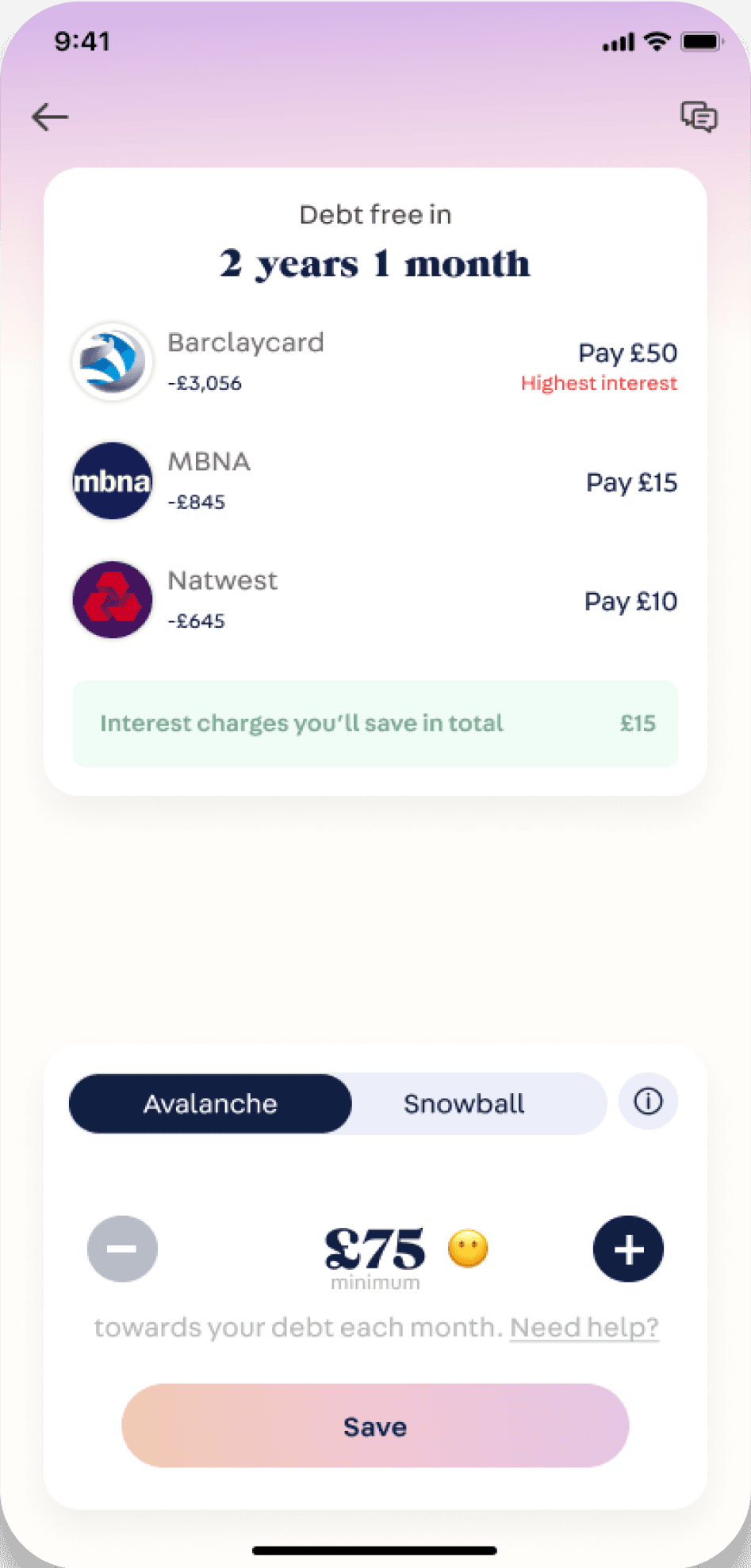

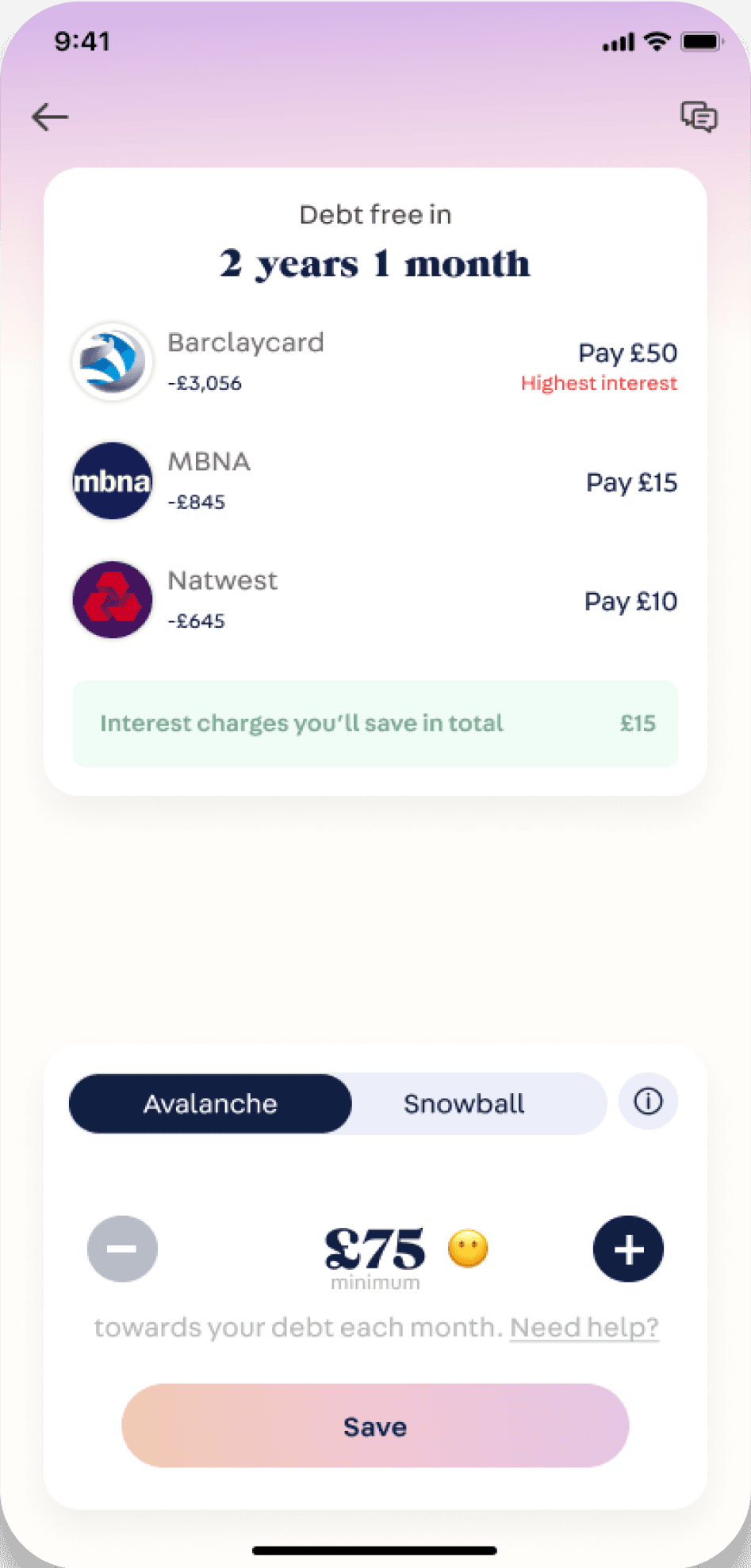

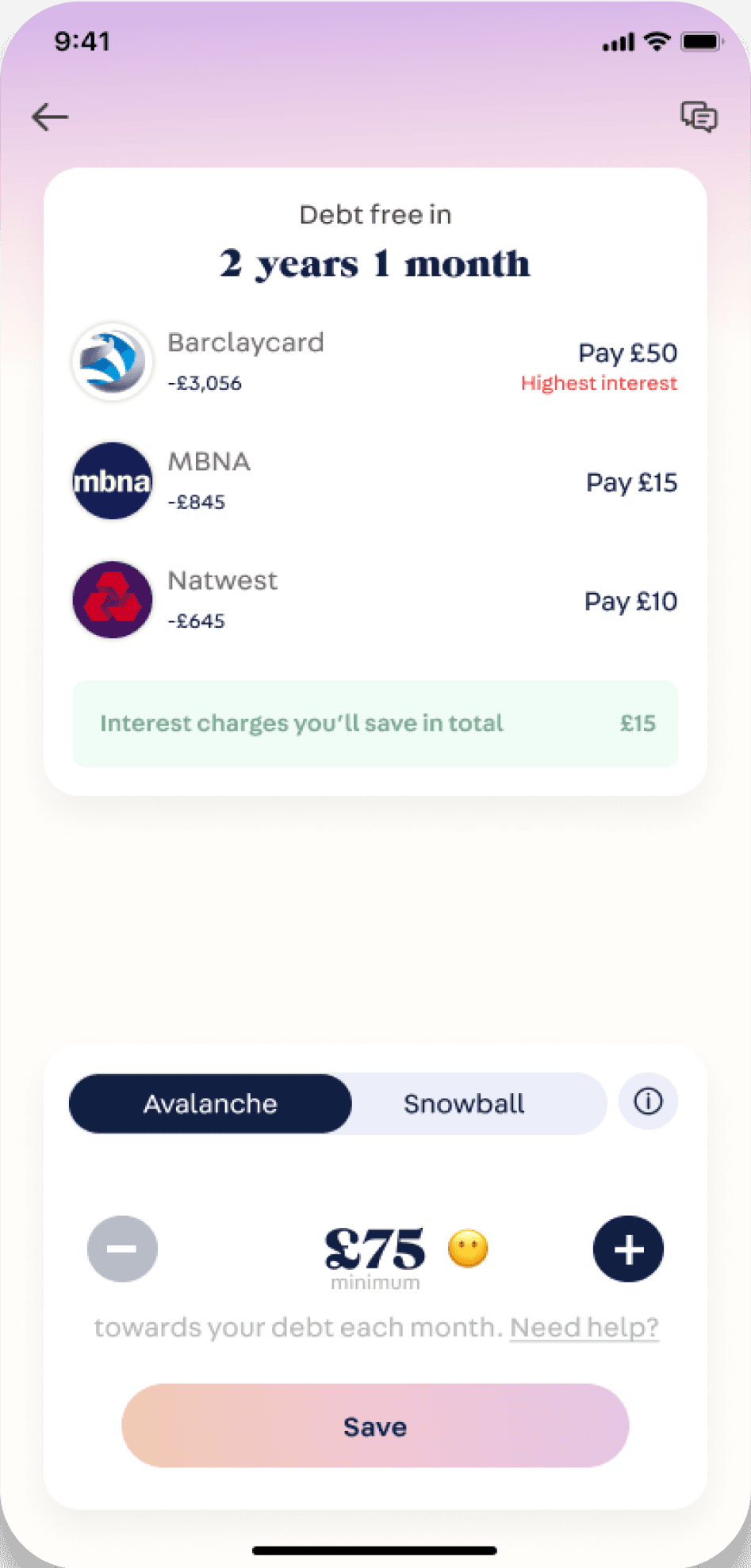

FINAL DESIGN ITERATION

Exploration of interactive components and how to uplift the experience

Exploration of interactive components and how to uplift the experience

Slider interaction with manual input

Slider interaction with manual input

Clicker

Technical issues with slider,

will we be able to live update the complicated debt free time calculation to match the speed of a slider?

Accuracy difficulty using a slider?

How do we decide the maximum amount?

Technical issues with slider,

will we be able to live update the complicated debt free time calculation to match the speed of a slider?

Accuracy difficulty using a slider?

How do we decide the maximum amount?

Slider button too far from optimal interaction area. Splitting the actions into 2 also disjointing.

Slider button too far from optimal interaction area. Splitting the actions into 2 also disjointing.

Low visibility

Low visibility

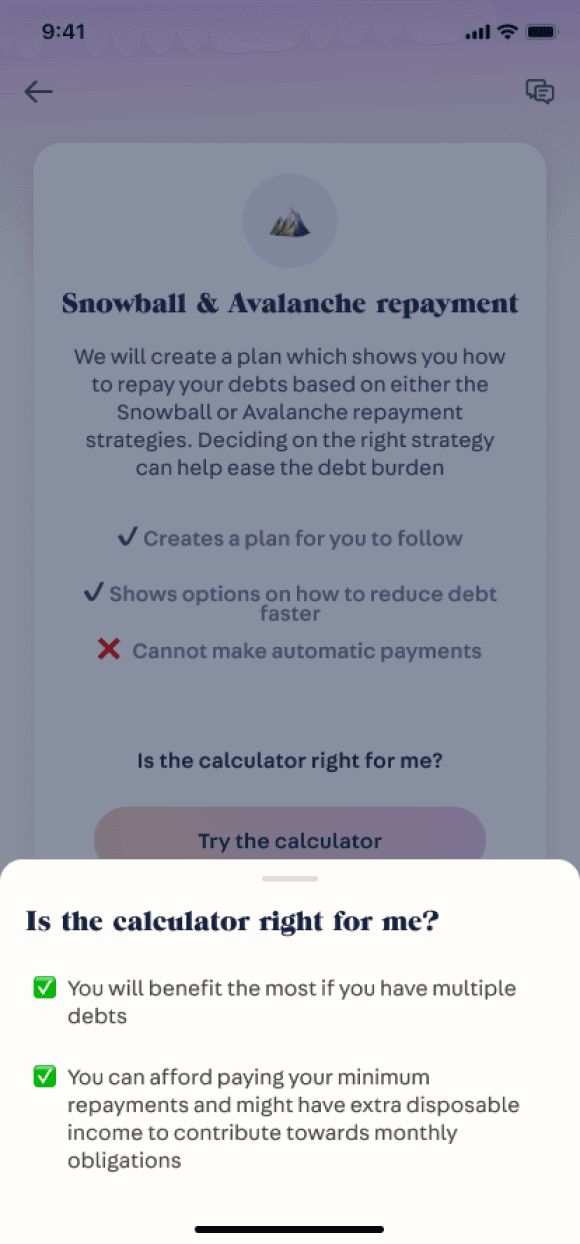

Slider button to access more information for the 2 repayment strategies.

Able to more seamlessly integrate delightful elements to encourage user.

Interest savings to encourage higher repayments

Clicker

Slider button to access more information for the 2 repayment strategies.

Able to more seamlessly integrate delightful elements to encourage user.

Interest savings to encourage higher repayments

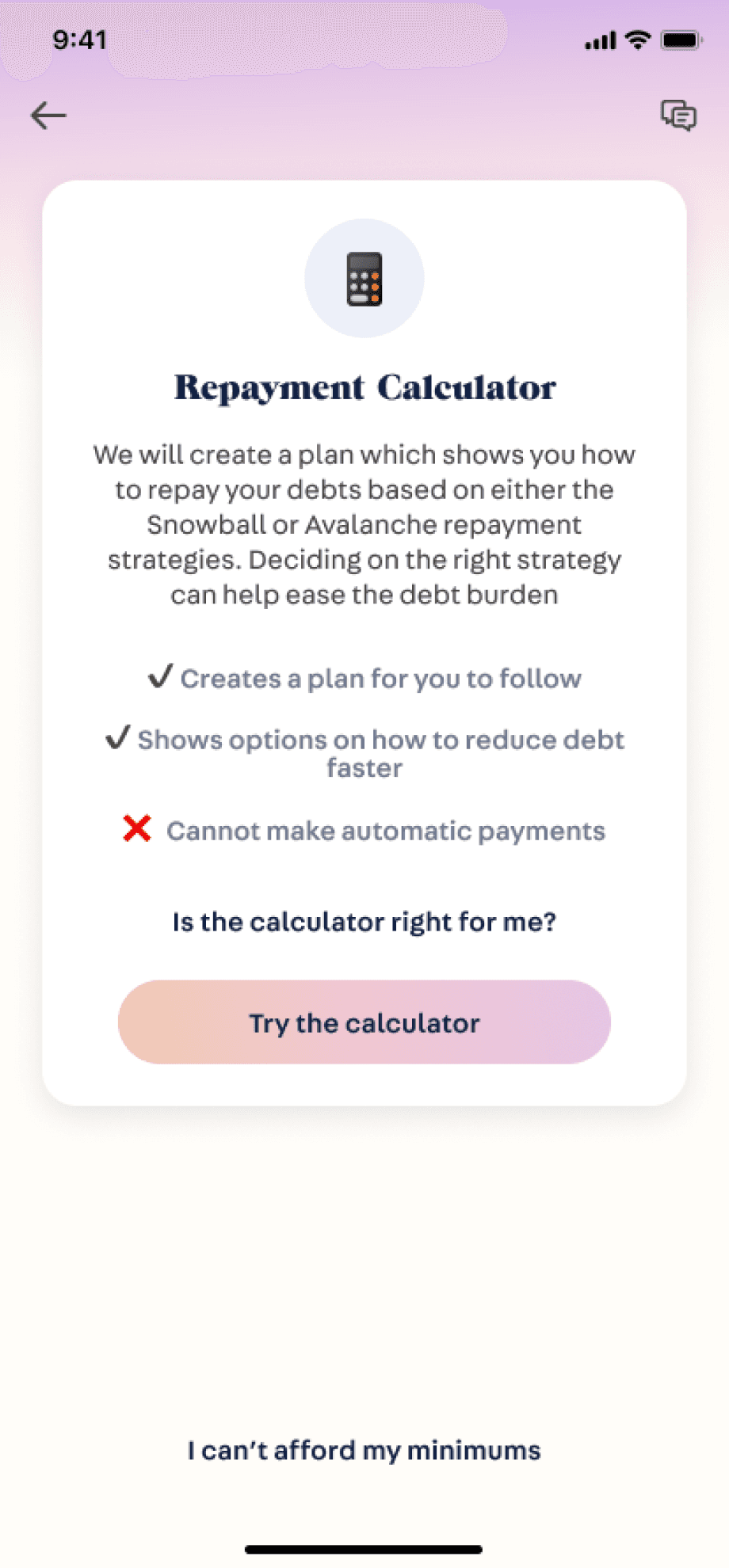

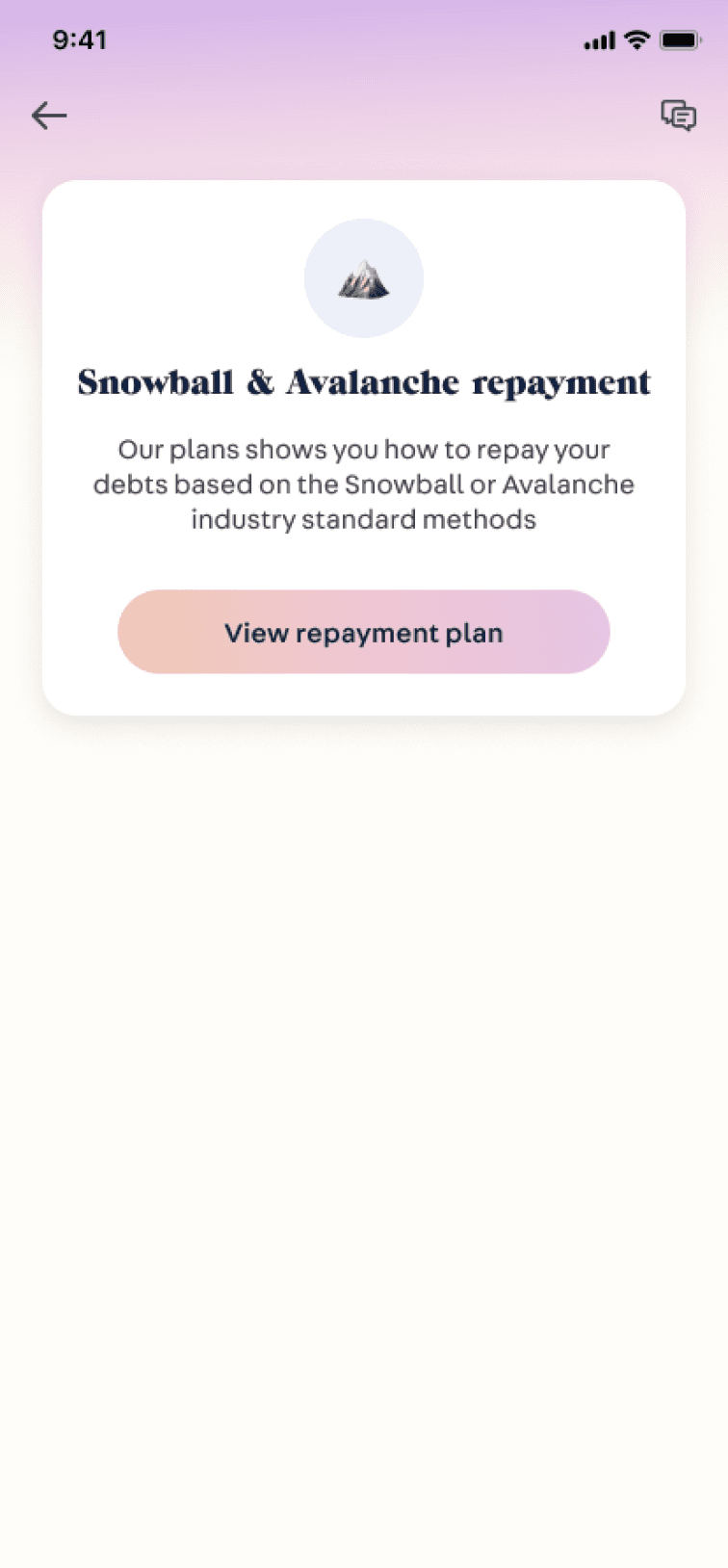

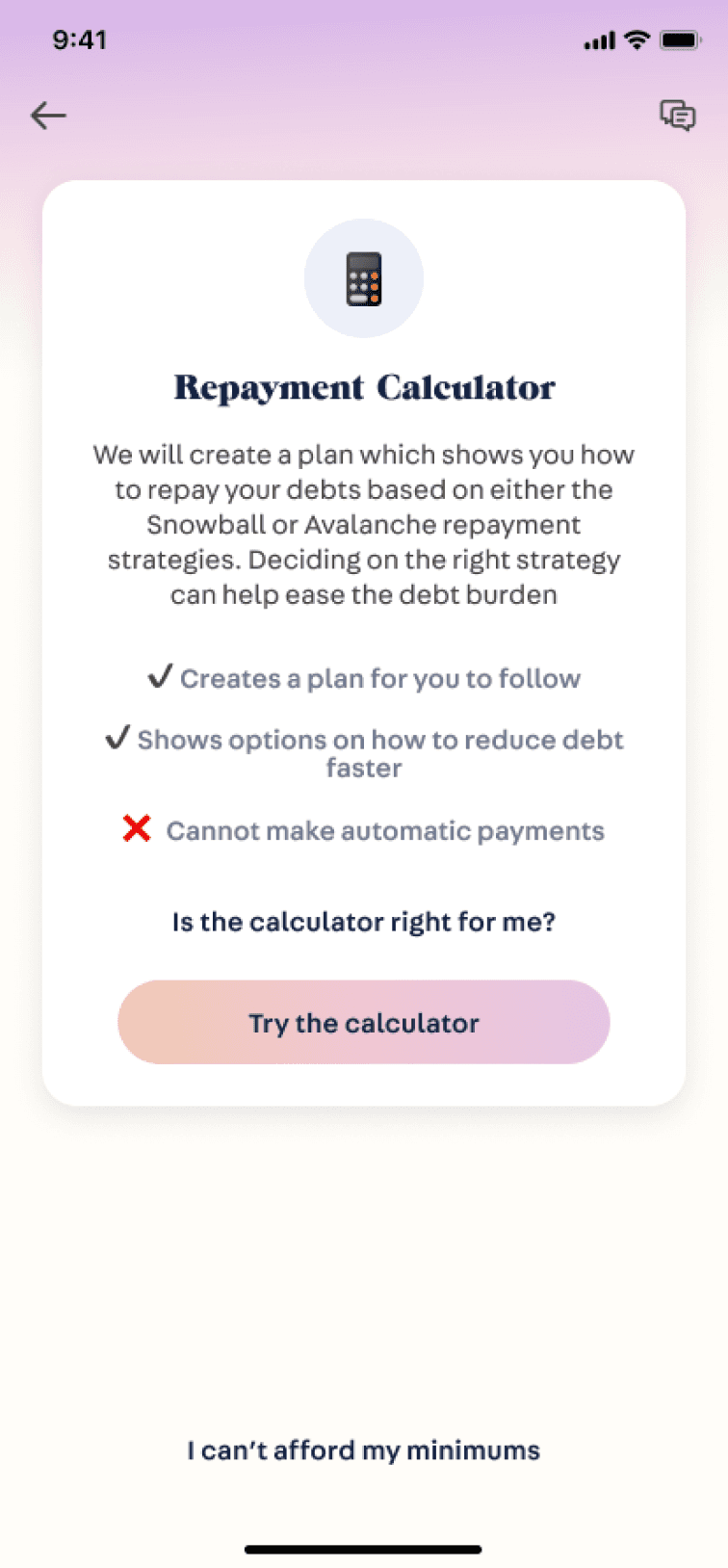

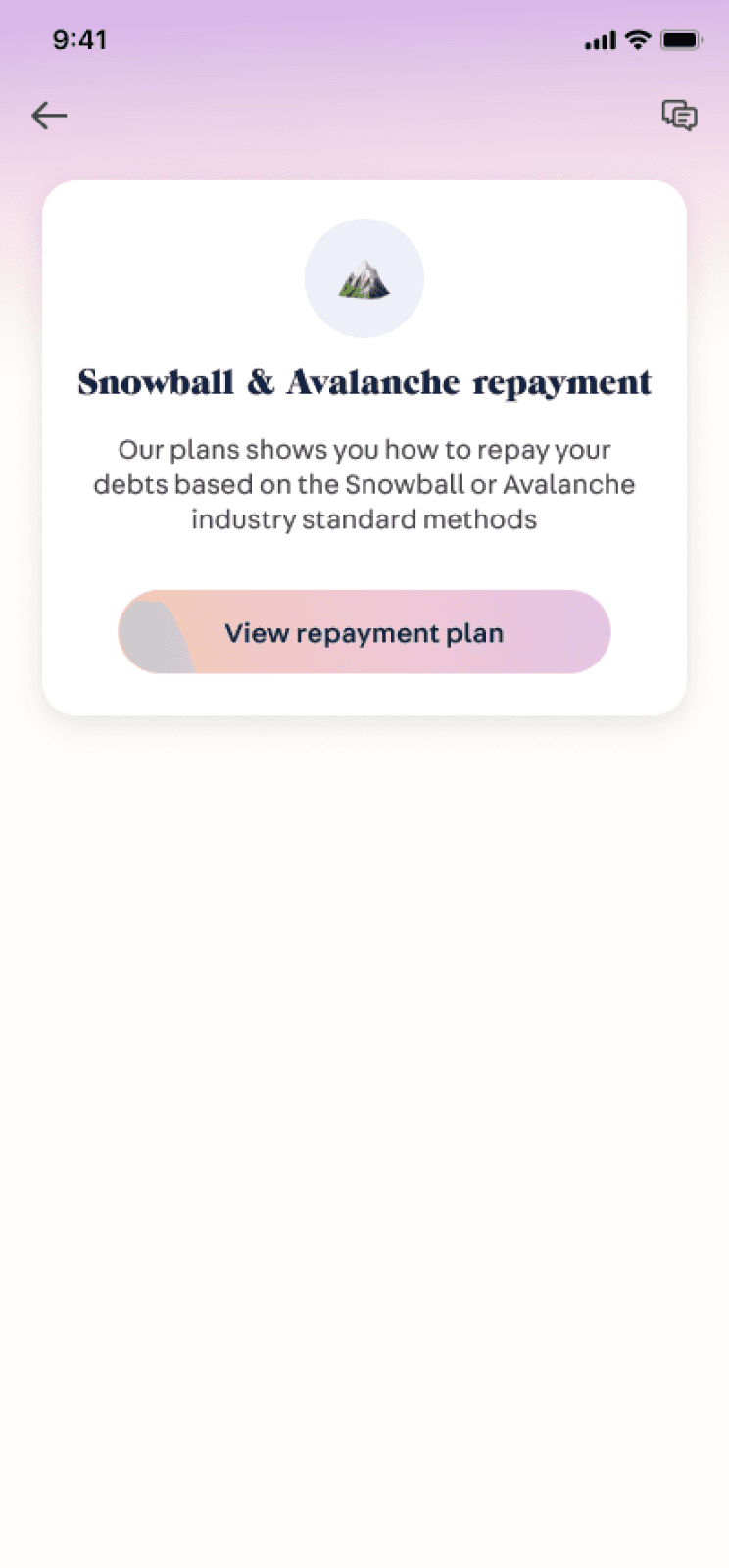

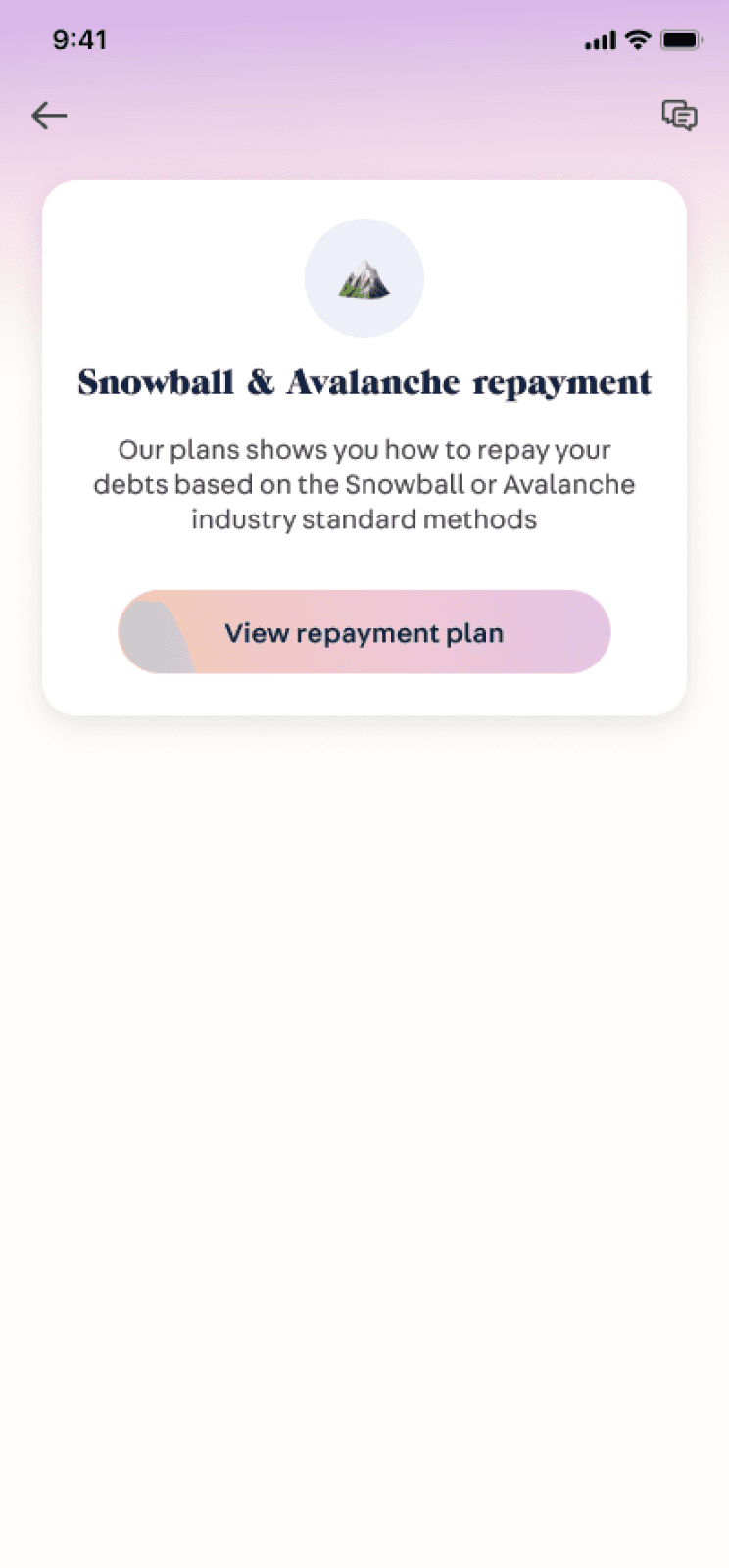

FINAL DESIGN ITERATION

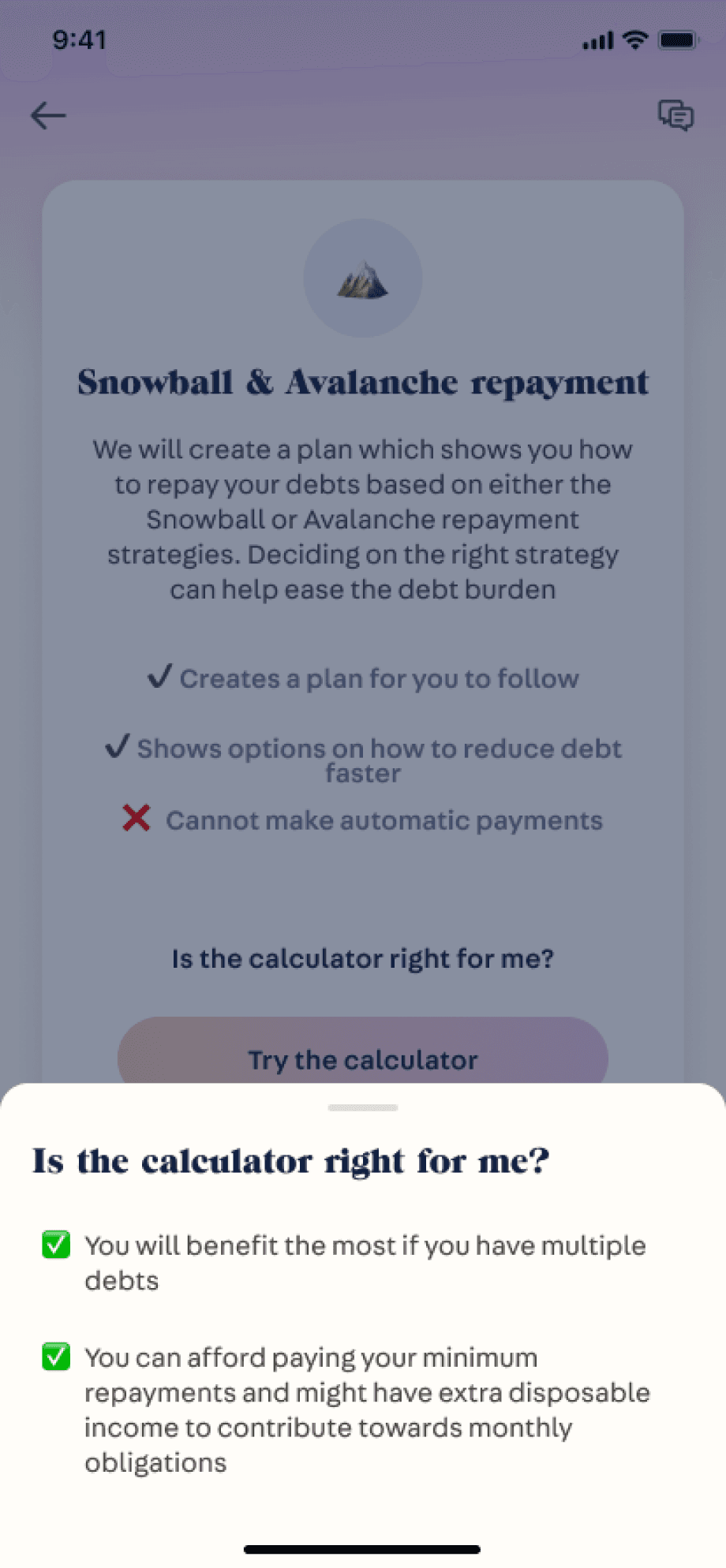

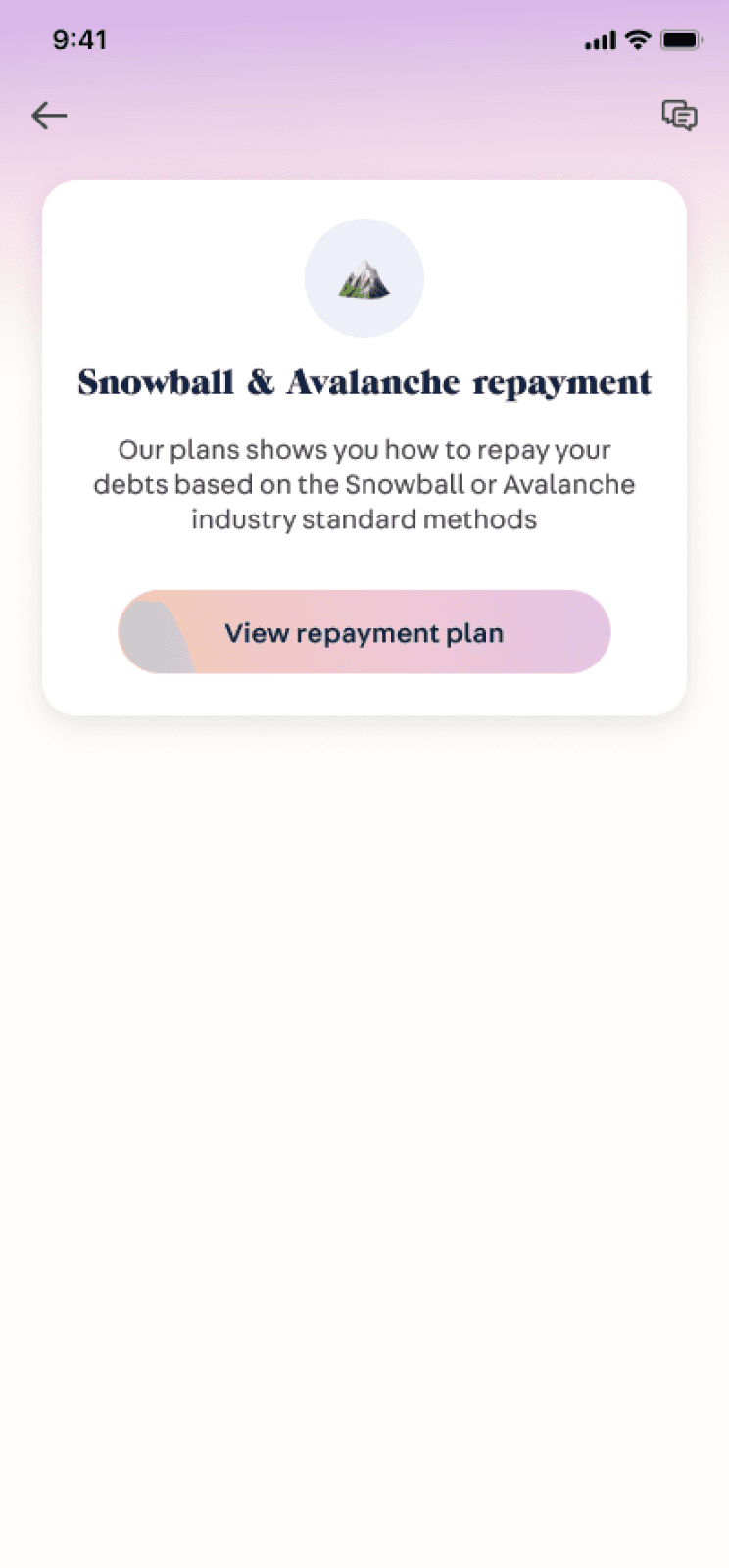

Transforming first touchpoint to be more educational

Transforming first touchpoint to be more educational

Transforming first touchpoint to be more educational

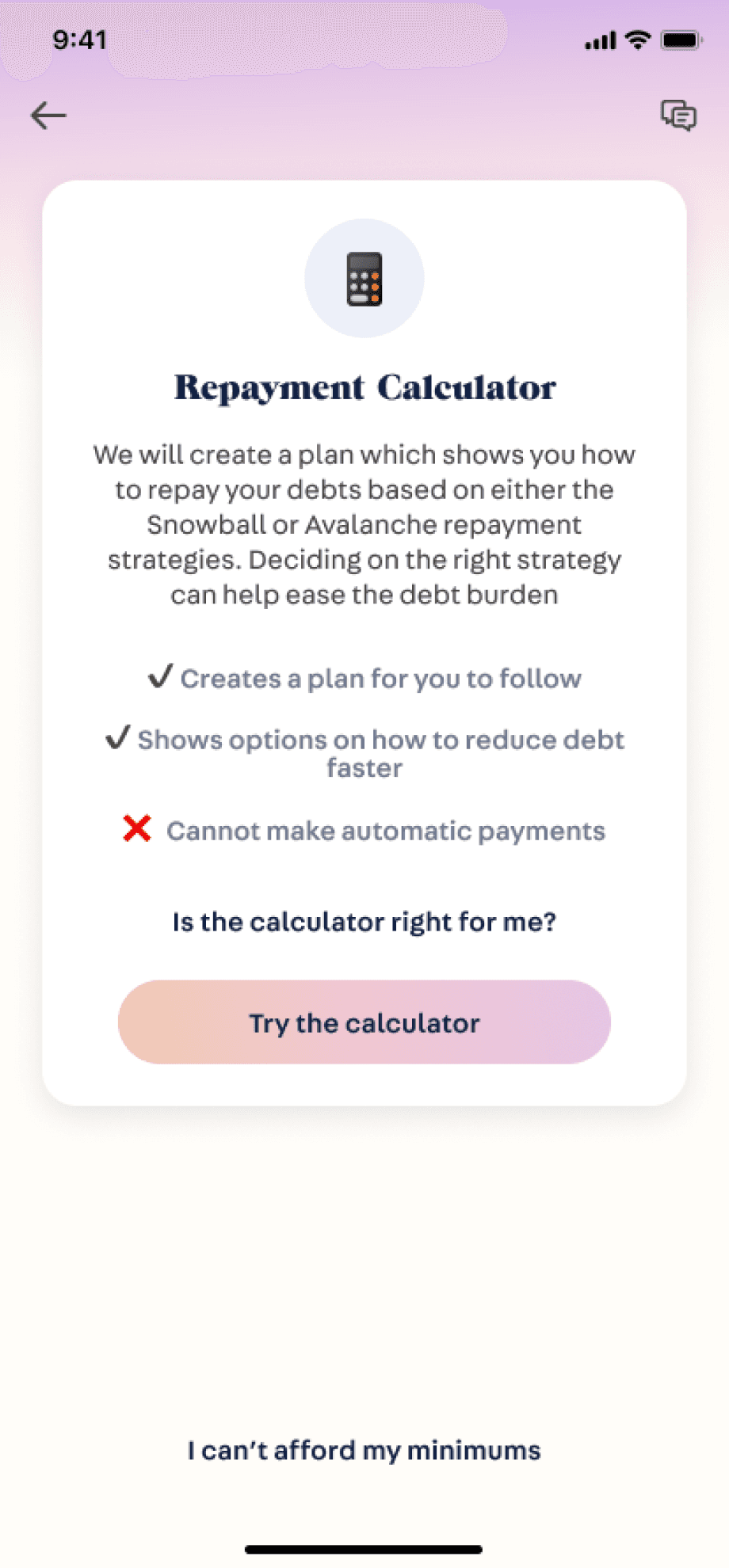

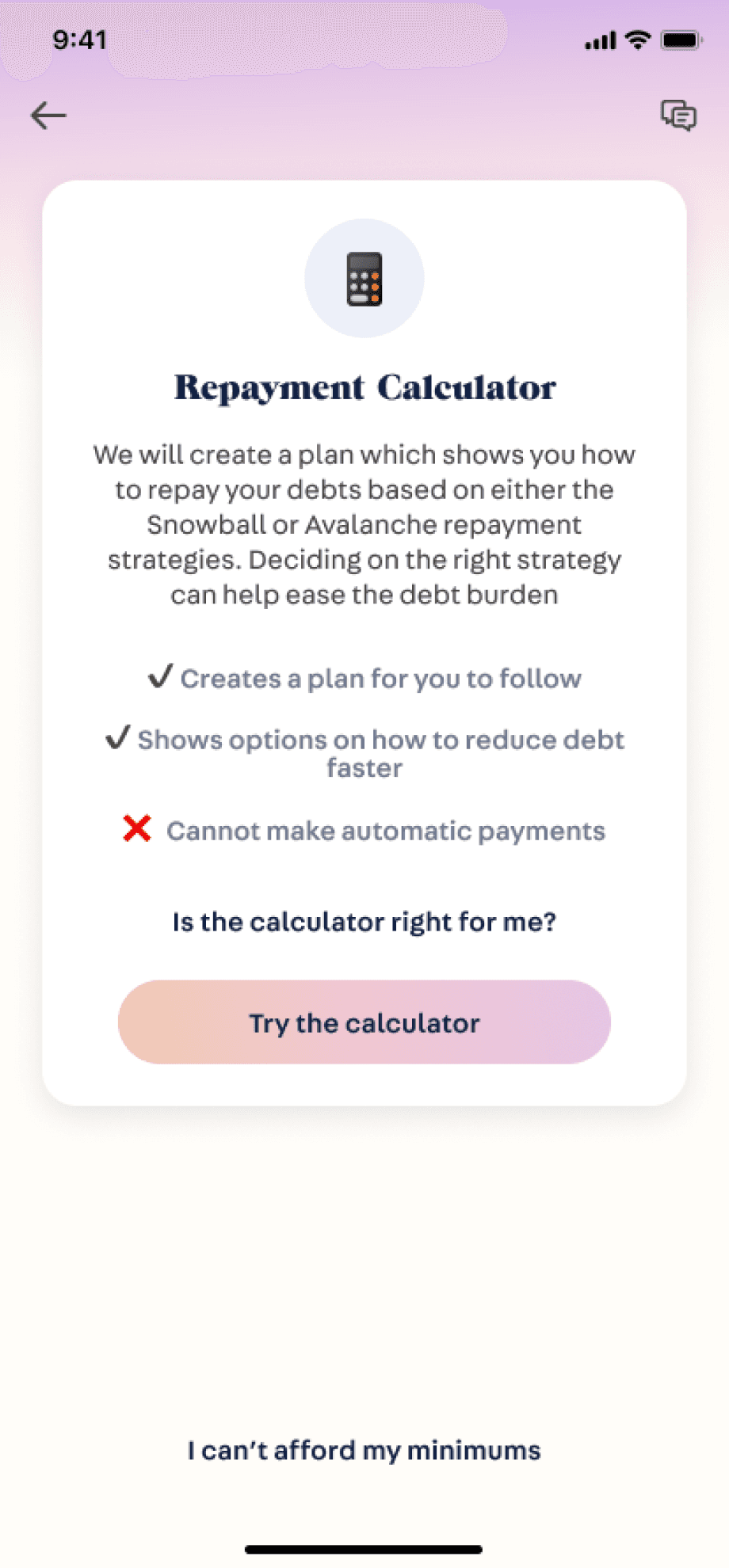

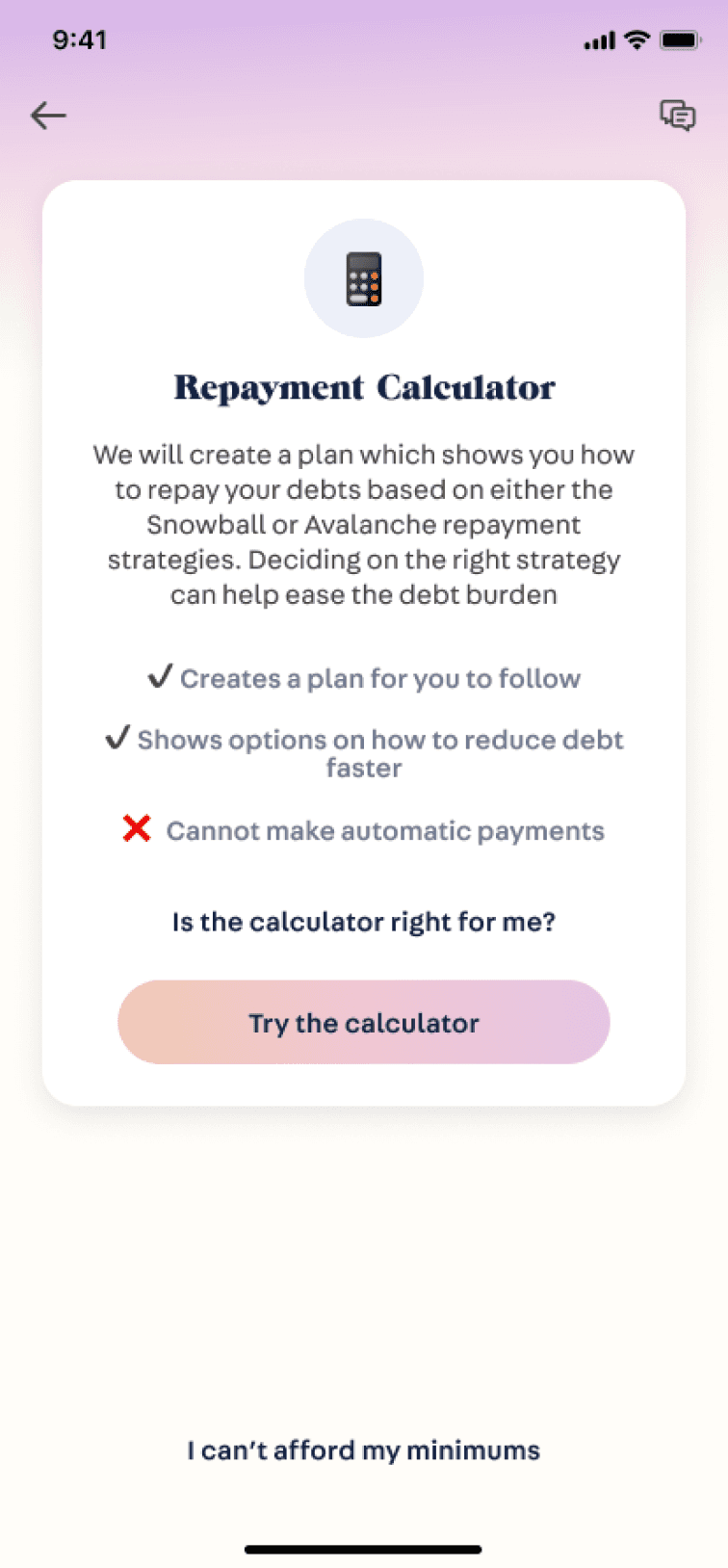

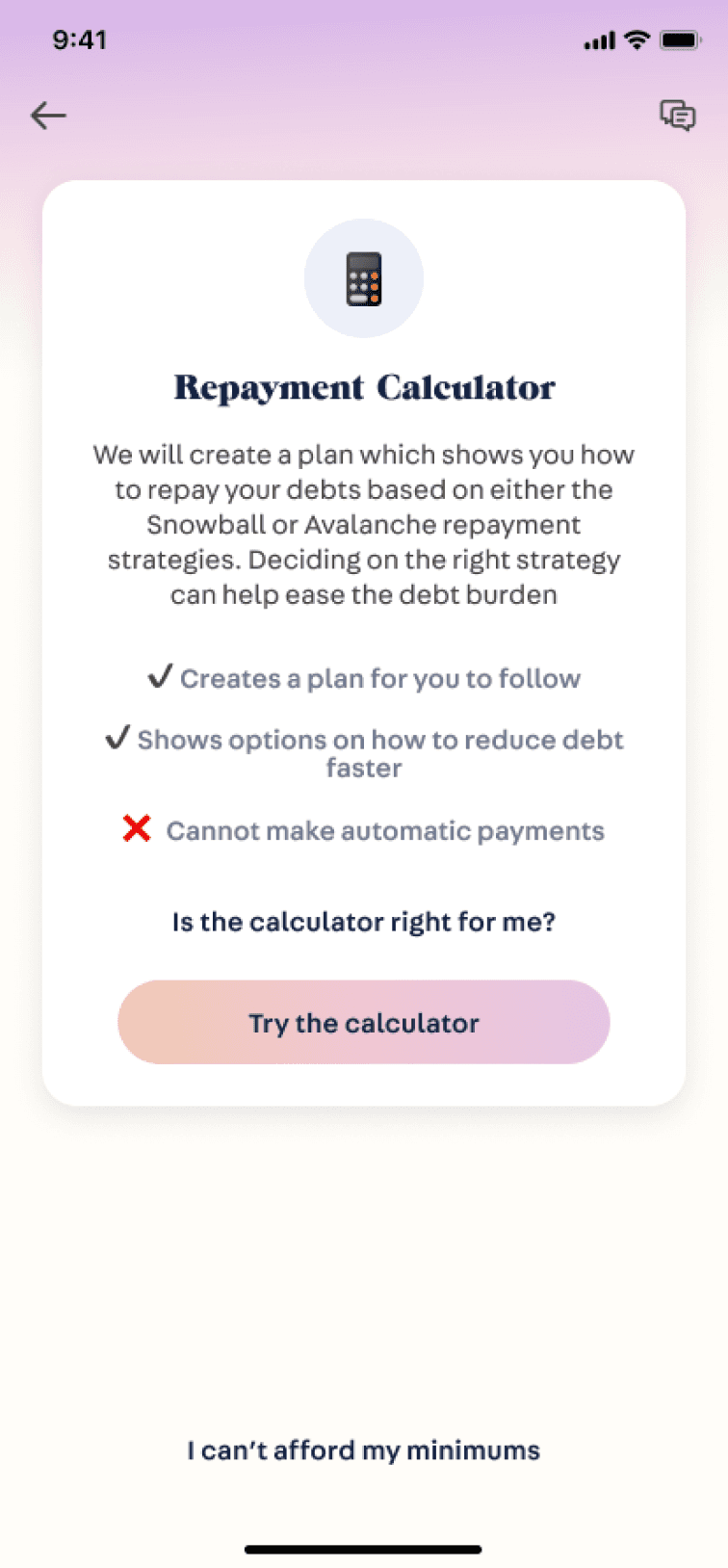

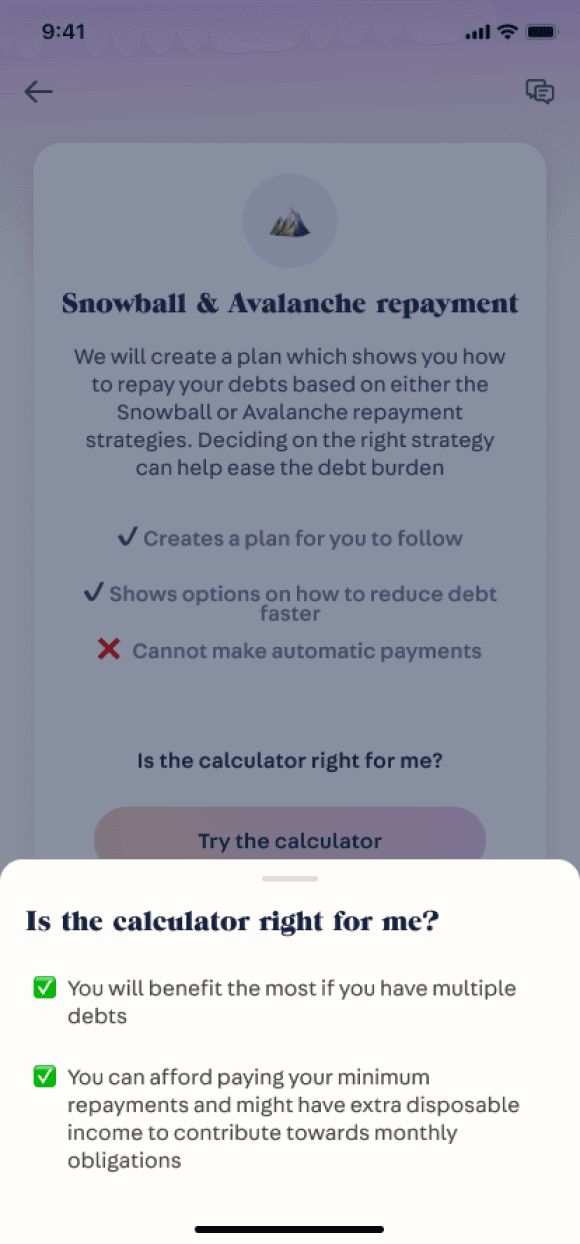

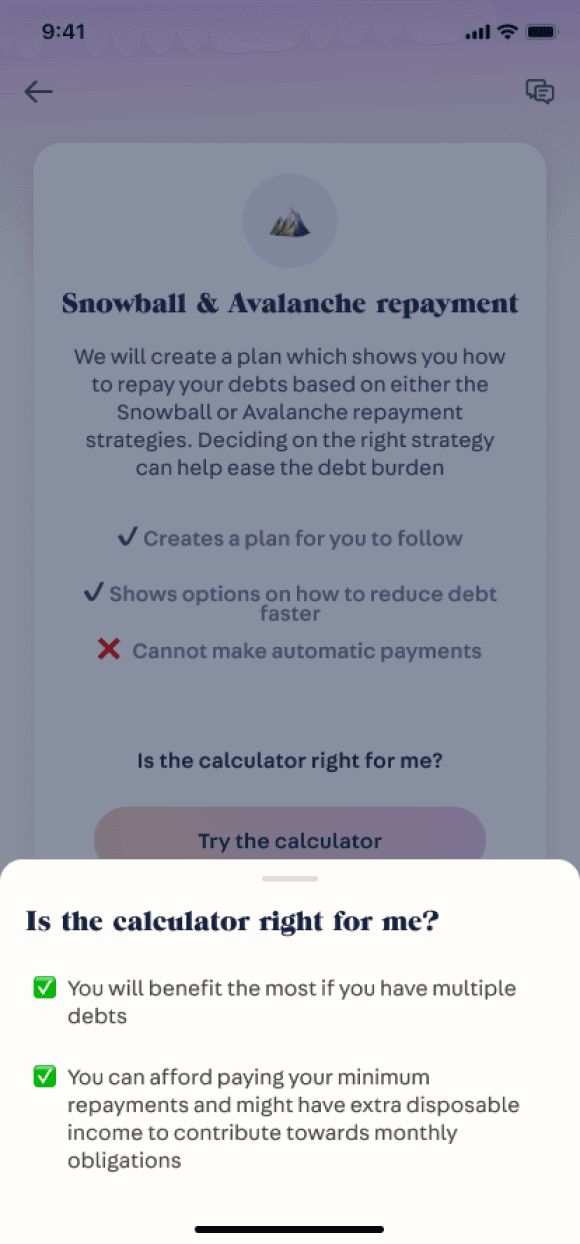

New Design

New Design

Breakdown of benefits and value for user.

Breakdown of benefits and value for user.

Primary CTA is conversational and approachable for the user.

Primary CTA is conversational and approachable for the user.

Considering the potential hardships user can be experiencing and offering alternate journey.

Feature name updated that speaks to the function with more relevant visual cue.

Feature name updated that speaks to the function with more relevant visual cue.

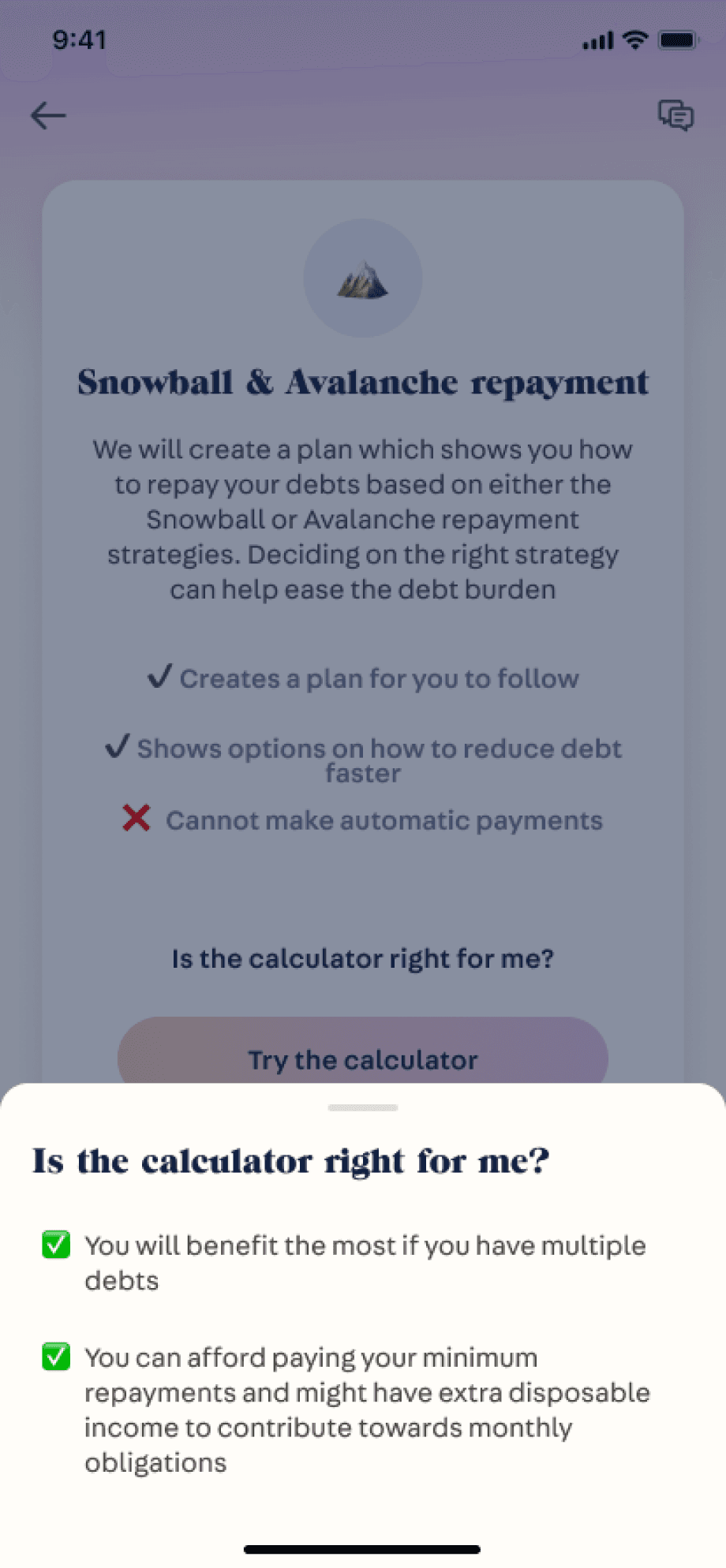

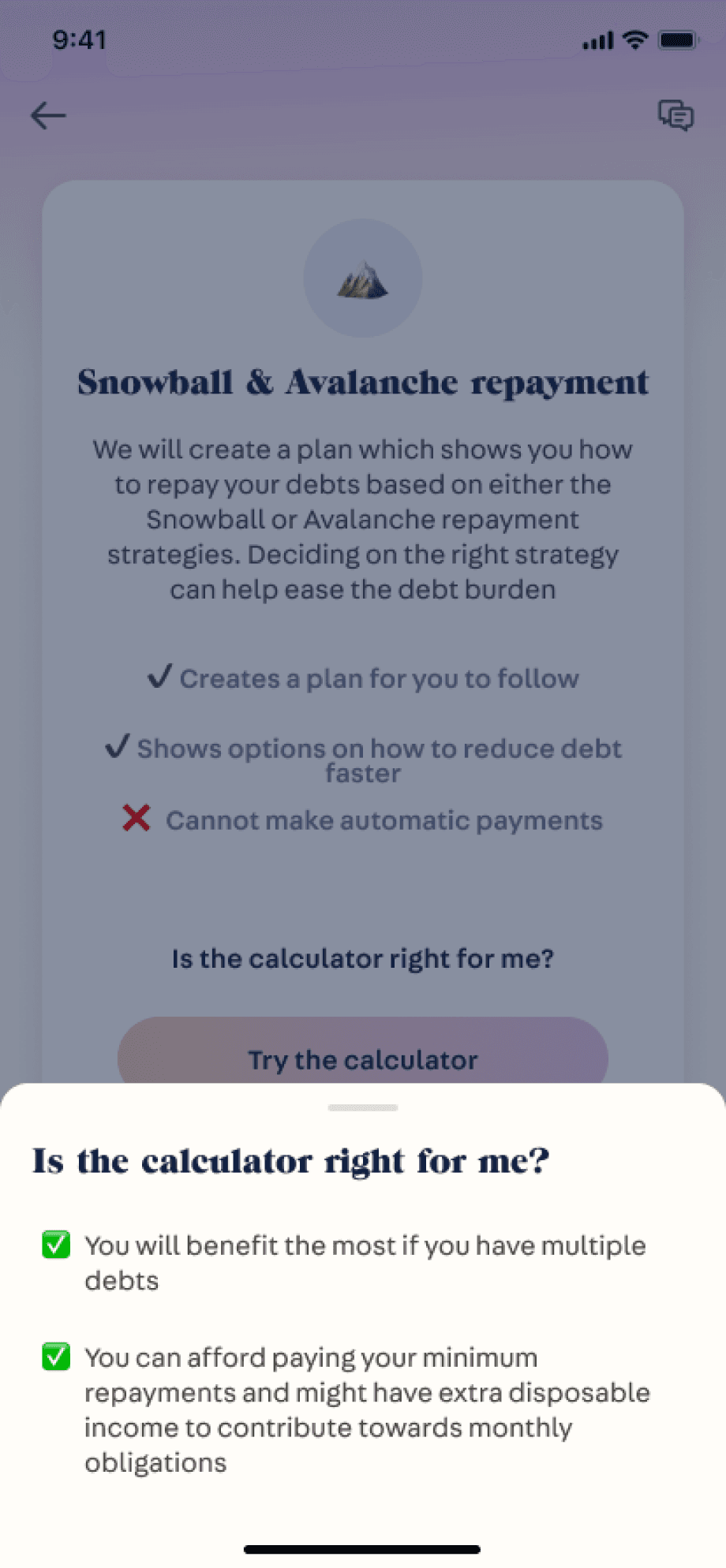

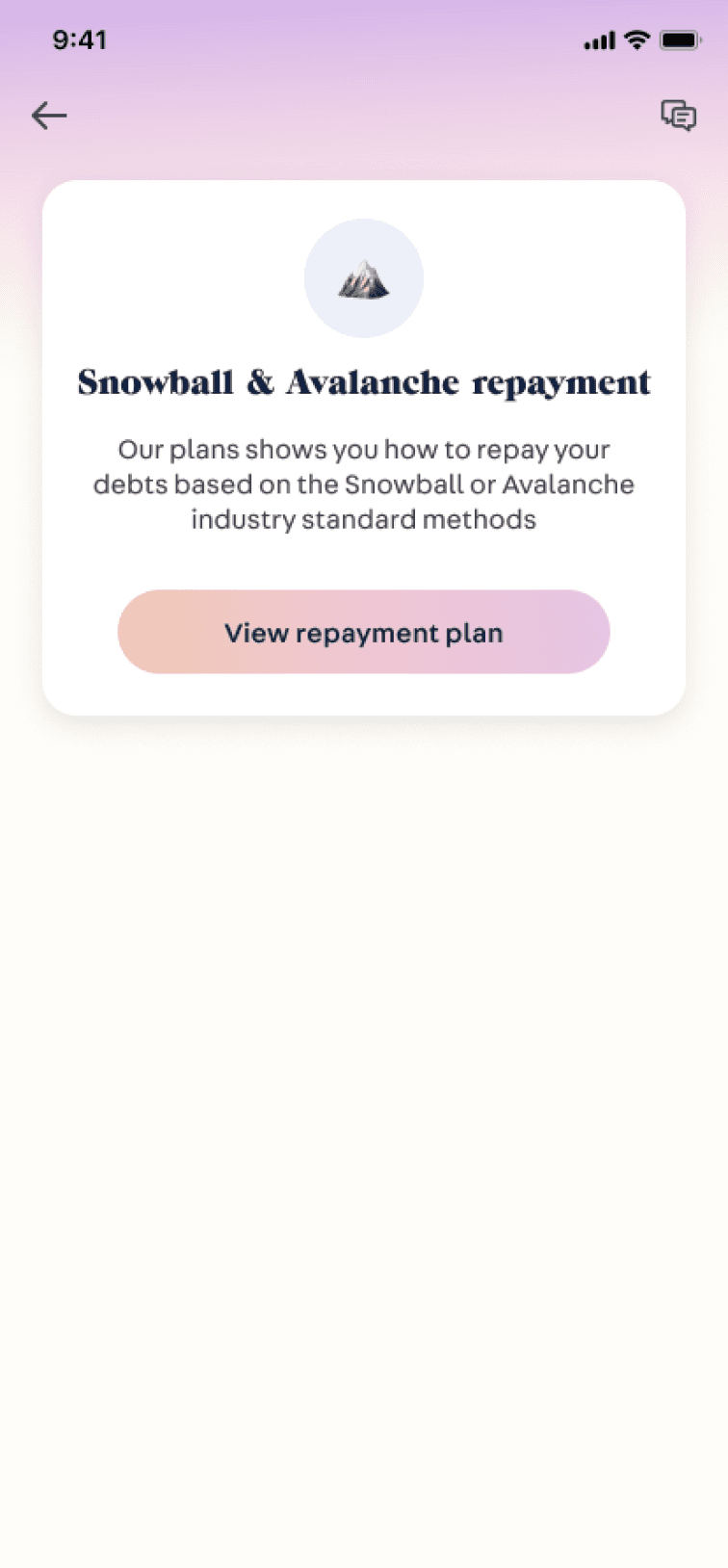

What are Snowball & Avalanche? Need more explanation of what this feature does

What are Snowball & Avalanche? Need more explanation of what this feature does

How is a visual representation of a mountain relevant?

How is a visual representation of a mountain relevant?

Confusing CTA. Do I already have a repayment plan?

Confusing CTA. Do I already have a repayment plan?

Before

Before

New Design

Breakdown of benefits and value for user.

Primary CTA is conversational and approachable for the user.

Considering the potential hardships user can be experiencing and offering alternate journey.

Feature name updated that speaks to the function with more relevant visual cue.

What are Snowball & Avalanche? Need more explanation of what this feature does

How is a visual representation of a mountain relevant?

Confusing CTA. Do I already have a repayment plan?

Before

FINAL DESIGN ITERATION

FINAL DESIGN ITERATION

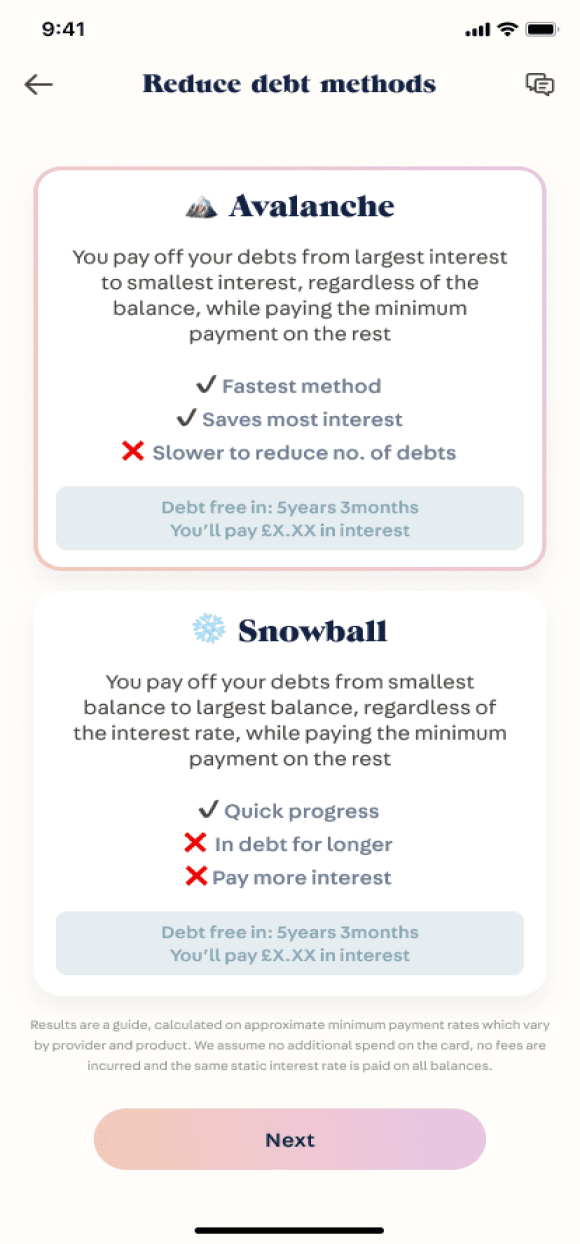

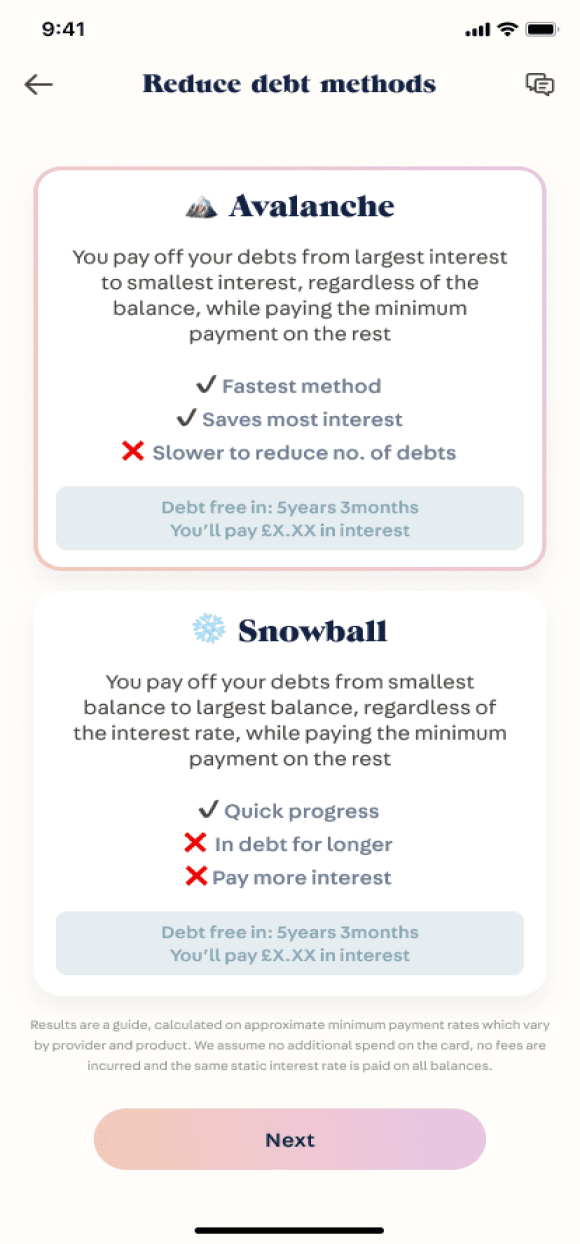

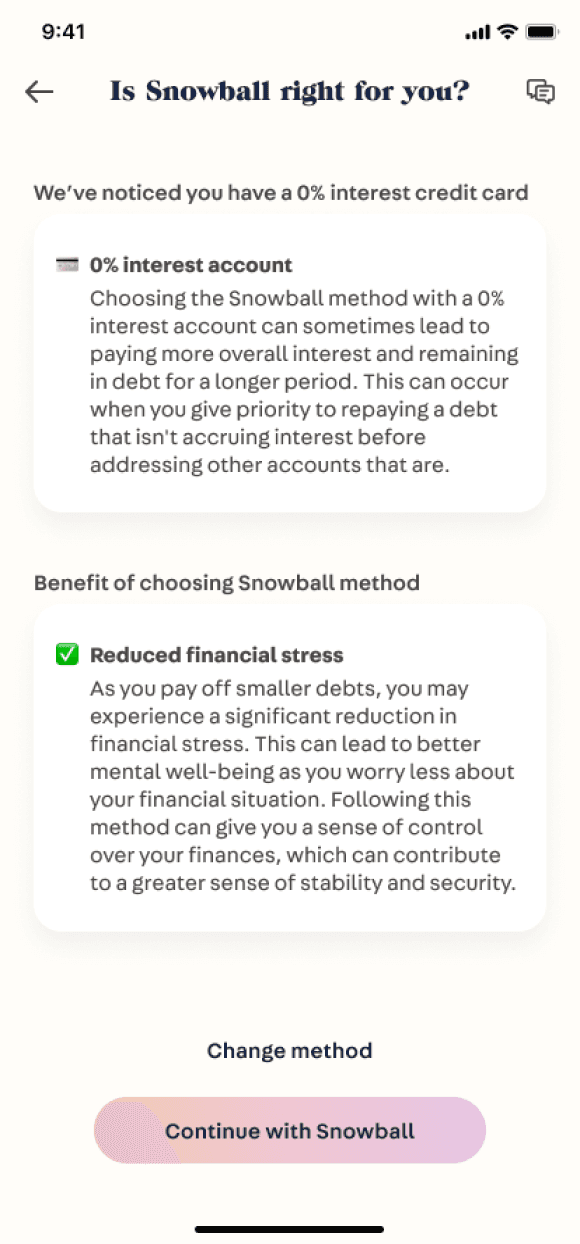

Presenting information without overwhelming cognitive load

Presenting information without overwhelming cognitive load

Presenting information without overwhelming cognitive load

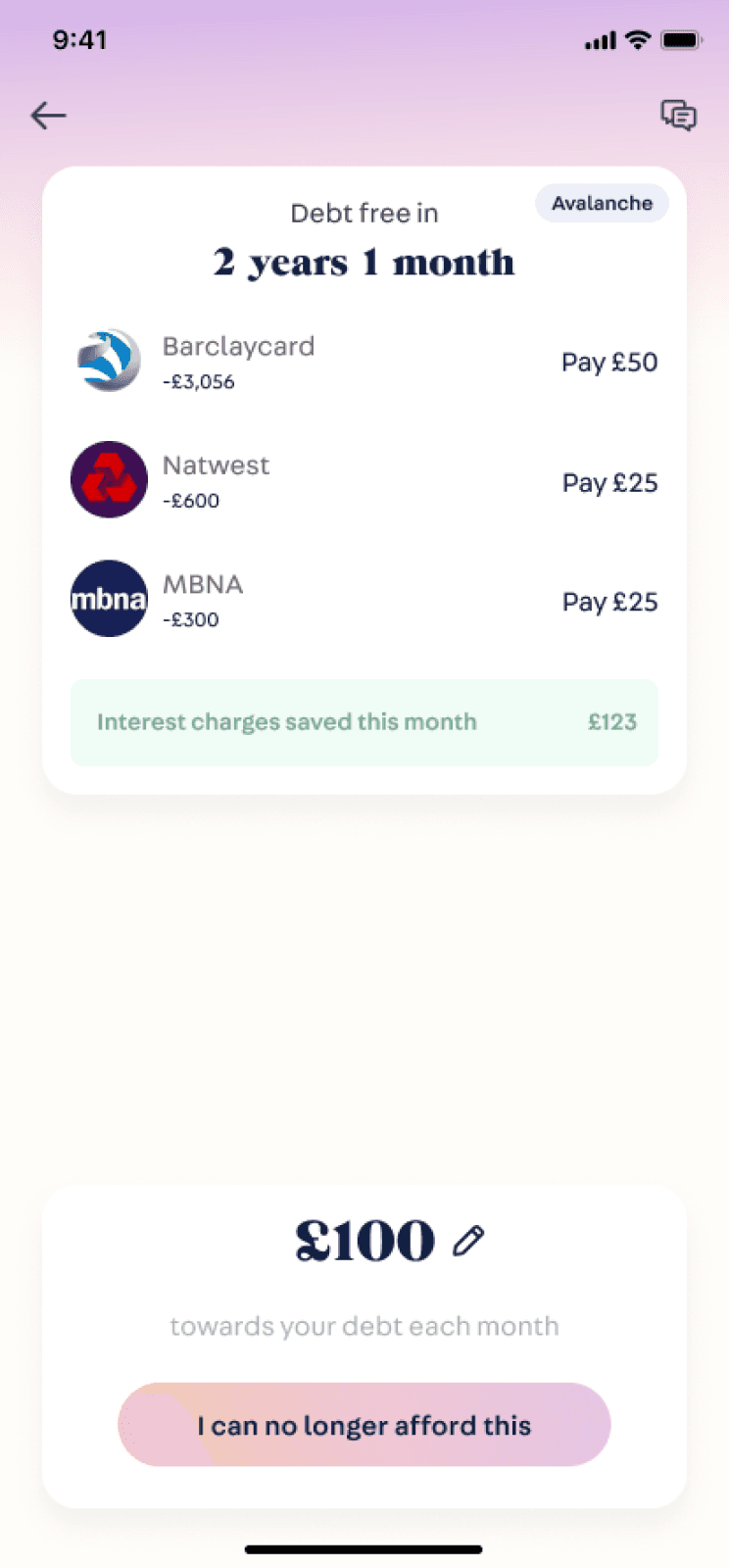

Before

Before

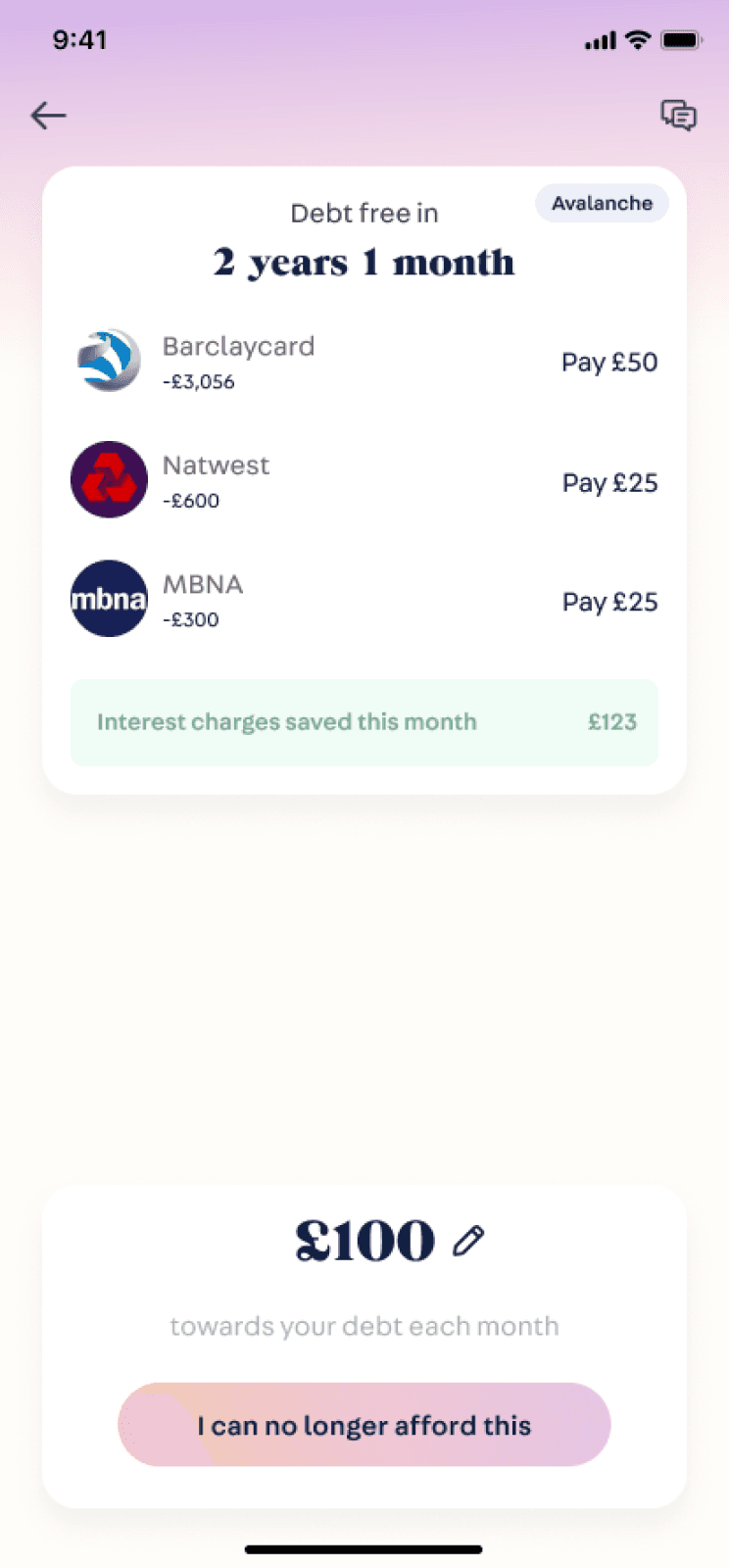

New Design

New Design

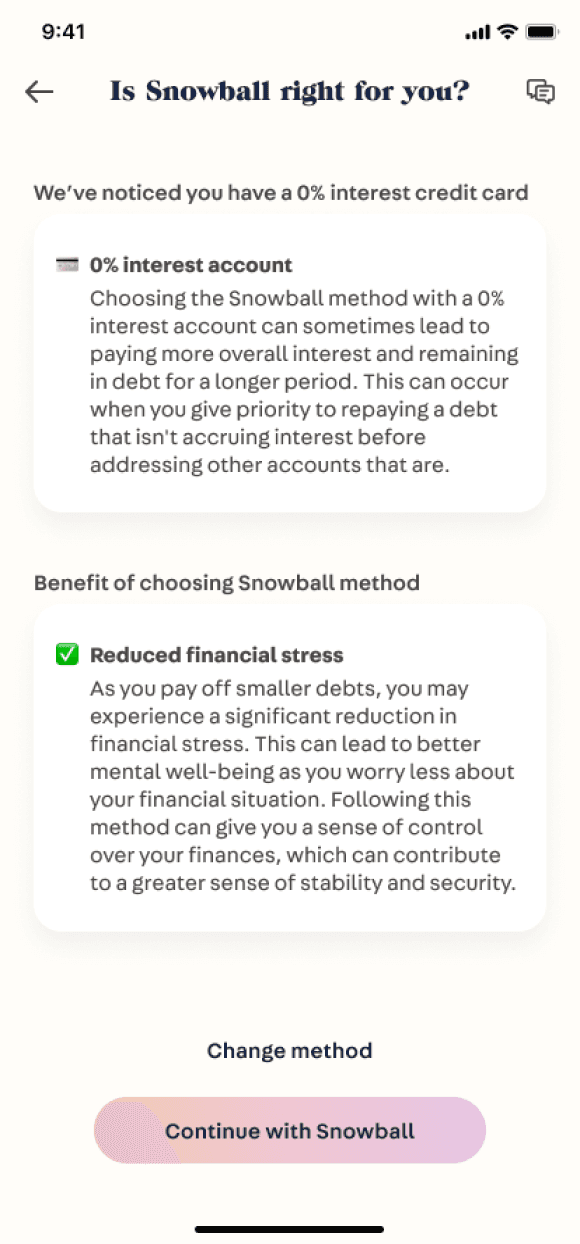

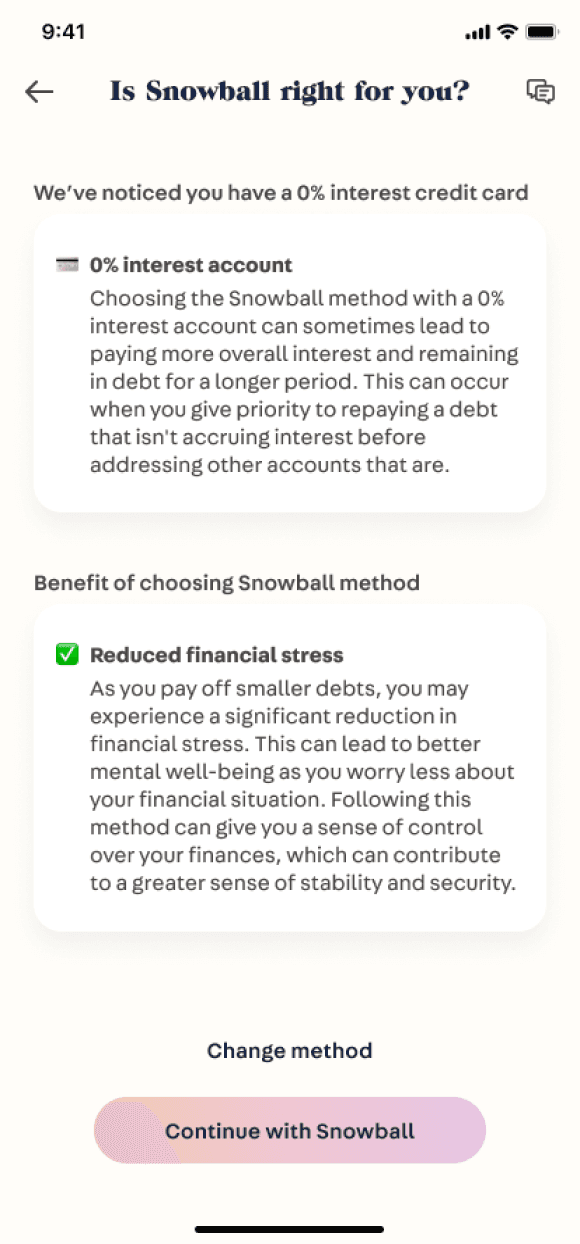

Integrating tool tips and interactive drawers that are accessible to users who need the extra information

Integrating tool tips and interactive drawers that are accessible to users who need the extra information

Too wordy, with too much financial jargon

Too wordy, with too much financial jargon

Too much information upfront without knowing impact

Too much information upfront without knowing impact

Progressive delivery of content and emphasising only most important information

Progressive delivery of content and emphasising only most important information

Before

New Design

Integrating tool tips and interactive drawers that are accessible to users who need the extra information

Too wordy, with too much financial jargon

Too much information upfront without knowing impact

Progressive delivery of content and emphasising only most important information

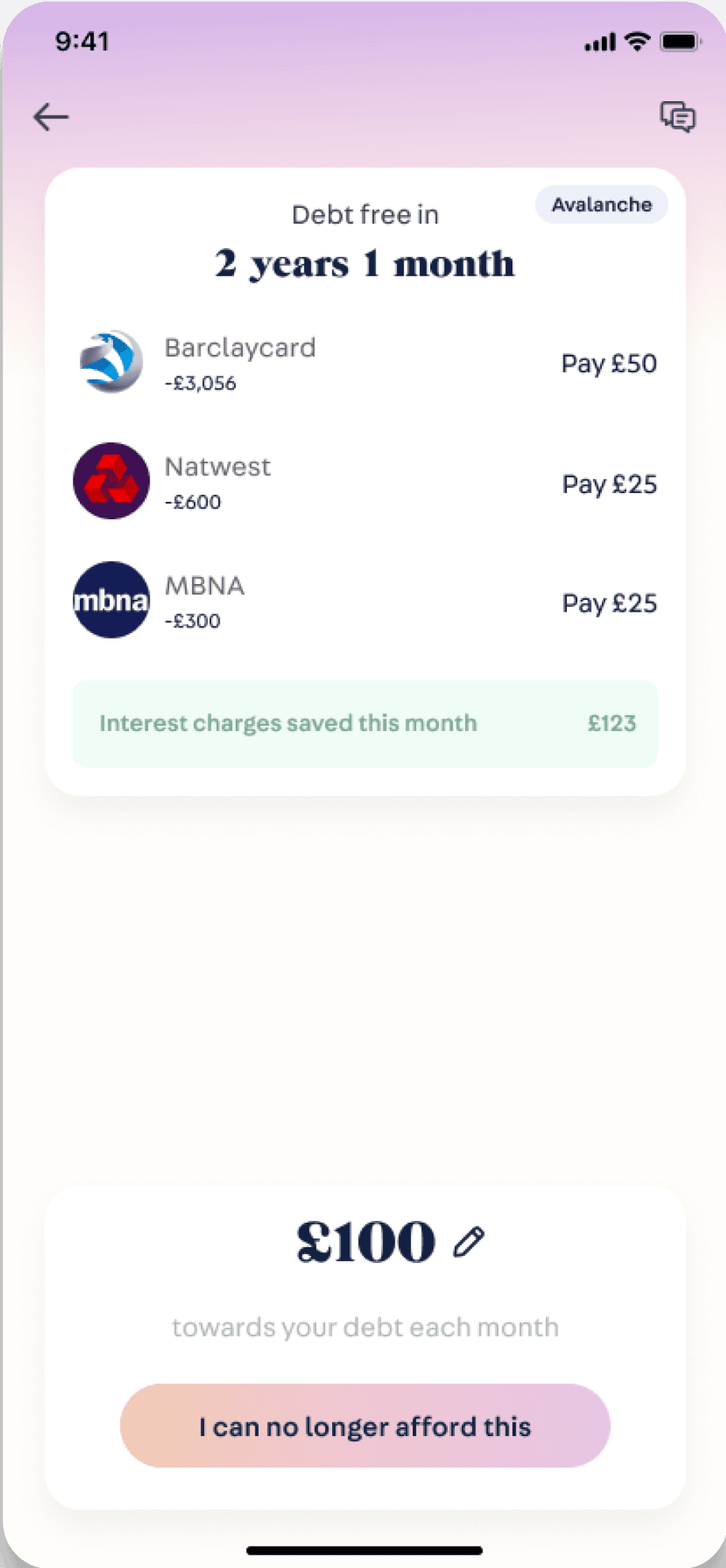

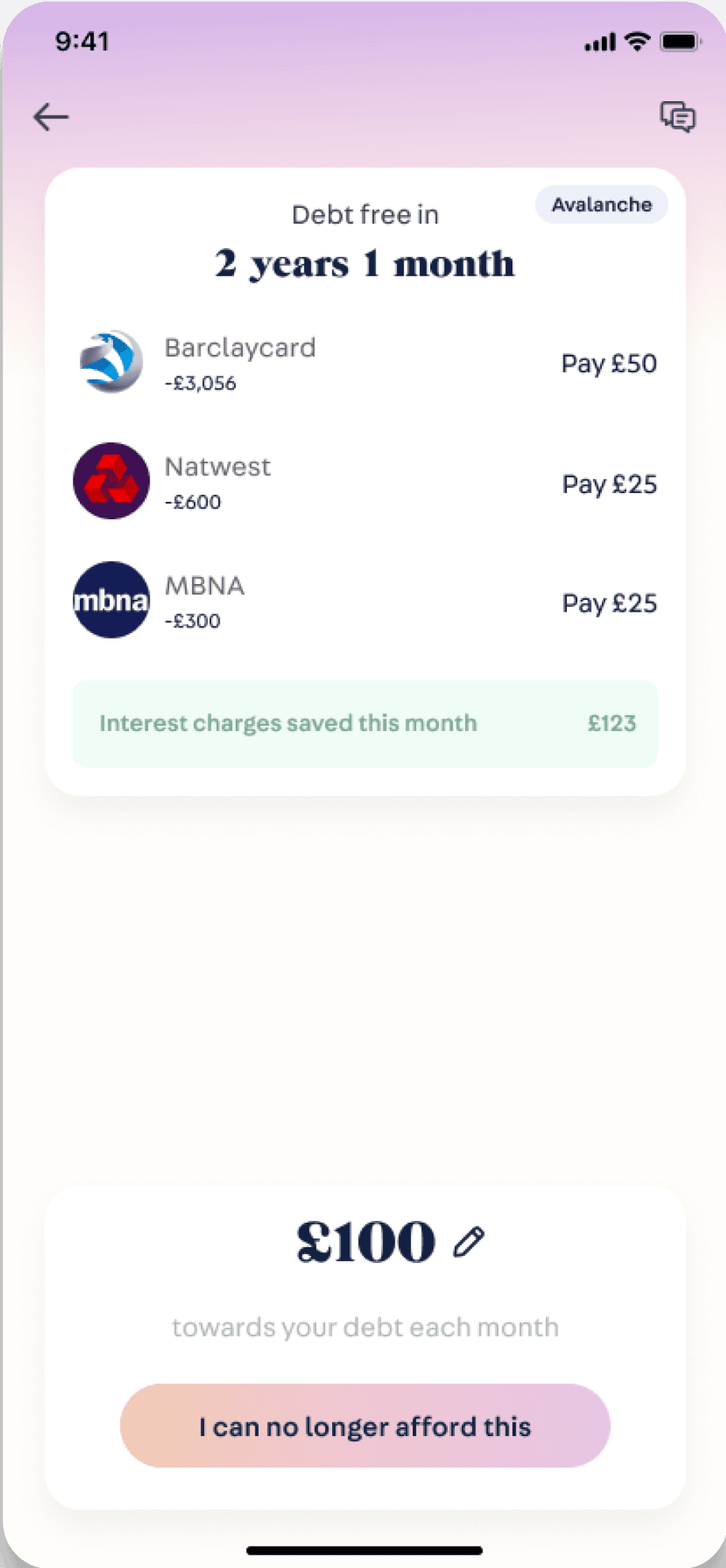

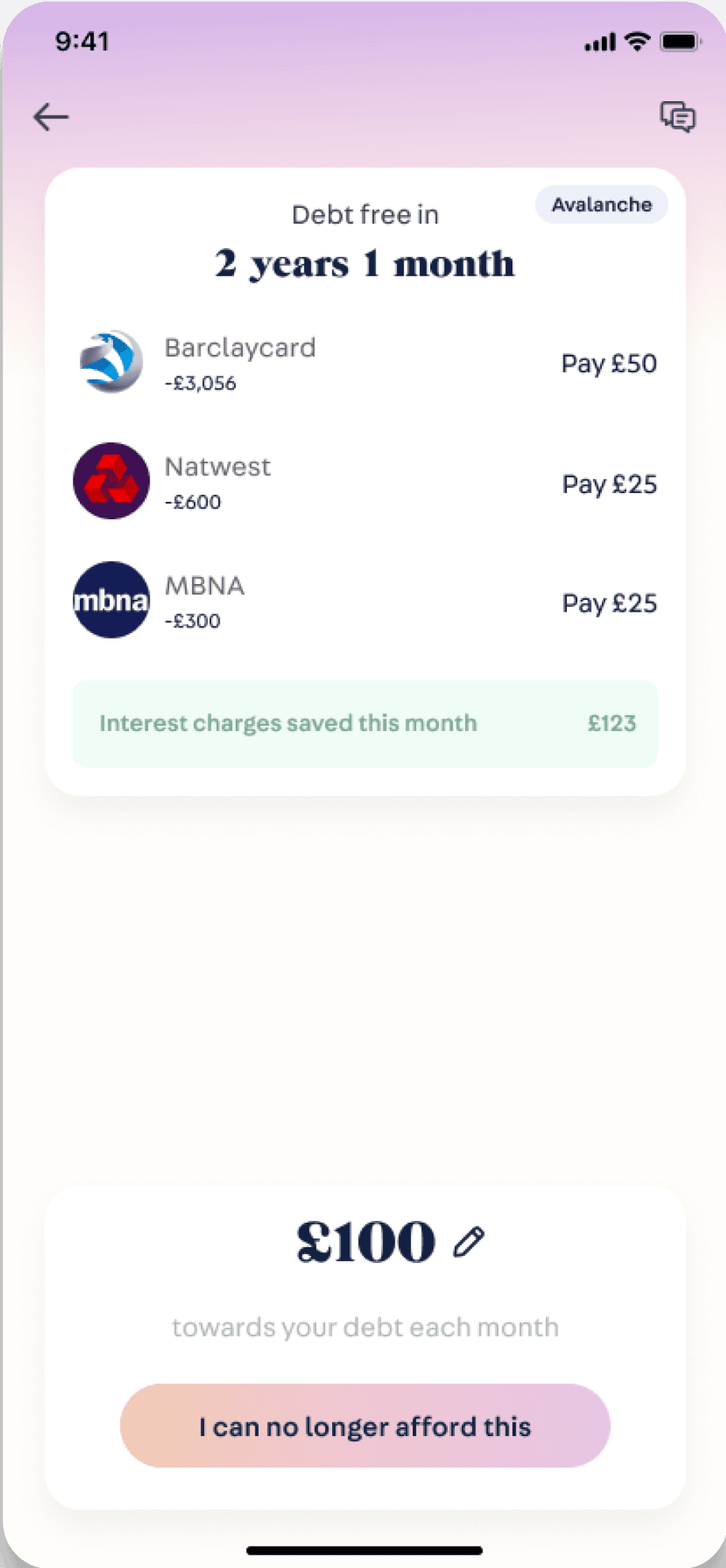

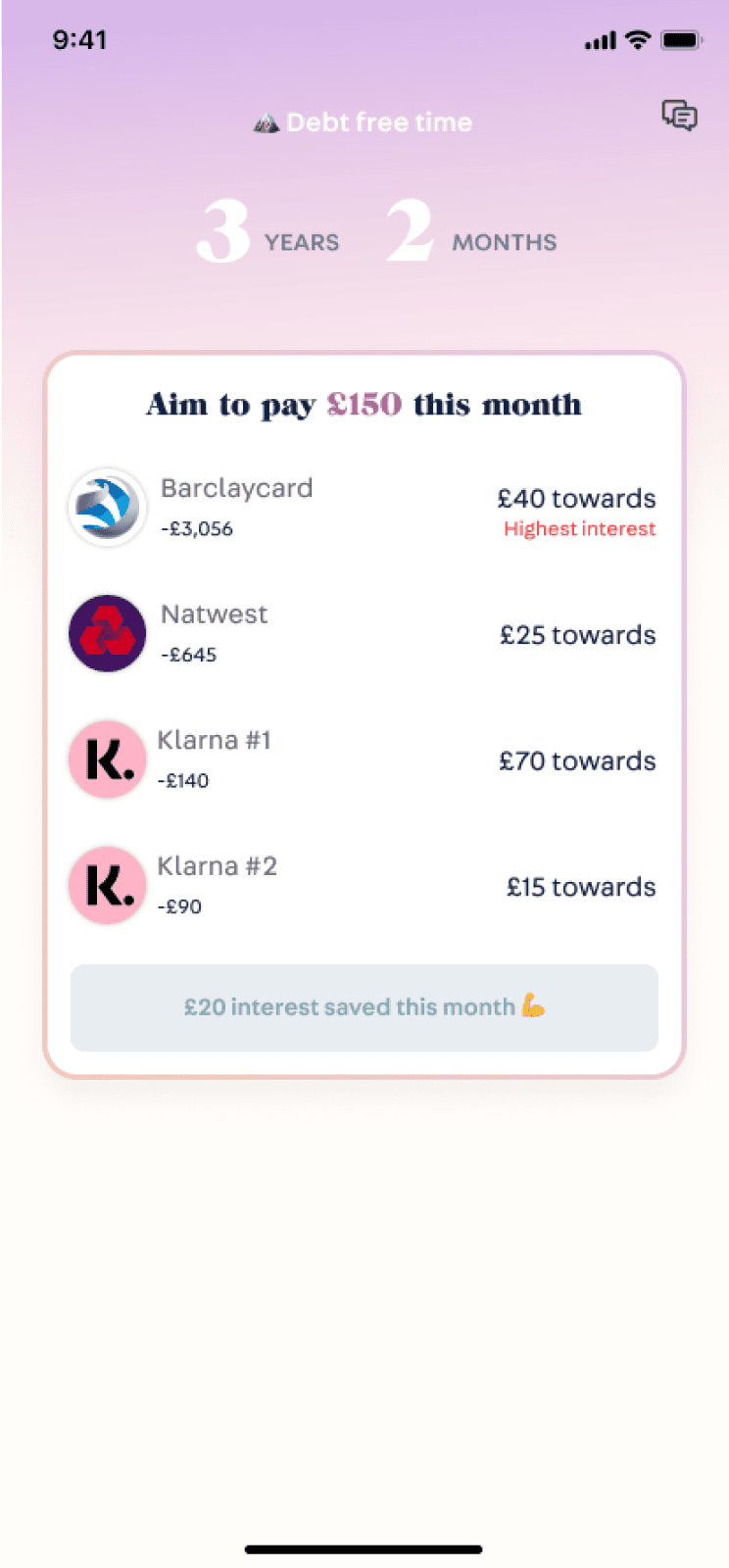

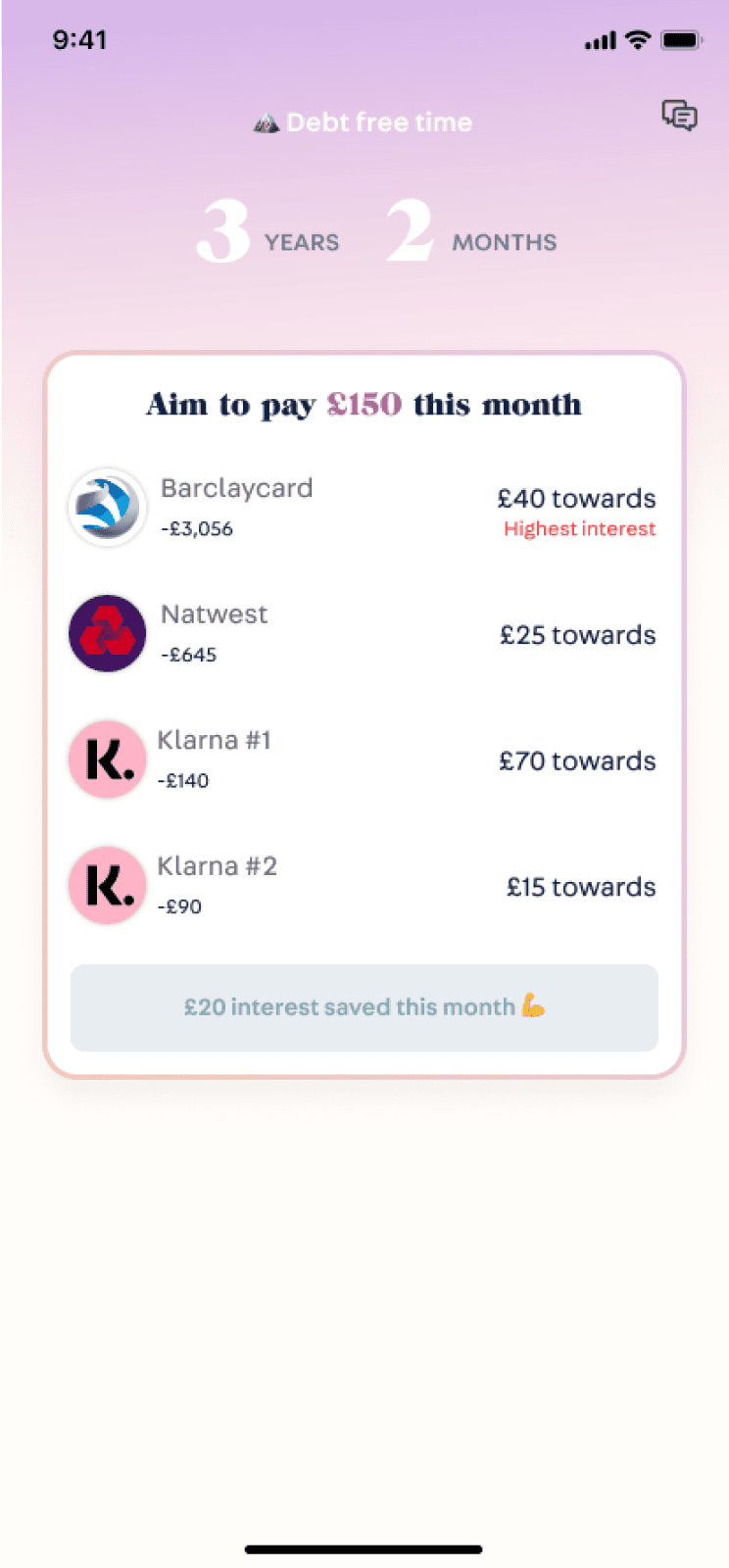

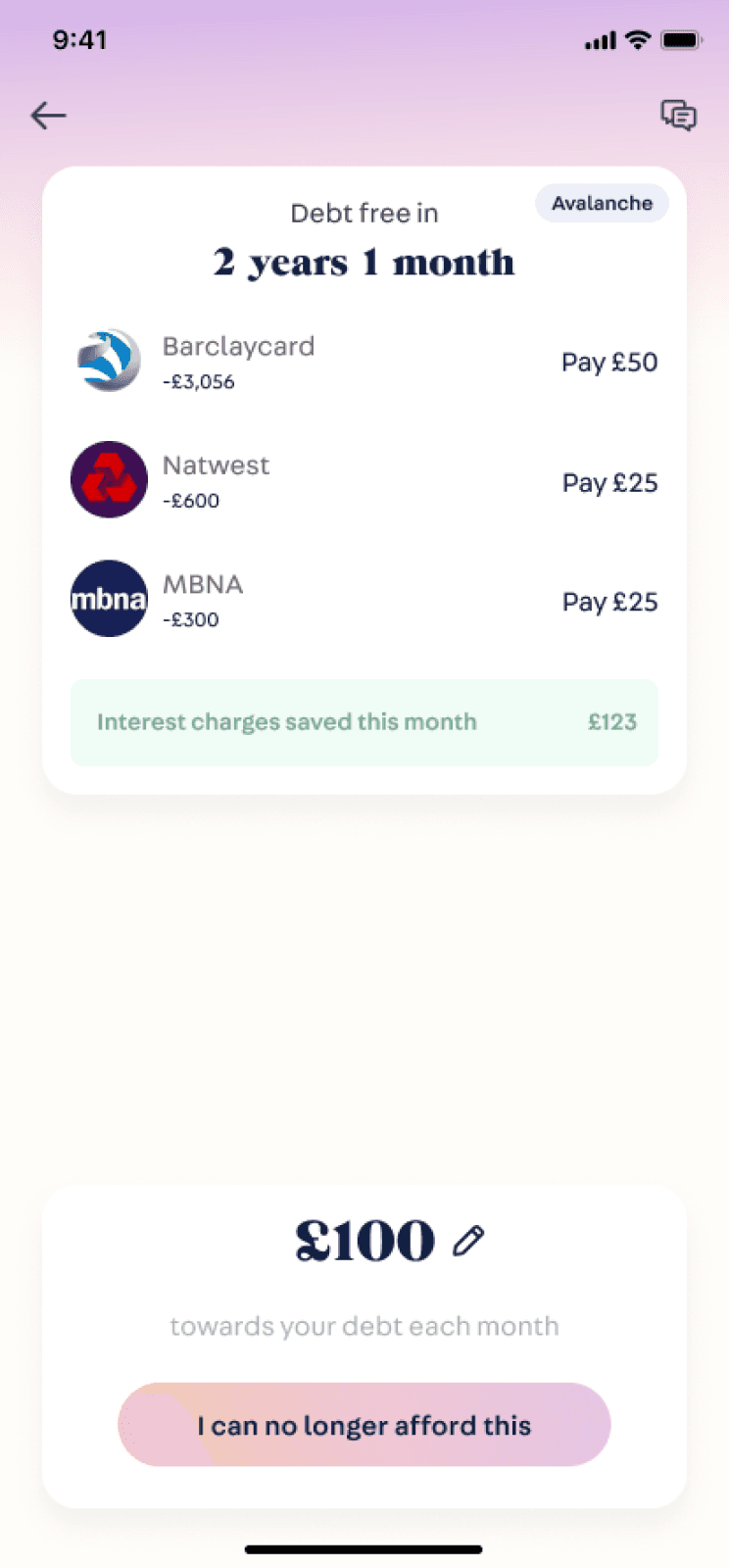

FINAL DESIGN ITERATION

FINAL DESIGN ITERATION

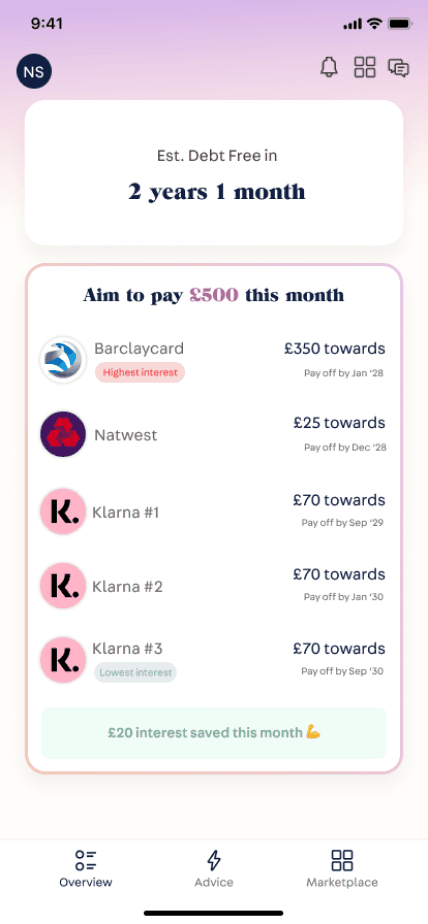

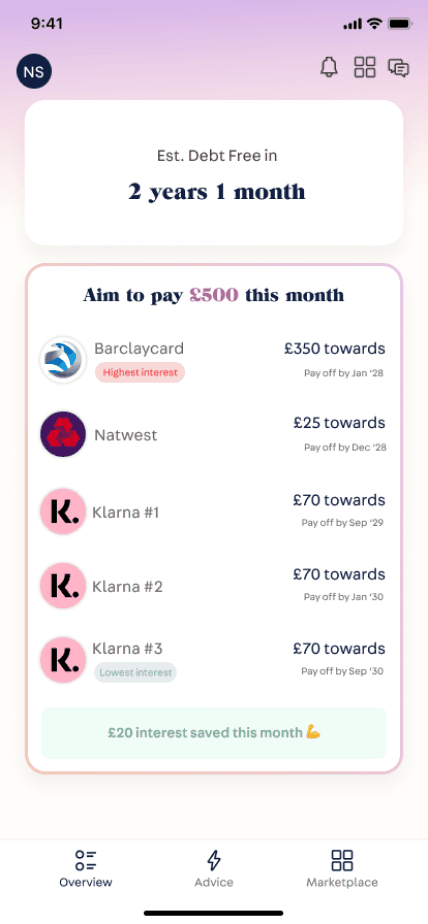

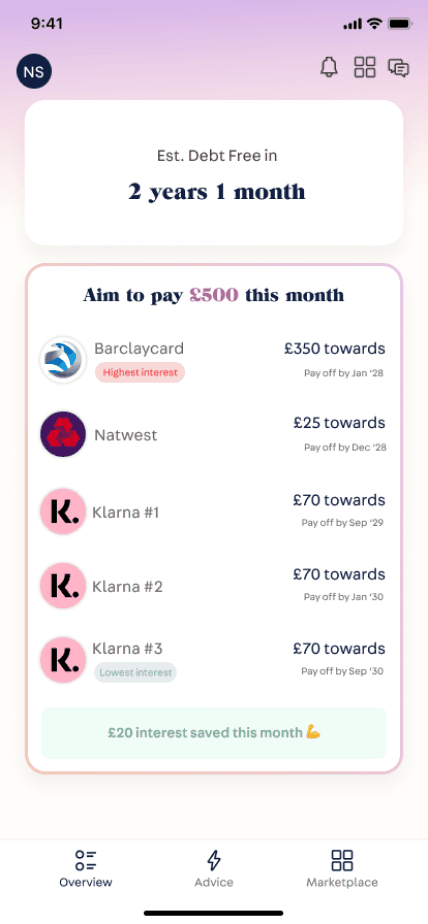

Improving usability and accessibility of repayment plan page

Improving usability and accessibility of repayment plan page

Improving usability and accessibility of repayment plan page

Easy to access controls to edit and update the plan when needed

Easy to access controls to edit and update the plan when needed

Missing CTA and instruction. How do I change my plan?

Missing CTA and instruction. How do I change my plan?

Unclear button

Unclear button

Low visibility

Low visibility

Pill button to indicate repayment strategy selected

Improved accessibility with higher contrast and clearer information

Improved accessibility with higher contrast and clearer information

Indicate positivity & benefits to user at a glance

Indicate positivity & benefits to user at a glance

CTA language is easy to understand

CTA language is easy to understand

New Design

New Design

Easy to access controls to edit and update the plan when needed

Missing CTA and instruction. How do I change my plan?

Unclear button

Low visibility

Pill button to indicate repayment strategy selected

Improved accessibility with higher contrast and clearer information

Indicate positivity & benefits to user at a glance

CTA language is easy to understand

New Design

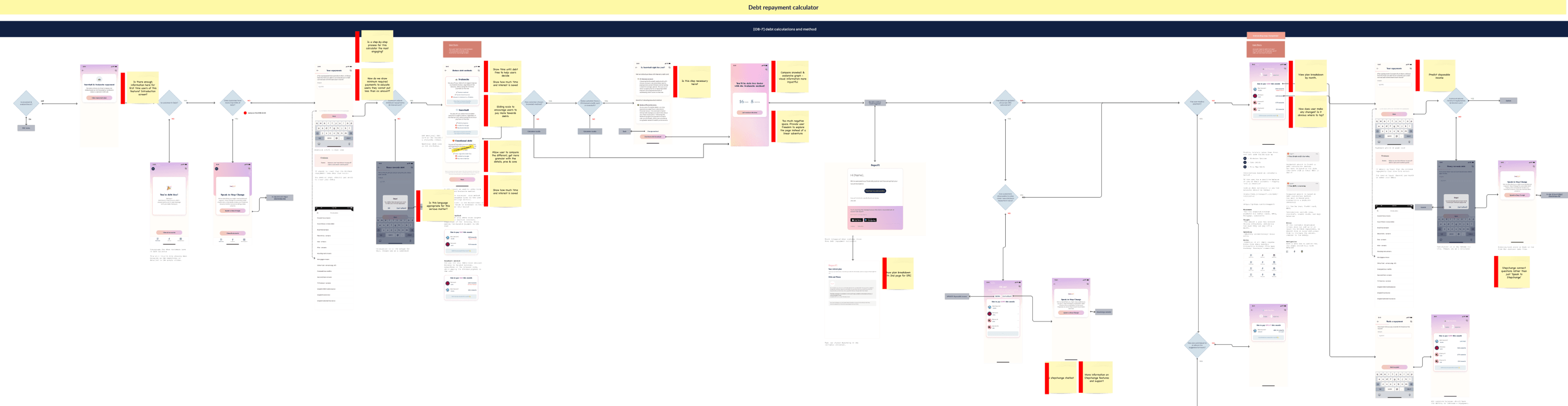

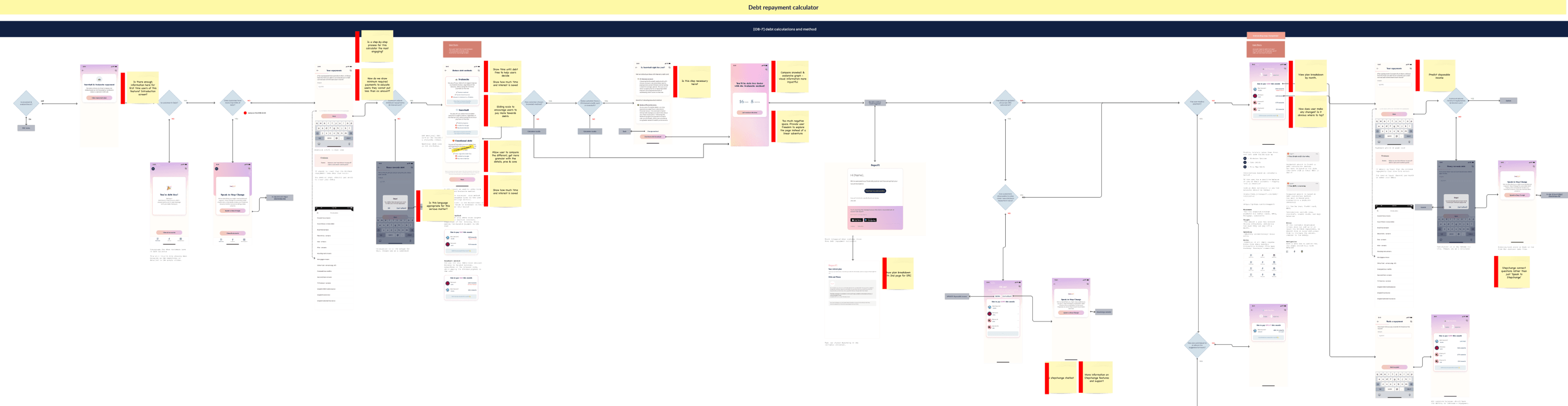

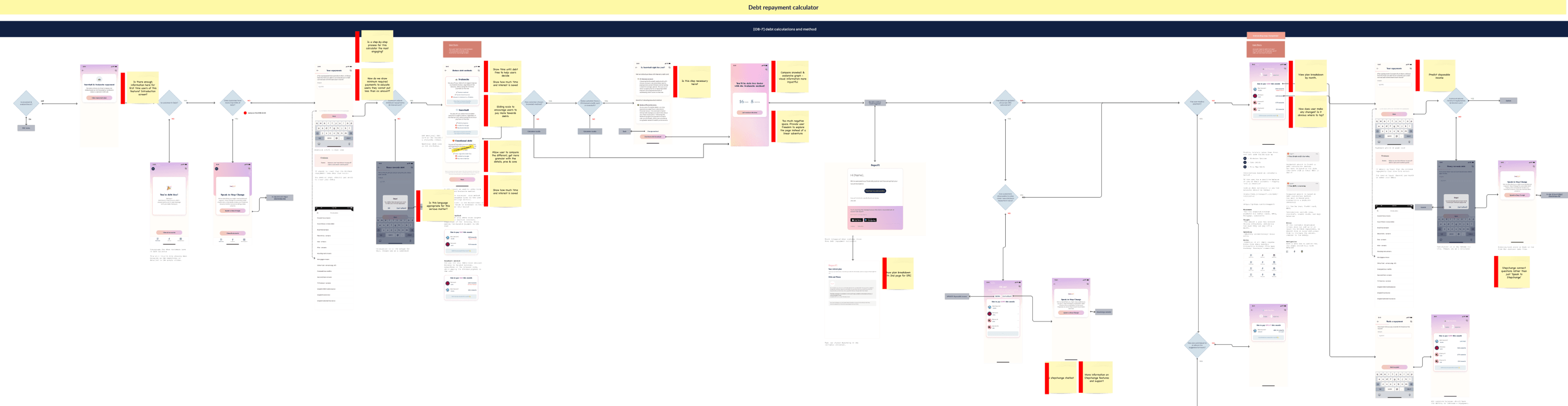

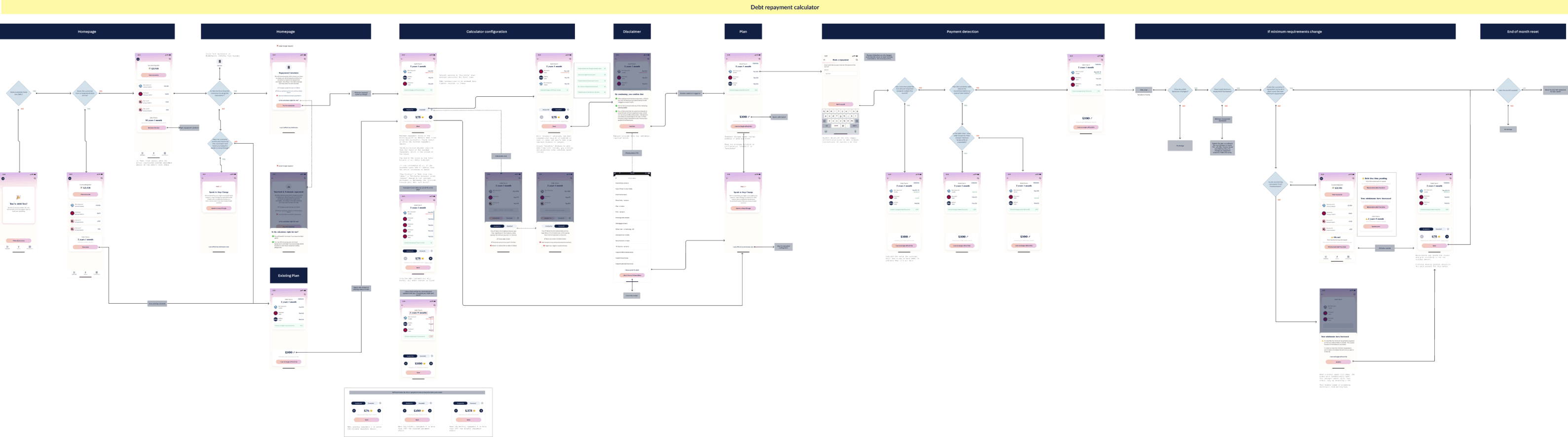

FINAL USER FLOW

FINAL USER FLOW

Redesign of entire calculator experience, considering all use cases and states

Redesign of entire calculator experience, considering all use cases and states

IMPACT

IMPACT

Waiting for FCA approval for launch... However feedback from user testing is promising.

Waiting for FCA approval for launch... However feedback from user testing is promising.

“I can see myself using this tool... this is a page I would be on a lot”

NEXT STEPS

NEXT STEPS

Setting up the metrics to measure success

Setting up the metrics to measure success

Setting up the metrics to measure success

Calculator Metrics

ITEM

Metric

Change MoM

X%

+-%

% of customers only paying minimum on debt

X%

+-%

% of customers with SuperFi debt repayment plan from CRC

X secs

+-%

Avg time spent in repayment calculator

X%

+-%

% customers who’ve reduced their debt amount this month

£X

+-%

Avg amount £ debt reduced by this month

X%

+-%

Avg amount £ interest saved

Continuous improvement

Set up and monitor metrics to validate impact of design.

Quality assurance of pages to ensure correct tracking and design works smoothly.

Test on extreme use cases in calculator to cater to users of all financial backgrounds.

Integrating the calculator into other parts of the app

Set up and monitor metrics to validate impact of design.

Quality assurance of pages to ensure correct tracking and design works smoothly.

Test on extreme use cases in calculator to cater to users of all financial backgrounds.

Integrating the calculator into other parts of the app

LEARNINGS

Building the user flow as an entire journey and experience instead of jumping straight into optimising user interface/screens.

Building the user flow as an entire journey and experience instead of jumping straight into optimising user interface/screens.

Simple solutions are effective, don’t need to make it too complicated with bells and whistles.

Simple solutions are effective, don’t need to make it too complicated with bells and whistles.

Do not jump straight into the solutions without understand the scope, purpose and measures of success.

Do not jump straight into the solutions without understand the scope, purpose and measures of success.

REFLECTIONS

This project was a huge highlight and a massive learning curve as I was able to lead the entire end-to-end design process, with the guidance of a experienced mentor. I also fell in love with the complexities of fintech and contributing to solutions for real problems that could really impact people’s lives and livelihood.

This project was a huge highlight and a massive learning curve as I was able to lead the entire end-to-end design process, with the guidance of a experienced mentor. I also fell in love with the complexities of fintech and contributing to solutions for real problems that could really impact people’s lives and livelihood.

This project was a huge highlight and a massive learning curve as I was able to lead the entire end-to-end design process, with the guidance of a experienced mentor. I also fell in love with the complexities of fintech and contributing to solutions for real problems that could really impact people’s lives and livelihood.

FINAL DESIGN ITERATION

Exploration of interactive components and how to uplift the experience

Slider interaction with manual input

Technical issues with slider,

will we be able to live update the complicated debt free time calculation to match the speed of a slider?

Accuracy difficulty using a slider?

How do we decide the maximum amount?

Slider button too far from optimal interaction area. Splitting the actions into 2 also disjointing.

Low visibility

Clicker

Slider button to access more information for the 2 repayment strategies.

Able to more seamlessly integrate delightful elements to encourage user.

Interest savings to encourage higher repayments

Get in touch. I’d love to connect

I’m in Melbourne, Australia

Get in touch. I’d love to connect

I’m in Melbourne, Australia

Get in touch. I’d love to connect

I’m in Melbourne, Australia

Get in touch. I’d love to connect

I’m in Melbourne, Australia